The IRS will need help to reduce the $450 billion annual loss to the US Treasury.

On Jan. 6, the IRS released its latest measurement of the tax gap, a staggering $450 billion a year, 30% more than the previous tax gap study five years earlier. The tax gap is the amount of taxes that are owed but not paid to the US Treasury by individuals, businesses, employers, estates and other taxpayers. The IRS last measured the tax gap in 2005, using data from 2001 tax returns. The most recent update is a measurement of 2006 return data that was compiled from IRS data and the examination of 14,000 random tax returns.

To put the numbers in perspective, the national budget deficit was $248 billion in 2006. With a tax gap of $450 billion for the same year, the national loss in uncollected taxes might seem unacceptable to many Americans.

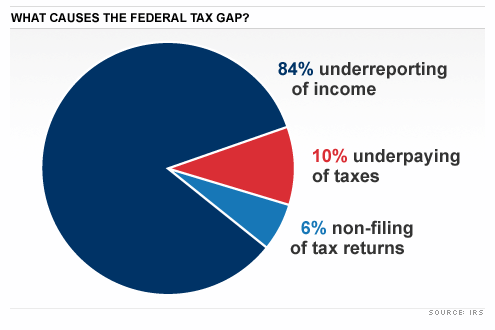

In fact, that’s exactly how the IRS views it. The tax gap is made up of three components, each representing a breach with tax laws that the IRS expects taxpayers to follow.

- Non-filing: $28 billion a year lost to taxpayers who don’t file required tax returns

- Underreporting: $376 billion a year lost to taxpayers who don’t report income or overstate deductions and credits on tax returns

- Underpayment: $46 billion a year lost to taxpayers who don’t pay what they owe

The new tax gap study also revealed that the overall compliance rate slipped slightly from 83.7% to 83.1%. However, the IRS noted that, when accounting for the study’s margin of error, the compliance rate is relatively unchanged from the 2001 data.

Either way, the IRS has much to do to reach its target goal of an 86% voluntary compliance rate for tax year 2009 and Congress’ goal of 90% voluntary compliance by 2017, both of which will be measured in the next decade. Legislators and the IRS may have to face the facts: To achieve voluntary compliance and close the tax gap, the IRS can’t do it alone. Traditionally, the IRS has used compliances initiatives such as notices, audits and voluntary disclosure programs. However, to meet its compliance goals, the IRS will need help from Congress.

Tax gap study reveals challenges the IRS faces.

The IRS has some effective tools to collect taxes that it knows taxpayers owe. These tools include audits, liens, levies, matching programs and discrepancy notices. In 2001, the IRS used enforcement methods like these to increase the voluntary compliance rate from 83.7%to a net compliance rate of 86.3%, after enforcement collections. In doing so, the IRS collected an additional $55 billion. In 2006, the voluntary compliance rate was measured at 83.1%. The IRS used enforcement to raise the net compliance rate to 85.5%, collecting an additional $65 billion. Even though the IRS collected $10 billion more in 2006 than in 2001, the compliance rate slipped by almost a full percent.

A 1% change in the voluntary compliance rate represents almost $27 billion a year to the US Treasury. If the IRS met Congress’ goal of 90% voluntary compliance, that would mean an additional $184 billion. From 2001 to 2006, the IRS increased its enforcement efforts to a far greater extent than the outcomes it realized. In that time, the IRS budget increased 21%, from $8.7 billion to $10.6 billion, and the compliance enforcement budget increased 36%, from $3.4 billion to $4.65 billion.

IRS compliance activity increases are shown below:

|

|---|

The IRS increased its compliance efforts disproportionately to the increase in individual and business taxpayers. In fact, from 2001 to 2010, the number of taxpayers increased by only 11%, from 141 million to 156 million individuals and businesses. But despite all of these efforts, the tax gap still increased by 30% from 2001 to 2006.

The biggest challenge the IRS faces in noncompliance is underreporting, which makes up 83% of the tax gap. From 2001 to 2006, despite 191% more underreporting inquiries and 72% more audits, underreporting still contributed $376 billion to the tax gap.

Individual small business taxpayers (Schedule C sole proprietors) represent almost half (48%) of all underreporting, or $179 billion a year in uncollected taxes. From 2001 to 2006, small business underreporting increased 21%. Taxpayers who report their own income, such as small businesses and independent contractors, are responsible for the most underreporting. Other individuals who receive income that is not reported to the IRS, such as landlords, make up a considerable remainder of underreporting noncompliance.

Without information statement reporting on these businesses and transactions, the IRS is left to “audit its way” to compliance. The tax gap data from 2001 to 2006 shows that the IRS cannot win that battle.

2001 and 2006 conclusions: The IRS cannot do it alone.

There are two major components of the tax gap that the IRS can’t do much about: requiring information statement reporting and simplifying the tax code.Since 2001, tax law has grown exponentially. As the IRS Taxpayer Advocate illustrates, from 2001 to 2010, Congress made 4,428 changes to the tax code – an average of more than one per day. Tax reform, and more specifically, tax simplification, would help reduce the tax gap. But it probably would not address many issues related to underreporting for small businesses and other nonreportable transactions, such as asset sales.

The 2001 and 2006 tax gap studies illustrate the importance of information reporting in compliance. According to the IRS, taxpayers who receive Forms W-2 and 1099, such as wage earners and retirees, are almost completely (99%) compliant. Taxpayers who self report their income and don’t receive information statements, such as small businesses and independent contractors, are only 44% compliant. A 2010 IRS Oversight Board Taxpayer Attitude study showed that 66% of Americans surveyed said that information statements influenced their accurate reporting of income and deductions. Besides personal integrity, information reporting was cited as the most significant factor influencing compliance. This bolsters what some view as an IRS perception that “trust is good, but control is better.”Information statements allow the IRS to better control compliance.

In the past, the IRS has been successful using information statements. The IRS receives more than 2.7 billion information statements each year. IRS systems trace these statements to individuals who have not filed or not reported all of their income on Form 1040. The IRS also uses these statements to question the validity of deductions and credits. For example, the IRS can match the returns of taxpayers claiming a Homebuyer Credit against Forms 1099-S for property sales in the past three years to determine possible ineligibility.

In 2010, the IRS started 6 million compliance inquiries for underreporters based on information statement matching. That was almost four times the number of 2001 inquiries. The IRS collected an additional $1,670 per tax return, on average, from taxpayers who underreported their income. However, because underreporting initiatives are usually centered on the most compliant taxpayers — individuals who receive information statements and not cash-based small businesses — the IRS can obtain only $5.2 billion a year from this program. That represents only a small fraction of the $450 billion tax gap.

In 2010, Congress passed new Form 1099 reporting requirements that were set to take effect for 2011 payments to businesses. This law would have required businesses to send Forms 1099 for all purchases of goods and services of more than $600 annually. As a result, the IRS would have received a wave of information statements to track nonfilers and underreporters. However, under heavy bipartisan pressure, the law was repealed in April 2011.

In another measure passed by Congress and set to take effect this year, the IRS will receive information from merchant card payers that may help with compliance. The IRS is expecting about 56 million new Forms 1099-K that will report credit card payments and third-party payments from banks and other payment sources, such as PayPal. For some businesses, these additional information statements will trigger unreported income inquiries by the IRS. Estimates have varied for how much in additional taxes the IRS will collect through the Form 1099-K requirements. Although there are no reliable estimates, the IRS estimates that the Form 1099-K reporting will generate about $1 billion a year in additional tax revenue. The IRS thinks it will have an impact on voluntary compliance for small businesses.

While the IRS can benefit from Congressional initiatives on information reporting, the legislation is typically unpopular with taxpayers and businesses — similar to the 2010 Form 1099 reporting requirements that were repealed. Heading into an election year, the IRS probably can’t look to Congress for much immediate help.

The IRS is moving forward.

The IRS hasn’t wasted any time streamlining its own compliance efforts. From 2007 to 2010, the IRS used findings from the previous two tax gap studies to focus on specific compliance areas. The following are examples of current IRS efforts.

Worker reclassification. The IRS is the middle of a three-year study on worker classification. The IRS’ objective is to properly classify workers, knowing that employees are 99% compliant. This initiative targets small business employers who file more than 85% of all employment tax returns.

Audits. The IRS is focusing on certain audit areas.

With little information reporting and a 53% error rate by taxpayers, rental property is a primary audit area for the IRS to reduce the tax gap.

The IRS is also focusing on S corporations. The IRS knows that about two out of three S corporations are single-owner entities that operate similar to sole proprietorships. The IRS is particularly interested in taxpayers who deduct S corporation losses. A US Government Accountability Office study showed that S corporation losses are overstated by an average of $21,600 per return. This misreporting is due largely to the failure of tax practitioners (who prepare more than 90% of S corporation returns) to consider whether the shareholder has basis to deduct the losses.

The IRS is getting more sophisticated with small business audits. It has asserted its authority to examine original small business electronic files, and although the results are not in yet, the IRS expects much better outcomes in these exams. In any event, the publicity associated with this IRS initiative will encourage taxpayers and their practitioners look more closely at the returns they file to make sure their records agree with the returns.

High-income taxpayers will continue to see IRS audits. In 2011, individuals with income of more than $1 million were audited 12.4% of the time, up from 8.4% in 2010. In 2010, IRS audits in this segment yielded more than $155,000 in additional taxes owed per tax return examined.

Foreign bank accounts. Taxpayers can expect to get questions about reporting of foreign bank accounts. In 2009 and 2011, the IRS used offshore voluntary compliance initiatives that corralled 33,000 taxpayers with unreported foreign accounts. These initiatives brought $4.4 billion to the US Treasury. The IRS announced Jan. 9 that it has reopened the initiative to foster taxpayer compliance with foreign bank account reporting. While the IRS encourages voluntary compliance in this area, it’s also serious about prosecution. In fact, in 2011, overall prosecutions for tax-related criminal cases increased by 11%.

Deputize practitioners. Consider that more than 60% of individuals use a tax preparer, and about 90% of S corporations and partnerships use a paid professional to do their taxes. Compliance is best leveraged through practitioners. Hence, in the past three years, the IRS has instituted:

- Preparer registration and annual educational requirements

- Increased penalties for preparer negligence

- Increased due diligence requirements for high noncompliance areas, such as the Earned Income Tax Credit

- Elimination of the IRS “debt indicator,” which preparers used for refund-anticipation loans – a contributor to erroneous refund noncompliance

State information. To find potential areas of noncompliance, the IRS can leverage the use of more state information. Recently, the IRS displayed its willingness to use this method in the gift tax area, when it was successful in enforcing a John Doe summons to the State of California to obtain the names of individuals with property transfers. The IRS will use this information, as it has done in 15 other states, to find taxpayers who haven’t filed gift tax returns. For small businesses, the IRS can look to leverage information at the state and local level to initiate various compliance projects. For example, the IRS currently uses state employment information in employment tax audits. However, initiatives like these are resource intensive, and the IRS is going to have fewer resources in 2012 than it had in 2011.

Doing more with less. The IRS is facing a $305 million budget cut in 2012. But Shulman will not sacrifice an effective filing season. If the IRS cuts resources, it will be in compliance. Last year, the IRS offered some employees a buyout to reduce its compliance-related expenses. This year, the IRS will likely lose about 1,000 employees by attrition.

In the future, the IRS will have to do even more with less. For example, it will have to administer the upcoming 2014 Patient Protection and Affordable Care Act (PPACA). The IRS has already absorbed some of the new tax laws associated with the PPACA. However, in total, it will have to administer 47 new tax laws and collect what is projected to be more than $400 billion in additional taxes before 2020.

Looking ahead. Given the IRS’ stagnating resources and increasing work, it must use a cost-effective approach. Using insight from the past two tax gap studies, the IRS has aimed to focus and improve its compliance efforts in areas where it can collect more taxes.

But, as evidenced in the latest tax gap data, the IRS can’t drastically increase compliance with this approach alone. For the IRS, substantially narrowing the tax gap will mean legislative changes, such as new information statement requirements and simplification of the tax code.

Without major changes like these, future tax gap numbers aren’t likely to go anywhere but up.

——————-————-

Jim Buttonow is Vice President of Product Development and Cofounder of tax technology company New River Innovation. Jim’s professional mission is to apply emerging technology to problems faced by tax professionals after they file. Jim is a CPA and former IRS Large Case Team Audit Coordinator. He worked at the IRS for 19 years. Since leaving the IRS, Jim has represented many clients before the IRS.

At New River Innovation, Jim is the chief architect of Beyond415™ (Beyond415.com), an award-winning technology for IRS practice and procedure, made for tax professionals. Through Beyond415, Jim also develops and presents CPE series on IRS practice and procedure for issues that arise after filing, such as audits, notices and discrepancies. Jim regularly speaks on compliance trends and post-filing practice efficiency strategies for CPA and accounting firms. Jim’s articles have appeared in several accounting publications, including the Journal of Accountancy and various state CPA society magazines. Jim can be reached at JButtonow@Beyond415.com.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs