Payroll

Payroll and the Restaurant Industry

Sep. 23, 2017

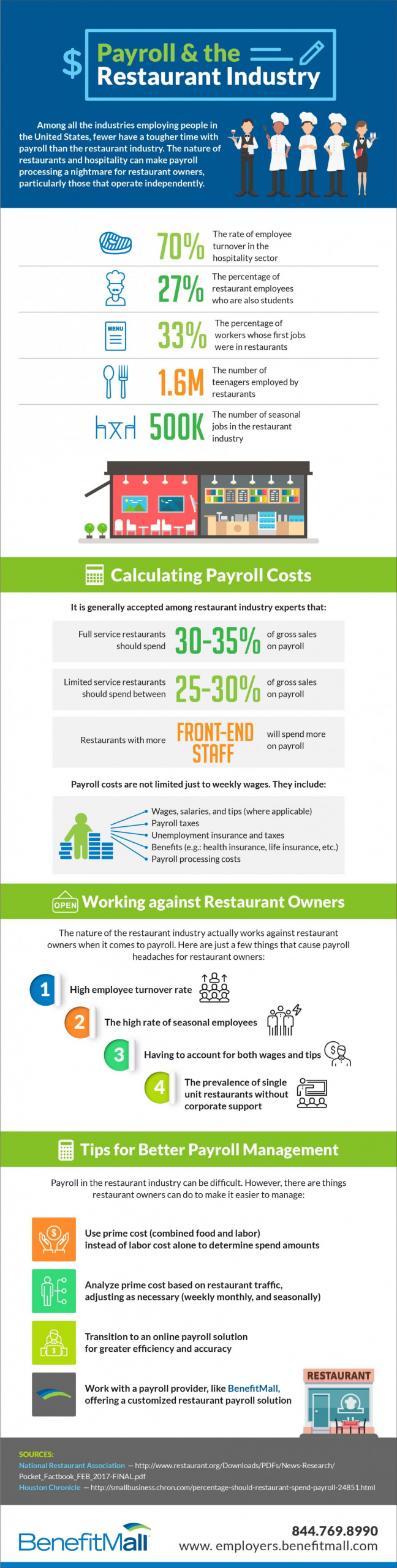

Among all of the industries employing people in the United States, few have a tougher time with payroll than the restaurant industry. The complex nature of operating a restaurant can make payroll processing a challenge for restauranteurs, especially those that are independently operated.

The overhead costs are high, including rent, equipment, licenses and insurance. In addition, there is a myriad of state and local regulations that must be navigated. Restaurant owners need to maintain a strong cash flow position to remain viable. But there’s something else that needs to be considered beyond financial resources: time resources.

Restaurant owners invest a tremendous amount of their own time to keep their operations running. Working seven days, a week is not unusual, especially in a small restaurant that does not have a large pool of employees to draw upon to fill shifts.

Let us look below at the Payroll + the Restaurant Industry infographic that helps to illustrate the ins and outs of restaurant payroll.

Payroll is a time-consuming and complicated task. For any restaurant owner who does not fully understand accounting and payroll reporting, running payroll can be tremendously frustrating.

Consider what restauranteurs have to deal with:

High Turnover – It’s no secret that profit margins in the restaurant business are extremely tight. High turnover makes payroll more complicated for the restaurant owner. This is a transient workforce where the number of employees, pay frequency and variable pay rates tend to fluctuate regularly.

Server Tips – No other industry has to deal with the complicated matter of server tips. Servers tend to make less than minimum wage with the expectation that their tips will make up for the lower pay. All those tips have to be accounted for so that they are accurately reported and taxed appropriately.

Online Payroll Can Be The Solution for Your Clients – Determining how your clients do payroll can help significantly. The complexity and nature of tip reporting, and successfully dealing with staffing shortages to free up time for other things are all things to consider when helping your clients select a payroll service. For example, accessing payroll services online makes it possible to streamline everything so that the restaurant owner’s only responsibility is logging into their account and entering employee data once a week.

To further examine payroll in the restaurant and help your clients make an informative decision about the best path to take, visit employers.benefitmall.com/restaurant-payroll.

———-

Kevin Thornton is senior vice president of restaurant sales for BenefitMall.