Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Technology March 9, 2026

"From internal audit and cybersecurity to third-party risk and AI governance, our name now conveys the scale of enterprise risk we help solve for today," Optro CEO Raul Villar Jr. said.

Firm Management March 9, 2026

Growth often feels natural and exhilarating. However, as a firm reaches a certain size, the very technical expertise that built the practice begins to act as a ceiling.

Taxes March 9, 2026

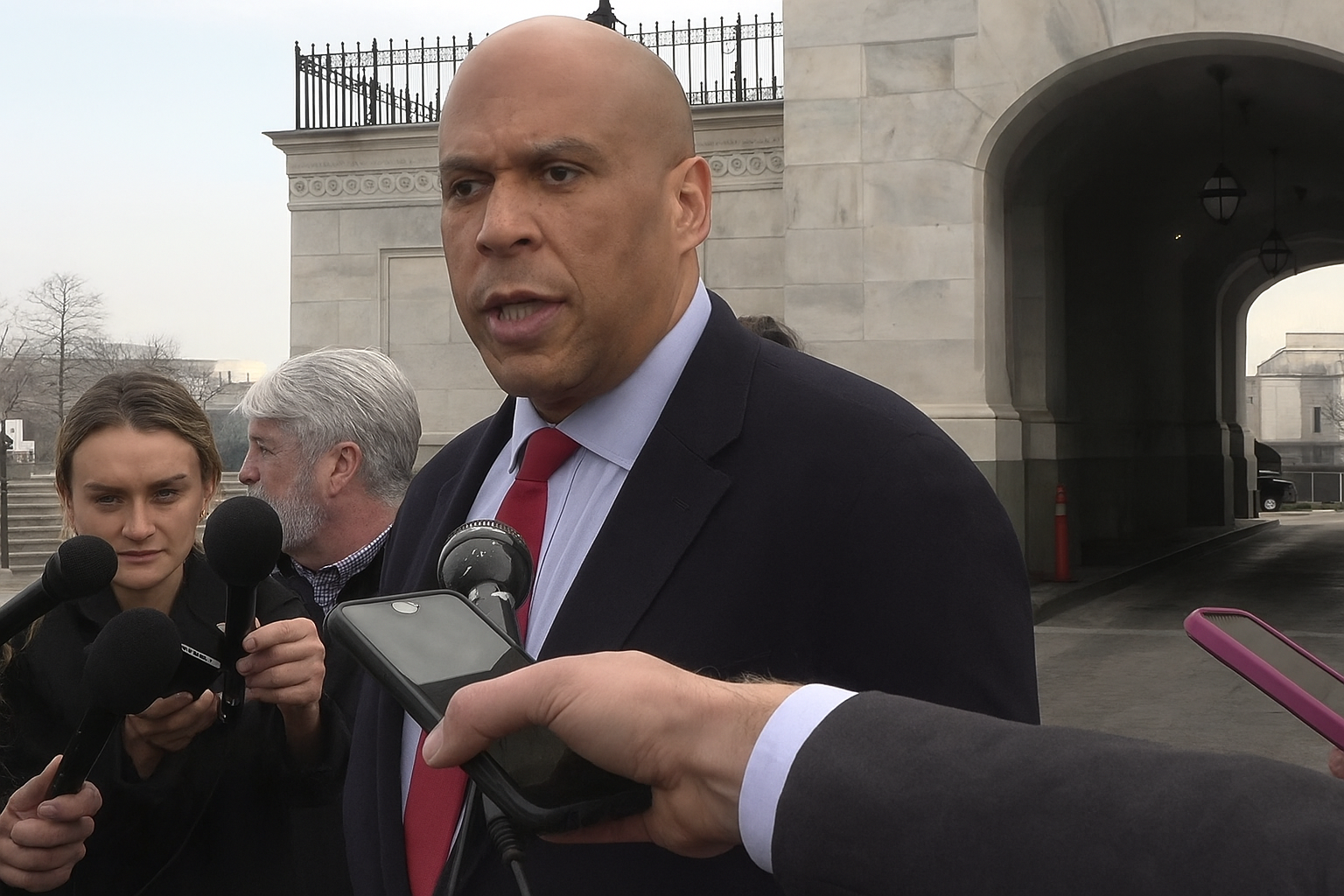

Sen. Cory Booker (D-NJ) plans to propose legislation Tuesday that would increase the standard deduction to $75,000 for married couples filing jointly.

Taxes March 9, 2026

For the week ending Feb. 27, the average refund was $3,742, up 10.6% over the average of $3,382 for the same timeframe last year.

Taxes March 9, 2026

In a letter to the tax agency, the American Institute of CPAs asked the IRS to expand the First Time Abatement program in order to cover more types of tax and information return penalties.

Accounting March 9, 2026

New survey data from the Association of Chartered Certified Accountants found that 48% of women working in finance and accounting aspire to be entrepreneurs, up from 45% last year.

General News March 9, 2026

Gas prices are rising at one of the fastest rates in years with the conflict in the Middle East expanding and the effective closure of the Strait of Hormuz, where 20% of the global supply of oil passes through.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Taxes March 9, 2026

Sen. Cory Booker (D-NJ) plans to propose legislation Tuesday that would increase the standard deduction to $75,000 for married couples filing jointly.

Taxes March 9, 2026

For the week ending Feb. 27, the average refund was $3,742, up 10.6% over the average of $3,382 for the same timeframe last year.

Taxes March 9, 2026

In a letter to the tax agency, the American Institute of CPAs asked the IRS to expand the First Time Abatement program in order to cover more types of tax and information return penalties.

IRS March 9, 2026

Taxpayers can check whether a nearby Taxpayer Assistance Center is offering extended hours by visiting IRS.gov to use the TAC Locator tool.

Taxes March 9, 2026

The Washington State Supreme Court's 1933 Culliton v. Chase decision spawned Washington's often-criticized tax structure, which relies heavily on sales and business taxes.

IRS March 9, 2026

Kathleen Mannion, 59, of Lawrence, MA, pleaded guilty last May to four counts of aiding and assisting in the preparation and filing of a false tax return and one count of theft of government money.

Taxes March 9, 2026

U.S. Sens. Ted Cruz, R-Texas, and Tim Scott, R-S.C., asked the Treasury Department to cut capital gains taxes on investors—and they claim the move does not need congressional approval.

Accounting February 28, 2026

Voting in the 2026 Readers’ Choice Awards is now open. Readers can vote for the programs, hardware, services, and other technologies they use and trust.

Technology March 9, 2026

"From internal audit and cybersecurity to third-party risk and AI governance, our name now conveys the scale of enterprise risk we help solve for today," Optro CEO Raul Villar Jr. said.

Accounting March 9, 2026

New survey data from the Association of Chartered Certified Accountants found that 48% of women working in finance and accounting aspire to be entrepreneurs, up from 45% last year.

Firm Management March 9, 2026

Aprio Global is designed to move beyond traditional international communities by focusing on purposeful collaboration, accountability, and shared success, while helping firms work together.

Auditing March 8, 2026

To support this growth, the company doubled its headcount over the past year, scaling operations to support rising global demand for agentic AI solutions purpose-built for finance.

Small Business March 6, 2026

The Trump administration said in a filing Friday that it is not equipped to immediately refund the more than $166 billion importers have paid or even stop charging the tariffs this week.

Firm Management March 6, 2026

Over the last five years, an increasing number of direct private equity investments in accounting firms has led to a dramatically higher number of indirect or subsequent “roll-up” transactions, the International Federation of Accountants says.

Firm Management March 6, 2026

The investment will accelerate Schellman's next phase of growth, expanding the firm's capabilities, scaling its team and enabling Schellman to serve clients across more markets and geographies.

Payroll March 6, 2026

Nonfarm payrolls fell 92,000 last month, one of the largest declines since the pandemic, after a strong start to the year, a Friday report from the Bureau of Labor Statistics says.

Taxes March 5, 2026

This tax-deductible money move can help individuals lower their tax bills while growing their retirement savings.

Payroll March 5, 2026

The U.S. visa system for highly skilled immigrants is being overhauled, with a new $100,000 fee for successful sponsors of immigrants arriving from another country.

Economy March 5, 2026

CPA business leaders reported higher optimism about the U.S. economy during the first quarter of 2026, while confidence in their own companies' prospects also improved, according to the latest AICPA and CIMA Economic Outlook Survey.

Payroll March 4, 2026

As the Federal Trade Commission kicks off National Consumer Protection Week, new data from Bankrate shows that a growing number of Americans are falling victim to financial fraud and scams.

Payroll March 4, 2026

U.S. companies added the most jobs since July last month, adding to evidence of some stabilization in the labor market.

Benefits March 3, 2026

Improvements to the benefits claims process have cut through the delays and bureaucracy for thousands of Americans with disabilities, according to new data from the Social Security Administration.

Payroll March 3, 2026

While the idea of heartbreak leave may be unconventional, the data from a new Zety report shows employees are already taking time off after breakups, just informally and without support.

Technology March 9, 2026

"From internal audit and cybersecurity to third-party risk and AI governance, our name now conveys the scale of enterprise risk we help solve for today," Optro CEO Raul Villar Jr. said.

Auditing March 8, 2026

To support this growth, the company doubled its headcount over the past year, scaling operations to support rising global demand for agentic AI solutions purpose-built for finance.

Technology March 5, 2026

A new consumer-focused tax filing platform was released Thursday by Prime Meridian, a Palo Alto, CA-based company that includes former IRS commissioner Danny Werfel as a strategic advisor.

Taxes March 5, 2026

The analysis of 30,000 U.S. users with moderate trading activity found $435 million in inflated capital gains for the 2025 tax year alone—a 944% overstatement compared to actual gains of $46 million.

Taxes March 5, 2026

While 82% of Americans say they’re concerned about tax fraud or identity theft this filing season, many don’t feel fully prepared to spot today’s increasingly convincing scams, McAfee says.

Technology March 5, 2026

AI-powered business travel and expense platform Navan has launched Expense Chat, a new AI agent designed to eliminate manual out-of-pocket expense submissions.

Technology March 4, 2026

Revi is designed to simplify manually intensive revenue accounting workflows for finance organizations to scale revenue operations and expand accounting team efficiency, the company said.

Technology March 4, 2026

The partnership enables Wiss to deploy NetSuite-native solutions for fixed assets, cash management, lease accounting, and intercompany automation.

Firm Management March 9, 2026

Growth often feels natural and exhilarating. However, as a firm reaches a certain size, the very technical expertise that built the practice begins to act as a ceiling.

Firm Management March 9, 2026

Aprio Global is designed to move beyond traditional international communities by focusing on purposeful collaboration, accountability, and shared success, while helping firms work together.

Firm Management March 6, 2026

Over the last five years, an increasing number of direct private equity investments in accounting firms has led to a dramatically higher number of indirect or subsequent “roll-up” transactions, the International Federation of Accountants says.

Firm Management March 6, 2026

The investment will accelerate Schellman's next phase of growth, expanding the firm's capabilities, scaling its team and enabling Schellman to serve clients across more markets and geographies.

Mergers and Acquisitions March 5, 2026

CRI's portfolio companies work together to provide clients with holistic guidance across both business and personal financial needs.

Mergers and Acquisitions March 5, 2026

Dallas-based tax services and software firm Ryan said Thursday it has acquired Hucke and Associates, a property tax consulting firm based in New York City.

Firm Management March 4, 2026

Top 50 accounting firm Kaufman Rossin announced Wednesday that CFO Marc Feigelson has been elected CEO, succeeding the retiring Blain Heckaman.

Mergers and Acquisitions March 2, 2026

The top 10 accounting firm is expanding its presence in the healthcare consulting market with the addition of The Innova Group, effective March 1.

March 26, 2026

What separates high-performing, future-ready accounting firms from those struggling to keep up?

January 20, 2026

Most firms focus on efficiency, automation, and AI, but the real challenges inside a tax workflow are often simpler and more human: unclear expectations, too many handoffs, information scattered across tools, and clients or staff feeling unsure about what comes next.

January 5, 2026

Filing corrected returns can be confusing—but it doesn’t have to be. Join Amanda Watson, EA, for a practical session designed to help you confidently navigate amended and superseded returns.

December 16, 2025

Manual processes slow your firm—and cost time, money, and talent. Firms that embrace automation and modern technology save hours, reduce costs, and build a workplace that attracts the next generation of CPAs.