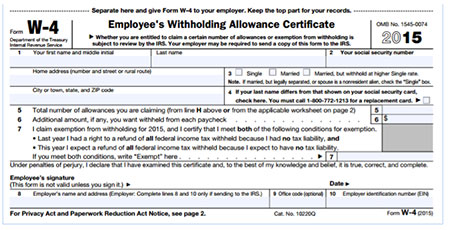

Let’s take a look at W-4s. As we all know, this is the document that employees turn in to an employer to calculate federal and (sometimes) state withholdings.

There was once a time when – if the employee turned in a W-4 with more than 10 exemptions – the W-4 needed to be sent to the federal government for verification. This requirement no longer exists, except for California state withholdings.

Elsewhere, a lock-in letter replaced this requirement. If an employer receives a lock-in letter from the IRS, the employer is then required to use the IRS calculation of exemptions instead of the employee W-4. The rare exception is if an employee submits a new W-4 with more taxes that are calculated than the lock-in letter-again, this is very rare. A lock-in letter trumps a W-4 and must be put in place by the employer no more than 60 days after it is received.

“How many times can an employee change their W-4?” is a common question. Actually, there is no minimum or maximum number of times. However, an employer has up to 30 days to implement the change. Another common question is “Does a W-4 expire?” There is no expiration date for W-4s so you could be correct to use a 1984 (or any other year) W-4, if no change has ever been received from the employee.

Let’s talk about what constitutes a legal and acceptable W-4. The form can only contain the employee demographic information, marital status, and the number of exemptions, with an area for additional dollar amount of withholding and a box for exempt. Any alteration of this, like set percentage or set dollar amount of withholding, voids the W-4. If the employer does not have a valid W-4 for the employee, the employer is required to use either Single 0 or the last valid W-4 they have on file for the employee. Also, make sure you are using the correct year W-4 when the employee submits it to the employer.

Now let’s look at the states. The W-4 is a federal document, and several states – but not all – accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings. You’ll notice that Pennsylvania does not have a state W-4-this is because the rate is a set percentage.

| Legend |

| Red = Accepts Fed W-4 |

| Green = Accepts Fed OR State W-4 |

| *CA – 10 or more exemptions must be faxed or mailed to state |

| State | Form |

|---|---|

| AL | A-4 |

| AK | No WH |

| AZ | A-4 |

| AR | AR4EC |

| CA | DE-4* |

| CO | FED W-4 |

| CT | CT-2-4 |

| DE | FED W-4 |

| DC | D-4 |

| FL | NO W/H |

| GA | G-4 |

| HI | HW-4 |

| ID | FED W-4 |

| IL | IL-W4 |

| IN | WH-4 |

| IA | IA-W-4 |

| KS | K-4 |

| KY | K-4 |

| LA | L-4 |

| ME | W-4ME |

| MD | MW-507 |

| MA | M-4 |

| MI | MI-W4 |

| MN | W-4MN |

| MS | 89-350 |

| State | Form |

|---|---|

| MO | MO W-4 |

| MT | FED W-4 |

| NE | FED W-4 |

| NV | N/A |

| NJ | NJ W-4 |

| NM | FED W-4 |

| NY | IT-2014 |

| NC | NC_4 |

| ND | FED W-4 |

| OH | IT-4 |

| OK | FED W-4 |

| OR | FED W-4 |

| PA | NONE |

| PR | .499r-4.1 |

| RI | FED W-4 |

| SC | FED W-4 |

| TN | N/A |

| TX | N/A |

| UT | FED W-4 |

| VT | W-4VT |

| VA | VA-4 |

| WA | N/A |

| WV | WV/IT_104 |

| WI | WT-4 |

| WY | N/A |

Knowing the federal and state W-4 rules will assist you in correct calculations of withholdings and can assist employees with the requirements.

——————

James Paille CPP is the Director of Operations for Thomson Reuters myPay Solutions. He has been an executive manager in the payroll service industry for more than 30 years, specializing in managing multi-location offices. Jim is President-Elect of the American Payroll Association as well as a member of the National Speakers Bureau, and chairs the CPP Certification Review Panel. He holds a Bachelor of Science in Accounting from St. John Fisher College in Rochester, NY.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Payroll