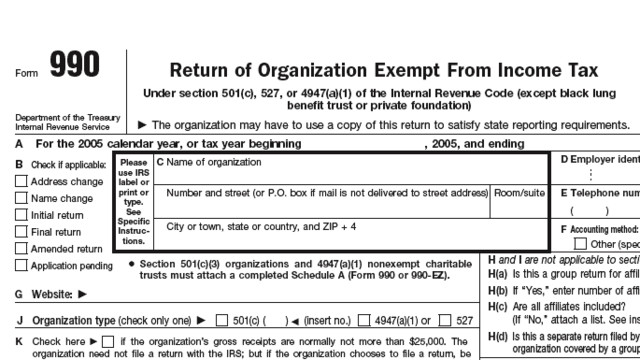

The IRS and Department of the Treasury have issued final regulations clarifying the reporting requirements generally applicable to tax-exempt organizations.

The final regulations reflect statutory amendments and certain grants of reporting relief announced by the Treasury Department and the IRS in prior guidance to help many tax-exempt organizations generally find the reporting requirements in one place.

Among other provisions, the final regulations incorporate the existing exception from having to file an annual return for certain organizations that normally have gross receipts of $50,000 or less. That exception was previously announced in Revenue Procedure 2011-15. The regulations also provide that the requirement to report contributor names and addresses on annual returns generally applies only to returns filed by Section 501(c)(3) organizations and Section 527 political organizations.

All tax-exempt organizations must continue to maintain the names and addresses of their substantial contributors in their books and records. This change will have no effect on transparency, as contributor information that is open to public inspection will be unaffected by this regulation.

The final regulations allow tax-exempt organizations to choose to apply the regulations to returns filed after September 6, 2019.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs