Do High CEO-Employee Pay Gaps Lead to Increased Profitability?

Reviled though they may be, big CEO-worker pay gaps coincide with good profits & stock results, study finds .

Jul. 10, 2017

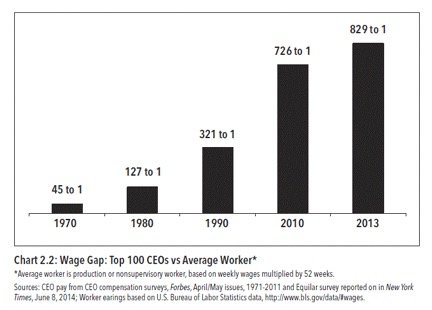

One of the most controversial aspects of corporate governance in recent decades has been the phenomenal increase in the gap between the pay of CEOs and other top executives and that of rank-and-file company employees. From about 20 to 1 fifty years ago, the CEO-worker ratio had soared well past 100-1 by the millennium and has risen to as high as double or triple that ratio in the current century.

It was in response to popular outrage at this development that the Dodd-Frank Act of 2010 required companies to disclose the ratio of total CEO annual compensation to the median pay of all other company employees. Supporters reasoned that the provision would shame companies into exercising restraint in remunerating their top executives. Although scheduled to go into effect January 1 of this year, the provision’s implementation was postponed, and its fate is now uncertain.

That fate could very well be influenced by some new research to be presented at a forthcoming scholarly conference.

At the annual meeting of the American Accounting Association (San Diego, August 5-9), a team of three professors will report that, instances of abuse notwithstanding, a high CEO-employee pay ratio is on the whole not the index of corporate misfeasance it is widely felt to be. In the words of the study, “From an efficient contracting viewpoint, a widening gap between CEO and worker pay can be seen as inevitable in an environment marked by larger and more complex business organizations.”

The paper stops well short of endorsing the ethics of high ratios. “Our study focuses on economic aspects of pay disparity between senior executives and average workers and does not allude to broader social norms such as fairness and social equity,” write co-authors Qiang Cheng of Singapore Management University, Tharindra Ranasinghe of the University of Maryland, and Sha Zhao of Oakland University.

Still, those economic aspects are anything but trivial to investors. Based on analysis of results at more than 800 companies, the study finds that high pay ratios are associated with both strong company stock performance and heightened profits.

Addressing the argument that such ratios depress worker morale, the authors conclude that “demoralizing effects (if any) of high pay disparity between senior executives and workers are not sufficiently large to harm the overall firm value and performance…On average, high pay ratios are not symptomatic of corporate governance failures and CEO rent extractions. Instead the results are consistent with the argument that high CEO pay ratios are an outcome of market competition for scarce CEO talent.”

The key to the widening CEO-worker pay gap, the professors conclude, is what they call “scalability.” As they explain, “Over the years, U.S. corporations have been growing both in size and complexity. Talents of senior executives such as CEOs are more scalable because decisions made by individuals at higher levels of the organization have firm-wide implications…[while] the firm-wide impact of a single rank-and-file worker is likely to be marginal at best. Therefore, the incremental talent/ability at the CEO level commands a disproportionately greater increase in compensation.”

Revealed through laboriously gathered statistics from a data trove that until now has been little used by finance and accounting scholars, the benefits associated with high pay ratios emerge intact through the many efforts the study’s authors make to test them.

For example, they probe the relationship between CEO pay ratio and two much-cited indicators of corporate governance quality – value creation through acquisitions and tolerance of subpar CEO performance. They find that “firms with high CEO pay ratios are more likely to make value-enhancing acquisitions [as measured by market response to their announcement] and have higher CEO turnover-performance sensitivity.” The latter is revealing, they explain, because “when corporate governance is weak, CEOs are less likely to be replaced following poor performance”; the fact that higher CEO pay ratios correlate with greater likelihood of dismissal for subpar results is “inconsistent with the argument that [such] ratios reflect governance failures.”

In a further test, the professors also find that their results stand when they control for an element of CEO compensation that has been found to significantly affect company performance – namely, the proportion of stock-based compensation in the chief’s pay. Acknowledging the strong incentive such pay gives managers to augment firm value, they control for it and find that “our inferences [with regard to CEO-worker pay ratio] remain the same.”

They also find that what is true for the CEO holds for companies’ top management teams. Reasoning that the scalability argument, if valid, should apply to top managers other than the chief executive, they investigate the ratio of rank-and-file-worker pay to that of the four highest-paid execs exclusive of the CEO and find that “our results extend beyond CEO pay ratio and can be generalized to the pay ratio between other top senior executives and the average worker.”

The paper’s findings are based on data laboriously obtained from a large private data resource that does not provide information to scholars in bulk or over spans of years, so that researchers must ferret out current worker pay levels one company at a time. By this means, the professors were able to obtain extensive detailed data on employee pay for a single year, opening the way for them to later analyze the relationship of worker-executive pay ratios to companies’ performance the following year, while controlling for many factors that can affect those results.

In doing so, they focused principally on two key gauges of firm performance – return on assets (a common measure of profitability), and a variable strongly related to stock price, Tobin’s q (value of company stock and debt divided by the replacement cost of firm assets). The professors’ analysis of the relationship of these measures to CEO-worker pay ratios comprised 817 companies, whose CEOs had mean total annual compensation of about $7.8 million and whose workers’ mean pay was about $74,000.

The professors found that the relationship of CEO-worker pay ratio to company performance was not only statistically significant but economically significant as well. When it came to profitability, a company with a CEO-worker ratio at about the 85th percentile had a return on assets 13% higher than that of a firm at the median. An analogous comparison with respect to Tobin’s q yielded a measure 2.1% higher than that of a firm at the median, suggesting a a material difference in stock performance.

As to how their findings should sway regulators, the professors are agnostic, arguing that the strength of their findings confers no particular policy-making authority on the finders. But Maryland’s Prof. Ranasinghe, when pressed, does offer one caution to managers:

“We do not contend that higher pay ratios cause superior performance per se,” he says, “or that meddling with ratios in a mechanical way will yield better company results. Our point is that, as companies strive to secure scarce CEO talent, it naturally leads to greater pay gaps. In other words, success in hiring highly talented CEOs results in both superior company performance and higher pay ratios.”

The paper, “Do High CEO Pay Ratios Destroy Firm Value?” will be among hundreds of scholarly presentations at the American Accounting Association annual meeting, expected to attract some 3,500 scholars and practitioners to San Diego from August 5th to 9th. The AAA is a worldwide organization devoted to excellence in accounting education, research, and practice. Journals published by the AAA and its specialty sections include The Accounting Review, Accounting Horizons, Issues in Accounting Education, Behavioral Research in Accounting, Journal of Management Accounting Research, Auditing: A Journal of Practice & Theory, The Journal of the American Taxation Association, Journal of Financial Reporting,, and Journal of Forensic Accounting Research.