TaxConnex recently released its study of national sales tax trends, compiled from data from the US Census Bureau. TaxConnex is a provider of sales and use tax outsourcing and consulting services.

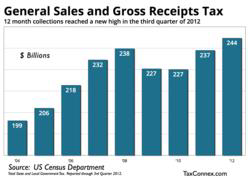

The data shows that sales tax collections have steadily increased over the past few years. However, due to a steep decline in 2008 and 2009, many states expanded the list of taxable services and applied the full-court press to Amazon and other online retailers. This action resulted in the collection of sales tax reaching an all-time high.

“The conversation du jour surrounding sales tax revolves around how much sales tax collection is being lost as a result of the shift in buying patterns to the Internet,” said Brian Greer, Partner, TaxConnex. “With the tenor of the conversations, you would expect that sales tax collections would be significantly down. This is just not the case. Sales tax collections, which account for over 30 percent of all states’ revenue and is the single largest source of revenue for many states, is at an all-time high.”

TaxConnex plans to provide updated guidance on the expanding tax base, sales tax rates and pending Federal legislation throughout 2013. They will also continue to monitor sales tax collections.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs