Justworks Payroll

888-534-1711

From the 2020 reviews of professional payroll systems.

Justworks is a PEO (Professional Employer Organization) that has bundled payroll, compliance, HR, and benefits administration under a single umbrella. Designed for smaller businesses that need access to affordably priced benefits and automated payroll and HR services, Justworks is cloud-accessible, with two plans available.

Both the Basic and the Plus plans in Justworks offer payroll, compliance reporting, and resources, with options for a variety of insurance options including medical and dental insurance options, as well as retirement plans.

Justworks supports both hourly and salaried employees. They can be paid on weekly, biweekly or semi-monthly pay frequencies – note, however, that non-exempt employees can only be paid on a bi-weekly or weekly pay frequency. Non-exempt salaried employees and hourly employees can record their hours worked in Justworks using Justworks’ Timecards feature.

The dashboard in Justworks provides access to all system functions such as payroll, HR, and benefit management, depending on the version subscribed to. Users also have access to a variety of system alerts indicating tasks that need to be completed as well as upcoming pay dates and tax dates. In addition to running standard payroll, Justworks also supports bonus and commission payroll runs, as well as any other off-cycle pay runs that may be needed.

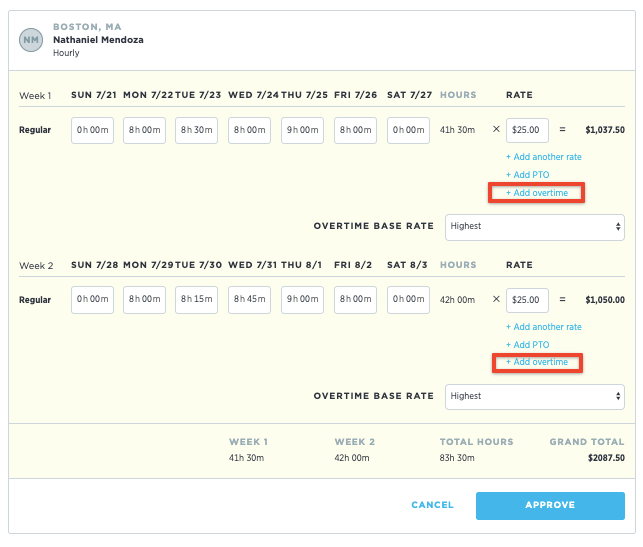

Managers can set up Justworks to enter time for both non-exempt salaried employees and hourly employees, though there is also an option available for employees to enter their own hours, which can later be approved by a supervisor. Once an employee is paid, they will receive an email notification of the payment, as well as the option to view their most current paystub.

Click for larger image: The employee timecard in Justworks lets you adjust hours and rates, add PTO and overtime.

Justworks also includes complete tax compliance in both plans, with tax tables available for all 50 states. In addition, the application handles all withholding, reporting, and remitting of payroll taxes, along with both W-2 and 1099 processing as well

Reports in Justworks are categorized by group, with Benefits, HR, and Payroll reports available. All reports can be accessed from the user dashboard, with reports completely customizable as needed. Reports available in the application include Onboarding Status, Last Pay Change, PTO Balance, Payroll, and Timecard usage. The Onboarding Status report can be particularly useful as it tracks the completion date of all required onboarding activity, with managers able to spot completion dates or if an area has not been filled out.

Justworks integrates with third-party applications including QuickBooks, QuickBooks Online and Xero, with the ability to sync data between applications. Users can also import data from timekeeping applications directly into the application. Justworks does not currently offer time tracking capability.

Justworks includes HR Tools that track paid time off, can assist in onboarding new employees, and share and store important HR documents. Users also have access to HR professionals during regular business hours. A benefits option is available in Justworks, that provides access to a variety of benefit choices, along with complete benefit administration. where users can choose from a variety of available benefits to offer their employees. In addition to handling all tax filings for payroll, Justworks also handles ACA filings, COBRA management, EEO-1 filings, New Hire reporting, and wage garnishments.

Justworks Help Center offers access to a searchable knowledgebase, with detailed help articles available for payroll, HR, and compliance. The support center in Justworks provides access to a product support options which include toll-free telephone support, as well as email, chat, Slack, and SMS support options, with software support available 24/7. Employer and employee support is also available 24/7. Justworks also offers a variety of resources aimed at small business owners.

Justworks is best suited for smaller businesses wanting to combine payroll, HR, and benefits administration into a single application. Designed as a substitute for an HR department, Justworks currently offers two plans. For employers with 25-99 employees, Basic is $44 per employee per month; the Plus plan is $89 per employee, per month. Discounts are available for larger employers. More details at https://justworks.com/pricing. Both Basic and Plus editions include complete payroll processing, online employee onboarding, and access to HR consulting, with options for benefit management including health insurance, a 401(k) plan, and other benefits such as dental and vision insurance along with health and wellness perks.

2020 Overall Rating – 4.5 Stars

Strengths:

- Offers an all-in-one solution that includes payroll, HR, and compliance

- Pricing reduced from last year’s pricing

- Complete tax filing and payroll compliance

- Robust benefits options available

Potential Limitations:

- Better suited to businesses with 100 or fewer hourly or salaried employees

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits

![justworks-primary-logo-navy-1-804x167[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/10/justworks_primary_logo_navy_1_804x167_1_.5f738f1e314d2.png)