Filing efficiency comes naturally to most CPA firms. With the current technology available and well-established industry best practices, it’s an obvious priority. But when it comes to post-filing work – issues, notices and other compliance activities that arise after tax filing – many CPAs face a manual process: Sift through files for documents from a previous IRS interaction, research the new issue, call the IRS, call the client, and repurpose the old documents to create a new response.

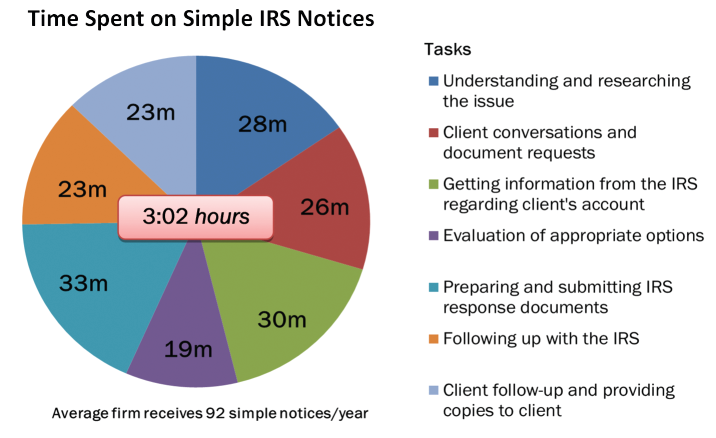

Now more than ever, CPA firms need to be just as efficient in their post-filing work as they are in filing taxes for their clients. A recent study showed that the average firm spends 66 days a year addressing client IRS issues. Even for the simplest post-filing notices, it takes firms a total of almost 35 days a year – an average of more than three hours per notice – to research, understand, respond and follow up.

On top of this, statistics show that the IRS and states are increasing compliance initiatives to close tax gaps and build up treasuries. This sounds ominous, but it doesn’t have to be. In fact, it represents a real opportunity for firms to establish better processes and provide superior service to their clients, through best practices that embrace technology.

The IRS is doing more with less

The IRS increase in post-filing initiatives did not arrive as a tidal wave. It increased steadily and slowly, like a rising tide. From 2001 to 2009, the number of IRS notices sent increased from 30 million to 201 million – that’s 570%. The reason is simple: Sending notices is a cost-effective approach for the IRS to increase compliance and cover more ground with fewer resources. For example, the return on IRS mail audits (correspondence audits) is more than $4,000 per audit hour.

That’s at least eight times more than a field audit, which returns less than $500 per audit hour and costs the IRS more to conduct. In 2010, mail audits constituted 82% of all audits, an increase from approximately 60% in 2001.

Another example is the IRS underreporter and nonfiling program. The IRS receives more than 2.7 billion information statements a year. When it matches these information statements to filed and unfiled tax returns, 20 million discrepancies result — and these are only for individual taxpayers. Because of resource constraints, the IRS can send notices to only 6 million of these discrepant taxpayers, without pursuing the other 14 million.

With each underreporter notice returning an average of $1,670, with minimal personnel effort, the IRS can expand this program and get meaningful results.

As the IRS is facing a probable $500 million budget cut next year and mounting pressure to increase compliance to raise revenue, it’s being forced to do more with less. There is no question that it will send more notices, conduct more mail audits and step up compliance initiatives.

The practitioner’s challenge

While most firms have a clear, efficient process for filing tax returns, many do not have a process to best serve their clients after filing. Most of the time, practitioners simply slog through it, and eventually the work gets done. But the average firm can bill for an only 28% of that work, representing a significant drain on money, time and client goodwill. Several reasons for this come into play.

The majority of post-filing services are not related to complex engagements such as audits. Rather, they are related to understanding, analyzing and responding to an increasing wave of IRS notices that may involve client assessments, account corrections and errors, penalties or balances owed. CPA firms don’t often create engagement agreements or bill for the “learning time” associated with these services.

CPAs often cite client retention as the reason they don’t bill for learning time. There are more than 1,000 types of IRS notices, and the origin of any given notice is often unclear. CPAs spend time researching and understanding the notice, IRS process, potential client issues and facts, and analyzing a response.

Clients tend to expect their CPA to know how to quickly address any tax issue that arises. And even worse, some clients think that their CPA is the cause of the notice or problem – not knowing that the notice was more likely caused by the IRS’ 570% increase in notices sent since 2001. This creates a tenuous situation, in which the notice and the subsequent service provided by the CPA become a risk point for client retention.

Many times, process inefficiencies exacerbate billing and client retention issues for CPAs. Most firms are reactive in their approach, relying on their most recent interactions with the IRS and state taxing authorities to address post-filing notices and issues. These procedures are often inefficient and don’t provide the best outcome. Here are some unintended results:

- Missed deadlines

- Premature second notices

- Long post-filing engagements

- Unexpected outcomes

- Inability to bill for these services

Best practices

In contrast, firms that excel in year-round client service approach post-filing services in a client-centric, systematic way. They combine process improvements with technology. This approach allows CPAs to be proactive, provide predictable actions and outcomes, strengthen client relationships and save time.

Here are some best practice tips that can improve your firm’s services in tax practice and procedure.

Educate your clients on increased compliance activity. CPAs routinely meet with their tax clients at least annually to discuss their tax return. Use this time to discuss the current compliance environment and let your client know about IRS and state notice activity. Explain that the IRS and states are trying to collect more taxes through compliance and that many individuals and businesses that never received a notice are now getting them. It’s not a matter of if your client will receive a notice – it’s when. You can also update your clients through a newsletter or other educational material.

As you educate your clients about increased compliance, also consider revising the scope of your tax engagement letters. Engagement letters that draw the distinction between tax preparation and compliance work can help avoid clients’ surprise when they are billed for that compliance work.

Be the first to know when your client receives a notice. Or, at least, you’ll find out at the same time. For federal tax issues, there’s a simple, client-centric solution to being proactive with notices and issues: IRS Form 8821, Tax Information Authorization. This authorization allows your firm to be copied on your clients’ notices without taking power of attorney. It shifts the burden off of your clients and prevents them from filtering any information you receive.

Also, being copied on IRS correspondence allows you the best opportunity to meet deadlines and get the full picture about any IRS activity on your client’s account, such as a tax return adjustment or a request for more information. Using this form sets you up to provide the best service, allowing you the maximum time to address the issue and avoid the second and third notice.

Know your clients’ facts – from the perspective of your client and the IRS. Most notices, with the exception of many collection notices, come as a surprise to CPAs and their clients. To accurately assess your client’s situation and determine next steps, you must understand the facts as the IRS sees them. It’s imperative to know whom to call, what to ask and how to verify the accuracy of the information. Develop a template document on how to interview the IRS and keep it updated. Include information such as how to pass IRS disclosure gates, which questions to ask and which documents to request to confirm actions taken.

Having a firmwide Form 8821, Tax Information Authorization, on file for your client will allow you or a member of your staff to immediately contact the IRS in the event of a notice or issue.

Some practitioners look to IRS transcripts as the answer to IRS account questions. But transcripts are best used to confirm some past IRS actions — not to understand client history and pending actions. That’s because IRS transcripts have limited information, by year, and don’t provide a history across several years or information on your client’s IRS account, such as pending transactions.

Once you have the IRS’ perspective on your client’s situation, you can match it against your client’s facts and clearly understand the issue.

Understand the solutions, options and process involved in addressing each issue. Experience helps here. However, most firms don’t perform enough repetitions to understand, in detail, the process and solutions for addressing each particular issue. Notices can lead to more notices if practitioners don’t also understand related issues. In a simple example, if you filed a late return for a client but didn’t address the underlying reason for filing late, the IRS may send penalty notices next.

There are several effective steps you can take to take to address an issue. Responding to the IRS in the format that it expects can prevent delays. A common example is an IRS underreporter notice. Often, practitioners send an amended return to the IRS to correct the underreporting.

This actually confuses the IRS process because there are two active client transactions in separate areas of the IRS: the underreporter unit and a filing service center. Ultimately, the IRS has to coordinate the amended return with the CP2000 to post the correct changes. This often leads to long delays and incorrect assessments.

You can also create a central “situational” file of best practices for the most common notices and issues. Maintain situational standard templates, including letters and correspondence, analysis worksheets, interview guides, checklists, call scripts and forms, that use best practices for dealing with the IRS and states. Keep the templates updated and in a central file for access across your firm.

Establish a system for tracking progress, status and deadlines across your firm. The problem with post-filing work is that the IRS doesn’t set a date each year for all IRS compliance deadlines; notices and issues are a year-round problem. Deadlines depend on the type of notice or issue and the date the IRS demands a response. Therefore, each firm must develop process workflows and reminders to operate efficiently.

Technology can help. Some CPA offices use simple calendar reminders. Others use more complex workflow systems to monitor status, create accountability and track actions. At a minimum, CPAs should use calendar reminders and share these deadlines with other firm members when dealing with IRS and state notices and issues. Centralized file management also helps with organizing and accessing client documents.

Going forward, tax practices should look for firmwide workflow and practice management systems that can produce real-time reporting, status and accountability of client post-filing issue progress.

Looking forward

There’s no doubt that the IRS and state compliance environment has changed. As CPAs look to solidify themselves as their clients’ year-round tax advisor, they have an opportunity to improve client service and firmwide efficiency. Doing so starts with establishing a set of best practices for post-filing work that allows firms move from a reactive approach to a proactive process. Practitioners who take advantage of technology to centralize files and templates, track status and respond to the IRS quickly and efficiently will position themselves ahead of the curve.

Assess your firm’s post-filing efficiency:

Firms that excel in year-round client service approach post-filing work in a client-centric, systematic way, combining process improvements with technology. Answer the following questions to see where your firm stands.

- How do you educate your clients about increasing notice volume and the changing compliance landscape?

- I regularly discuss post-filing compliance with my clients in person or with educational material.

- I talk to my clients about post-filing compliance only when they experience an IRS issue.

- Depending on the client, I sometimes discuss post-filing compliance work before the client has an IRS issue.

- Do you limit the scope of tax prep engagement letters so that clients aren’t surprised by bills for post-filing work?

- Yes, I use engagement letters to specifically outline tax prep services and clearly explain to my client that post-filing work requires a separate engagement.

- No, I use the firm’s standard engagement letters without further explanation.

- Depending on the client, I sometimes tailor engagement letters for tax prep and post-filing services.

- How many clients have you lost a client due to a post-filing notice or issue?

- I have never lost a client over an IRS issue or notice.

- I have lost three or more clients over an IRS issue or notice.

- I have lost one or two clients over an IRS issue or notice.

- Are you automatically copied on most of your clients’ notices through Form 2848, Power of Attorney, or Form 8821, Tax Information Authorization?

- Yes, I use Form 8821 to allow me to be copied on most of my clients’ notices.

- No, I wait for most of my clients to alert me to notices they receive.

- I use Form 2848 or Form 8821 on some of my clients to be copied on notices.

- Typically, how many times must you call the IRS for a client with a post-filing notice or issue?

- I typically call the IRS once to get the information I need or resolve the issue.

- I typically have to call the IRS more than once to find the right contact, get the information I need or resolve the issue.

- It’s about half and half. Sometimes I need to call only once, and sometimes I need to call multiple times.

- Does your firm keep updated template documents and best practice information on post-filing practice and procedure in a centralized location?

- Yes, we have a set of documents and/or resources for post-filing work available across the firm.

- No, I use documents and/or resources from past IRS interactions, but they’re not standard or available across the firm.

- For some issues, we have standard or commonly used documents and/or resources available across the firm.

- Do you use technology to organize, track status and set reminders for post-filing engagements across your firm?

- Yes, we use technology to keep track of our post-filing work and/or centralize documents.

- No, we deal with issues and notices the traditional way, without technology to track status or centralize files.

- Sometimes. Depending on the issue, client or practitioner, we may use technology to keep track of our post-filing work and/or centralize documents.

How to score:

For every answer A, give yourself 1 point.

For every answer B, give yourself 3 points.

For every answer C, give yourself 2 points.

If you scored:

7-10, Your firm excels in year-round service. You take advantage of best practices to educate your clients, bill for more services, stay proactive on notices and issues, and improve efficiency through technology.

11-15, Your firm is flexible in meeting the needs of clients, but doesn’t always follow a process. You do some things better than others, but there are some effective steps you can take right now to streamline post-filing work, reduce learning time, and increase your billable hours when it comes to post-filing practice and procedure. See the best practices outlined in this article.

16-21, Your firm doesn’t use a system to tackle post-filing compliance. As a result, you’re left with less billable time and more opportunity to provide better client service. Take a look at the best practices outlined in this article for steps you can take right now.

———————————

Jim Buttonow is Vice President of Product Development and Cofounder of the tax technology company New River Innovation. Jim’s professional mission is to apply emerging technology to problems faced by tax professionals after they file.

Jim is a CPA and former IRS Large Case Team Audit Coordinator. He worked at the IRS for 19 years. Since leaving the IRS, Jim has represented many clients before the IRS. At New River Innovation, Jim is the chief architect of Beyond415 (Beyond415.com), an award-winning technology for tax practitioners to efficiently handle IRS issues, notices and audits. Through Beyond415, Jim also develops and presents CPE series on IRS practice and procedure for issues that arise after filing, such as audits, notices and discrepancies. Jim regularly speaks on compliance trends and post-filing practice efficiency strategies for CPA and accounting firms.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs