If you have nothing to do for a few hours on a rainy April afternoon, you can scroll through Hillary Clinton’s tax returns for the last 30 years.

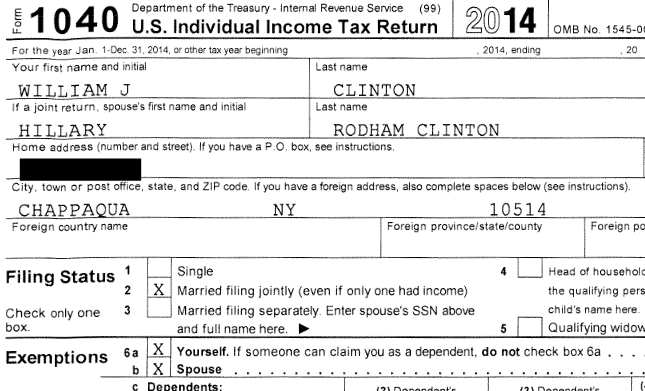

The former Secretary of State and New York Senator, who has been living in a fish bowl since her husband Bill became governor of Arkansas and ascended to the presidency, recently released copies of her joint tax returns for the last eight years. This release supplements previous returns made public during her years as First Lady and Bill Clinton’s campaigns. All told, the returns go back 30 years.

Currently, Hillary Clinton is the leading candidate for the Democratic presidential bid this year. She has called for full disclosure of returns by her main opponent, Vermont Senator Bernie Sanders, and the Republican frontrunner, billionaire Donald Trump. Sanders began releasing his latest personal tax information on April 15, while Trump has steadfastly refused to do so, citing an ongoing IRS examination.

Presidential candidates are not required by law to release their returns to the public, but most have opened up their files in recent years. Other financial disclosures must be made to the Federal Election Commission.

As detailed by statements from Clinton’s camp, the couple paid almost $44 million in federal income taxes for the period of 2007 through 2014. In the last two years of the returns, 2013 and 2014, the Clintons paid an effective federal income tax rate of 35.4 percent and 35.7 percent, respectively. When taking state and local taxes into account, their combined effective tax rate was 44.6 percent in 2013 and 45.8 percent in 2014.

Since 2007, the couple has donated almost $15 million to charity. In 2013, charitable giving represented 11.4 percent of their income. This rate fell slightly to 10.8 percent in 2014.

Below is a summary of the last 14 years of returns as provided by Clinton’s campaign. Their full income tax returns are available at https://www.hillaryclinton.com/tax-returns/.

|

Year |

Effective Federal Tax Rate |

Effective State and Local Tax Rate |

Effective Combined Tax Rate |

|

2001 |

37.7% |

6.7% |

44.4% |

|

2002 |

38.2% |

6.8% |

45% |

|

2003 |

32% |

7.8% |

39.7% |

|

2004 |

31.1% |

7.7% |

38.9% |

|

2005 |

30.8% |

7.6% |

38.5% |

|

2006 |

29.5% |

7.6% |

37.1% |

|

2007 |

25% |

11.6% |

36.6% |

|

2008 |

30.5% |

7.1% |

37.6% |

|

2009 |

30.5% |

9.4% |

39.9% |

|

2010 |

31.2% |

9.1% |

40.3% |

|

2011 |

29.5% |

10.3% |

39.8% |

|

2012 |

30% |

9.2% |

39.2% |

|

2013 |

35.4% |

9.2% |

44.6% |

|

2014 |

35.7% |

10.1% |

45.8% |

Clinton has supported the “Buffett rule” designed to ensure that the wealthiest taxpayers pay a greater share of the federal income tax burden. She has also advocated for tax simplification. “We’ve come a long way from my days going door-to-door for the Children’s Defense Fund and earning $16,450 as a young law professor in Arkansas – and we owe it to the opportunities America provides,” said Clinton when her latest returns were released. “I want more Americans to have the chance to work hard and get ahead, just like we did. And reforming the tax code can help.”

Taxes have remained one of the key campaign issues as we head towards the conventions. Don’t expect this to change.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes