Small Business

Protecting Small Businesses from Check Fraud

Apr. 04, 2012

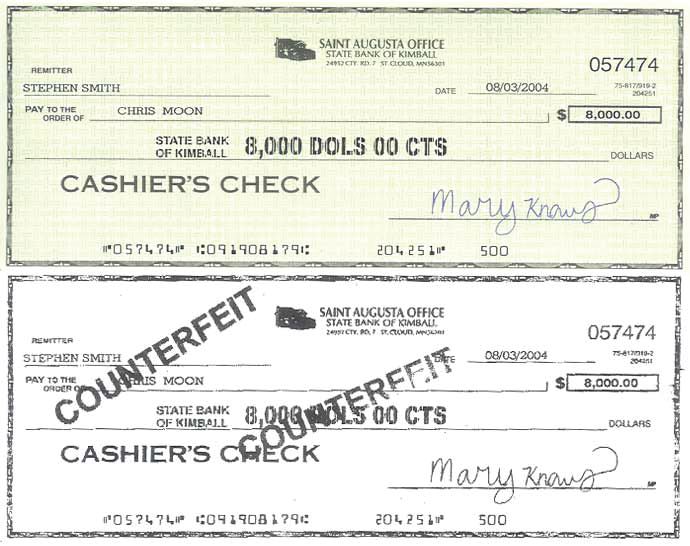

Even with the increase of electronic payments, checking account fraud is on the rise. Perhaps it’s due to people struggling in a down economy or “moral decay,” but more likely it’s because the latest computers and printers make it is easy to duplicate checks that appear acceptable to cash at a bank or retail establishment. Add to that the growing trend of banks accepting deposits through the smart phones and pictures of checks, and the potential for fraud is increased. In some cases, individuals have deposited a check via this image process, and then attempted to deposit or cash the original check, thus getting double credit on a deposit.

Time is of the Essence

If a checking account is charged with an illicit check or electronic charge, the bank should be notified as soon as possible and, if notification is made within 24 hours, most institutions will credit the amount of the fraud back to the checking account. If notification is made within 30 days, funds will be eventually returned to a checking account, although there may be longer delays due to an investigation of the incident.

If a business’ account has been subject to repeated attempts at fraud by a skilled criminal, the bank may require closing the account and opening a new one, which can be a headache for the business and their management, especially for those who have recurring automatic electronic payments or incoming credits that are connected to that account.

Protection

When someone creates an offense, protection is to maintain a good defense. Large private firms often employ specialists as treasury managers. These individuals usually have a professional designation as a “Certified Cash Manager,” or a “Treasury Management Professional.”

All accountant, both in public and private practice, need to be aware of the potential for check fraud and how to protect funds. Here are the basics that all accounting professionals need to advise their clients on:

- Protect blank checks. Keep them locked up. Use of original check stock will make it easy for a perpetrator of fraud.

- Reconcile a checking account immediately upon receiving bank statement. Once that is done, every penny is accounted for and irregularities (if any) will come to light. For good internal control, a person other than the regular bookkeeper or accountant should perform that function. This is probably the most important step in maintaining checking account control within the office.

- Transactions may be reviewed the next day by utilizing the bank’s touch-tone feature or website. This is essential for 24 hour notification.

These first three steps should be followed by every organization regardless of the size. There is no additional bank charge to perform these tasks and they are very effective.

- The next step available to businesses is a reverse positive payment process. This is an on-line process where checks cleared the previous day are provided to the bank customer. The bank customer has the option of returning those checks immediately by making an indication next to those checks they wish to return. This feature provides the ability to return checks on-line at a very small additional cost.

- The most complete step is the positive pay program available to businesses. This is a method where advance notification is made of check number, amount, and payee (optional field) for checks written. When transmitted to the bank, immediate notification is made before the fact. A bank teller would be aware if an illicit check is being presented by accessing their own computer. If one of these check is presented to the bank, it will be rejected before it is charged against the customer checking account. Most large companies employ positive pay and a bank may insist that smaller companies do so if they have multiple fraud attempts. Company notification of checks written is generally done electronically. The additional bank charges are minimal.

- Electronic charges may be blocked by setting up a debit ACH filter. A debit ACH is an electronic charge against the account initiated by a system that does not include one’s own bank. An example is a tax payment using the IRS website A individual with the right software can draw money out of any account by initiating a debit ACH. The filter will cause those charges that are not approved to reject, thus protecting the checking account from illicit electronic withdrawals. Any company using debit ACH’s to a large extent or experiencing electronic fraud should utilize this system. Again, bank charges are minimal.

If a business’ account has been charged with a bogus transaction, as stated above, the bank should be notified immediately and a police report should be filed, which will require an affidavit that provides the details of the fraud and possible suspects. The bank and others involved in the transaction, such as those cashing the check, may also require a copy of the affidavit.

Retail establishments that cash bad checks for their customers obviously need to make an effort to collect their losses, whether using automated electronic resubmission to a bank, a collection agency or legal process. If the business that was a victim of check fraud finds themselves faced with calls and notices from a collection agency or legal representative, having a copy of the police report can help explain the situation more convincingly to the agency.

However, some agencies use more aggressive techniques that are aimed at annoyance or intimidation to get people to pay. If you or your client has been an honest victim of a check fraud scam, then don’t let the collection agencies get to you.

Responsibilities of the bank and bank customers are spelled out under Article 4, part 4-406 of the Uniform Commercial Code, which requires not only banks, but bank customers to be diligent in catching bad checks that may be charged against an account. Regardless of the cause, customers are required to provide timely notification to the bank using the resources provided to them, or they can be liable.

These are ideas and responsibilities to protect against check fraud and protecting funds. Remember that the bank and bank customer are financial partners, and cooperation between each is essential in stopping fraudulent transactions and apprehending perpetrators.