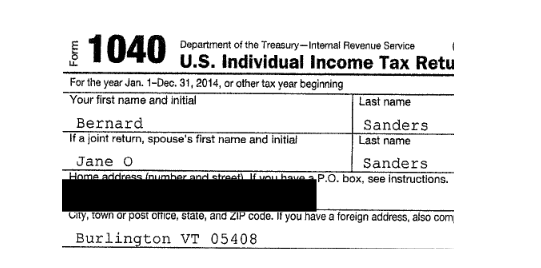

After weeks of prodding from his main opponent for the Democratic presidential nomination, Bernie Sanders finally released the remaining forms and schedules of his 2014 tax return on April 15. The result? No major surprises – the Vermont senator paid significantly less tax, and earned less taxable income, than his well-heeled revivals, including former Secretary of State Hillary Clinton, who had repeatedly called for Sanders to release his returns.

But the information also indicates that Sanders, a frequent crusader for tax equality, wasn’t shy about using the current tax laws to his advantage. He and his wife Jane paid an effective federal income tax rate of 13.5 percent on taxable income of more than $205,000. According to the Tax Foundation, a conservative-leaning group, the average effective tax rate for a couple with an income between $200,000 and $500,000 was 15.2 percent in 2014 — 1.7 percent higher than Sanders.

In comparison, Hillary Clinton paid an effective tax rate of 35.7 percent on her 2014 federal return. She and her husband Bill Clinton raked in about $14.6 million for the year.

When the returns were released, Sanders announced that there was no need for excitement. “They are very boring tax returns,” he said. “No big money from speeches, no major investments. Unfortunately — unfortunately, I remain one of the poorer members of the United States Senate.” He “blamed” the delay on Jane, who prepares their taxes, saying. “We’ve been a little bit busy lately. You’ll excuse us.”

Notably, Sanders was able to reduce his tax bill by claiming several big-ticket itemized deductions on his 2014 return, including the following:

- Almost $23,000 of home mortgage interest;

- Almost $15,000 in property taxes;

- Almost $10,000 in state and local income taxes;

- $8,000 in charitable donations (including $350 in gifts of property to charity); and

- More than $4,400 in unreimbursed job expenses.

In addition, according to an article in Forbes (“Bernie Sanders’ Tax Return Has Some Odd Deductions,” 4/19/16), Sanders also deducted roughly $9,000 in business meals, while being taxed on 85% of his Social Security benefits, as required by law for someone in his income range. Sanders has been adamant about wealthier individuals paying their fair share into Social Security.

Detractors of Sanders claim that he is being hypocritical for maximizing the available tax benefits while stumping to close down loopholes in the tax law. But supporters say that he is only doing what anyone else would do in his situation and there’s no shame in cashing in on legitimate tax breaks. What’s your opinion?

A PDF version of the Sanders income tax return is online.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes