Can you deduct the cost of moving expenses on your personal tax return? Probably not. Under the Tax Cuts and Jobs Act (TCJ), the deduction for job-related moving expenses has been suspended for 2018 through 2025, except for certain military personnel. In other words, you generally can’t claim a deduction in 2022.

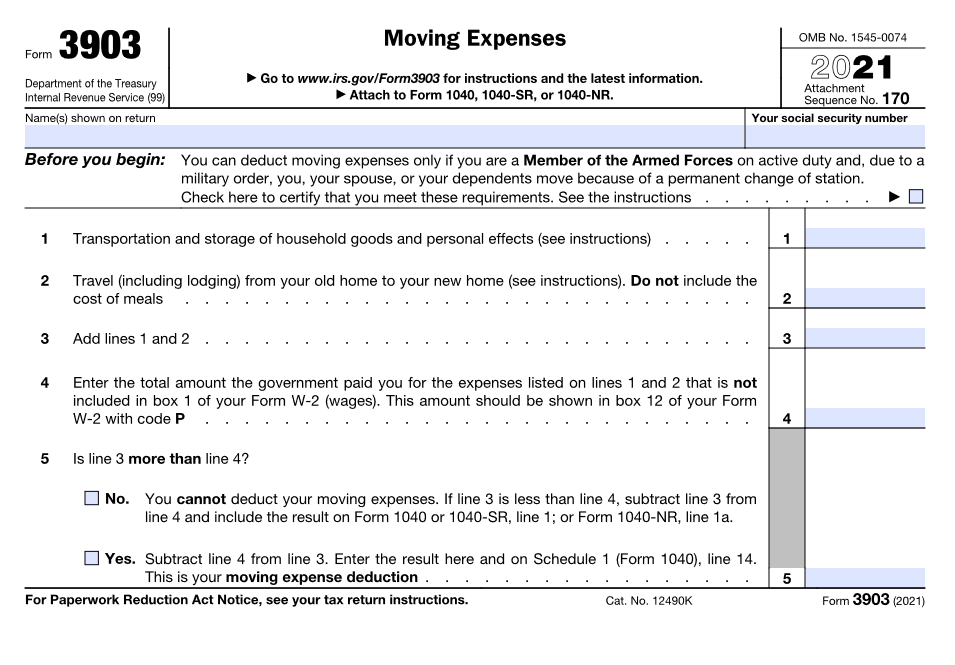

However, this deduction is still available if you’re on active duty in the military and you satisfy all the other requirements. In addition, some states like California offer tax deductions for moving expenses. So let’s take a quick look at the key rules in this area.

Background: Under federal law, you could claim moving expense deductions only if you met a two-part test involving distance and time.

- Distance: The new job location must be at least 50 miles farther from your old home than your old job location was from your former home. The IRS uses the shortest of the most commonly traveled routes to measure the distance between the two points.

- Time: Typically, you must work full-time for at least 39 weeks during the first 12 months after you arrive in the general area of the new job. But you don’t have to work for the same employer as long as the 39-week test is satisfied.

For a self-employed individual, the time test is working full-time for (1) at least 39 weeks during the first 12 months and (2) a total of at least 78 weeks during the first 24 months after you arrive in the general area.

Assuming you pass both parts of the test for a job-related move, you could deduct the reasonable costs of moving your household goods and personal effects to your new location, as well as the travel expenses (including lodging, but not meals) between the two locations. Normally, this includes charges by a moving company or a truck rental.

Note that the costs must be “reasonable.” Therefore, you are allowed to deduct the cost of direct travel from one location to the other, but costs attributable to sightseeing or other side trips are nondeductible. Furthermore, certain “indirect costs” of moving—including meals, house-hunting trips, temporary living expenses and attorney’s fees and real estate commissions—can’t be deducted either.

The allowable deduction generally covers qualified expenses of moving yourself, your spouse (if married) and other members of your household, such as dependent children. And the courts have even approved deductions for moving a pet!

If you travel by car, you may deduct the actual expenses for the move, assuming you keep all the necessary records, or use an IRS-approved flat rate. The flat rate for a job-related move in 2022 is 18 cents per mile (plus tolls and parking fees).

Finally, in a corresponding move, the TCJA suspended the tax exclusion for employer-provided moving expense reimbursements, except for taxpayers on active military duty, for 2018 through 2025. So you can’t circumvent the moving expense deduction crackdown by having your employer reimburse expenses. Reimbursements in 2022 constitute taxable income.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs