Small Business

2018 Review of Pulse

Feb. 19, 2018

Pulse is a cash flow app designed to work in conjunction with current software to provide better cash management functionality for the small business owner. Pulse tracks both income and expenses, as well as current and monthly cash flow. Pulse is available in three versions; Standard, Plus, and Premium, with each version offering more advanced features and functionality.

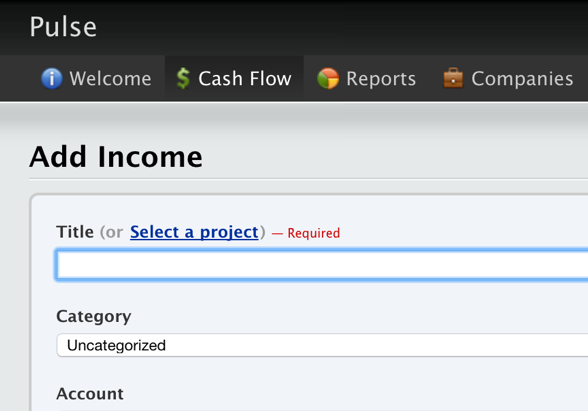

Pulse users can access the application from any device, including smart phones and tablets. The product offers good cash flow forecasting capabilities, with the ability to easily project future cash flow by month. Users can quickly import income and expense transactions directly from QuickBooks, QuickBooks Online, or from a CSV file. Though users can import these transactions in order to start using Pulse, additional income and expense transactions can be entered directly in Pulse in order to have the latest information available. Cash flow can be monitored by week, month, or users can use a custom date range to track. One of more useful features in Pulse is the ability to see the effect the future projects, clients or expenses will have on business cash flow. Users can also post both recurring income and expense transactions in Pulse on a daily, weekly, monthly, or yearly basis.

All transactions recorded in Pulse are posted in real time, so cash flow, reports, dashboards, and reports always reflect the most current data available.

The Cash Flow table displays every transaction entered into Pulse, with users able to organize the table by week or by month, as desired. Users can track current and expected income and expenses in the Cash Flow Table, and can track any current or upcoming projects as well. Pulse also offers a good selection of cash flow reports, including the Income and Expenses Report, which offers an excellent overview of all income and expense related activity, displayed in a colorful bar graph with totals for each month. The report also provides users with the beginning cash on hand totals, as well as total income and expenses, and finally, ending cash on hand totals. Users can also run and Income and Expenses report by Category, so users will always know exactly how much money they’ve spent, and what they’ve spent it on. Accountants using Pulse will be able to track income, expenses, and cash flow for all of their clients. All Pulse reports can be exported to Microsoft Excel as well as to a CSV file for additional customization capability.

Pulse offers standard security measures to keep all data safe, and the product offers four levels of system access, so managers can create access levels based on user needs. Available access roles include Account Owner, Admin, User, and Read-Only User.

Pulse offers easy company import capability for those using Basecamp or High-Rise Import. The product also offers direct integration with both QuickBooks and QuickBooks Online, and data can be easily imported and exported via a CSV file as needed.

Designed for the small business owner, Pulse offers affordable cash management capability. Pulse is also a good option for accountants that wish to get a better handle on client cash management. Pulse pricing starts at $29 per month for the Standard edition, with the Plus edition running $49 per month. A Premium edition is also available that supports up to 20 users and up to 60 financial accounts, with the Premium version running $199 per month.

Overall Rating – 4.5 stars