There was a time when hearing “the check is in the mail” was like a vote of confidence. People didn’t worry about delays or identity theft. But times have changed, and new technology has given us faster, more efficient ways to pay.

Accountants, whether in a larger organization or advisors to small businessowners, still love writing checks. In fact, the latest data from the Association for Financial Professionals (AFP) shows that B2B payments by check actually increased between 2013 and 2016.

But just because accountants want to keep using checks doesn’t mean they should be mailing them. Here are six reasons why accountants are stepping away from the mailbox and moving toward safer, easier, cheaper and greener alternatives.

Paper opens the door to fraud

According to a 2018 survey conducted by AFP, fraud attacks against payment systems continue to persist. Vulnerability to fraud increases with the number of times a payment is touched. A mailed check can be touched by as many as eight people during its lifecycle.

To protect against fraud, financial professionals want more secure payment options that don’t require sensitive information from the payee, have limited touchpoints and offer multiple layers of control.

Paper takes patience

Paper checks are slow, especially when combined with snail mail. It doesn’t take much to pop a check in the mail, but writing the check, getting it signed and waiting for it to reach its destination can take a while. Checks can be lost or compromised in transit, and your account information can end up in the wrong hands.

Paper slows down all processes it touches. Both payers and payees prefer direct, timely delivery to prevent checks from getting lost in the mail.

Paper’s cash flow conundrum

When the check is in the mail, funds are trapped in transit for an average of two days. If you’re away from your office and need to make a payment on the spot, you’ll have to expedite it and pay a hefty courier charge.

Companies want a flexible payment option that gives them control over their funds and the speed to time disbursements to the last possible second. After all, cash flow is king!

The hidden fees of paper

If your company send checks by mail, you may be paying more than you expect. Bank of America estimates the cost of issuing a paper check can range anywhere from $4 to $20, based on the price of the check and shipping, plus the time employees spend writing, mailing, collecting and reconciling the check. The cost of postage alone can add up to a good chunk of change. According to Bill.com, businesses spend $235 on postage to mail 500 checks.

To counter high overhead costs, businesses are looking for a payment solution that eliminates the added expense of envelopes and other supplies needed to send checks.

Paper creates environmental waste

For little pieces of paper, checks sure are a drain on natural resources. It takes ink and paper to print them, fuel to ship them and time and energy to process them.

From recycling rainwater for carwashes to powering their facilities with solar panels, businesses are looking for ways to reduce their carbon footprint. Switching to an electronic payment solution can help them reduce their paper footprint.

eCheck solution drives efficiency

From going paperless to using workflow apps, companies are taking steps to make their operations more efficient. They are embracing new technology, connecting with tech-savvy consumers, delivering a superior customer experience and making sales.

To keep the momentum going, they need a payment solution that retains the wide acceptance of a check, offers digital speed and security and the simultaneous delivery of remittance information, but does not require businesses to modify systems and processes. One such solution is Deluxe eChecks.

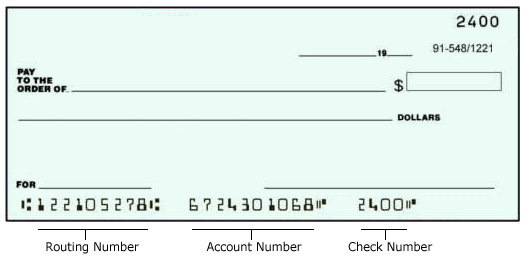

With eChecks, payers send payees notification emails with links to secure sites housing their checks and remittance information. Payees access and print checks on their printers, and deposit them at their financial institutions like any other paper check. No sensitive information is required from the payee and the transaction takes place at the speed of email.

And during Small Business Week only, Deluxe is offering accountants an opportunity to get 25 Deluxe eChecks free of charge, by calling 877.632.7573 and mentioning the code DLX_small_business_week. For more information on Deluxe eChecks and the benefits to accountants and other businesses, visit: www.deluxe.com/echecks.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs