During a recent CECL webinar, Sageworks surveyed professionals from banks and credit unions asking which functional area currently owns the allowance for loan and lease losses (ALLL) process for their institution. They were also asked which functional areas will be involved in the ALLL process under CECL. Nearly half of the respondents to the first question said that the credit area currently owns the ALLL process. When asked about CECL, respondents said that finance, accounting and treasury areas will also play a part in the CECL calculation.

Sageworks, a financial information company that provides lending, credit risk and portfolio risk solutions, conducted the poll during an August 22 webinar on CECL Transition Planning and Execution, which focused on how to prioritize activities in a CECL transition plan.

According to more than 350 poll responses from bank and credit union vice presidents of finance, chief credit officers, finance managers and chief financial officers, 47 percent said that the credit area of the institution currently owns the ALLL process in the incurred loss model. Another 29 percent said that the accounting area owns the process, and 24 percent said the finance area owns the ALLL process.

When asked which functional areas will be involved in the ALLL process under CECL, the same respondents had the option to choose multiple areas of the institution. Reflecting the first question, 91 percent of respondents said that the credit area will be involved in the ALLL process under CECL. However, 68 percent of respondents also said the accounting area will be involved, as well as 58 percent said that the finance area will be involved. Further, 22 percent said the treasury area will be involved in the ALLL process under CECL.

“What is noteworthy here is that respondents clearly indicated that more functional areas of their institutions will need to be involved in the estimation of the ALLL under CECL. The ALLL process today is often siloed, in that one functional area is the primary owner of the process (i.e., credit vs. finance). Though other areas may be providing input to the estimation today, it is anticipated that the process will evolve to be more cross-functional under CECL,” said Sageworks Executive Risk Management Consultant Tim McPeak.

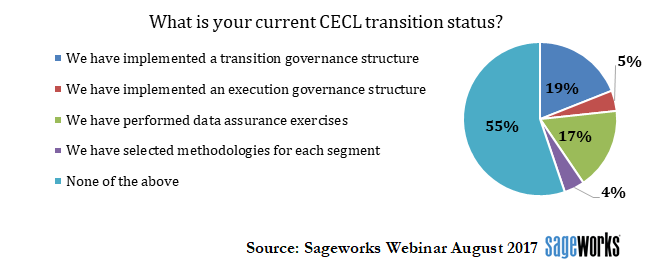

“Regarding the CECL transition status, respondents selecting specific answers appear to be focusing today on building governance structure (20%) and assessing their data adequacy (19%). These choices are understandable and appropriate relative to timelines for implementation. What is most striking, however, is the large number of respondents choosing “None of the above” (53%). This suggests that many institutions have yet to begin their preparations for CECL in earnest.”

Poll Results

To learn more about CECL transition and execution, visit http://web.sageworks.com/cecl-execution/ to register for the next webinar on September 14.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs