The IRS has reduced its backlog of unprocessed paper tax returns by 80%, has sent out refunds more quickly in 2023 than in previous years, and has cut wait times for those trying to reach the agency by phone, the national taxpayer advocate said in her midyear report to Congress on June 21.

“What a difference a year makes!” National Taxpayer Advocate Erin Collins wrote in the report’s preface. “Beginning with the COVID-19 pandemic in 2020, taxpayers experienced the worst service in memory from the IRS. Among other problems, tens of millions of taxpayers suffered from delays that at times exceeded 10 months to get their returns processed and receive their refunds; millions of taxpayers who responded to IRS notices waited an average of more than six months for the IRS to process or otherwise address their correspondence; and only about 13% of taxpayers who collectively placed more than 500 million telephone calls to the IRS were able to reach a telephone assistor. Not much had changed by this time last year. When I released my midyear report to Congress in June 2022, I wrote, ‘It’s Groundhog Day.’

“In submitting this report, I’m finally able to deliver some good news: The taxpayer experience vastly improved during the 2023 filing season,” she continued. “The IRS caught up in processing paper-filed original forms 1040 for individuals and various business returns; refunds were generally issued quickly; and taxpayers calling the IRS were much more likely to get through—and with substantially shorter wait times. Overall, the difference between the 2022 filing season and the 2023 filing season was like night and day.”

Despite these improvements, the report says the IRS is still behind in processing amended tax returns and taxpayer correspondence. Typically, employees in the agency’s accounts management function perform two roles: they answer telephone calls and they process taxpayer correspondence, amended returns, and other cases. The report says the IRS was much more effective in answering taxpayer calls this year, “but [that] could only be accomplished by prioritizing the phones over other IRS operations, and it resulted in greater delays in the processing of paper correspondence.”

Let’s take a look at some highlights from today’s report:

Processing of paper tax returns

The IRS reduced its backlog of unprocessed paper-filed original tax returns from 13.3 million at the end of the 2022 filing season to 2.6 million at the end of the 2023 filing season—a reduction of 80% and a return to pre-pandemic levels.

As of June 3, however, the inventory of unprocessed paper-filed original returns had grown to 4.1 million, consisting of about half individual returns and half business returns, the report says.

Processing of amended tax returns

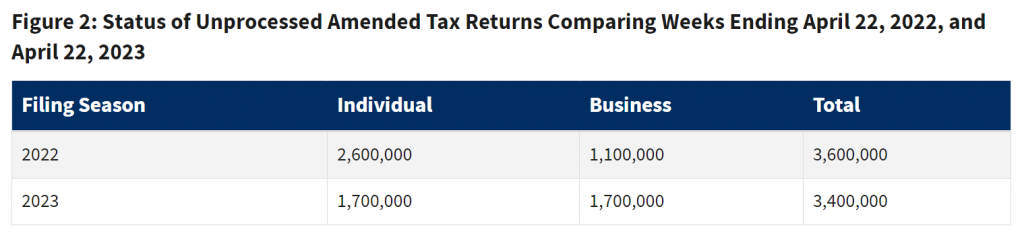

In contrast to the 80% reduction in the backlog of paper-filed original tax returns, the IRS’s inventory of amended returns was 3.6 million in April 2022 and 3.4 million in April 2023, a reduction of only 6% between the two periods.

For individual amended returns (forms 1040-X), the IRS’s processing time was about seven months as of the end of the 2023 filing season. On the business side, the IRS attributes a large portion of the delay in processing amended returns to employee retention credit (ERC) claims. The ERC is a refundable tax credit that Congress authorized to encourage businesses to retain employees during the COVID‑19 pandemic. Employers can receive up to $26,000 per employee if they meet certain conditions. While most ERC claims are legitimate, the IRS has received many fraudulent claims and placed promoter claims involving the ERC on its “Dirty Dozen” list of tax scams.

“The influx of fraudulent claims has put the IRS between a rock and a hard place,” Collins wrote. “If the IRS pays out claims quickly without taking the time to review them individually, it will be making some payments to individuals potentially engaged in fraud. If it takes the time to review claims individually, legitimate businesses who need the funds Congress authorized to help them stay afloat may not receive them in time.”

Processing of taxpayer correspondence and other accounts management cases

In addition to answering telephone calls and processing amended tax returns, accounts management employees process taxpayer responses to IRS notices and many types of taxpayer requests, such as applications for employer identification numbers, a large percentage of identity theft victim assistance cases, and tax preparer authorizations.

The IRS hasn’t made a ton of progress in reducing its paper accounts management inventories over the past year. The inventory is just 6% lower than at the same time last year. In April, it was taking the IRS 130 days to process its adjustments cases, an improvement from the 214 days it was taking last year, but still well above the IRS’s standard processing time of 45 days.

For identity theft victims, the delays have been particularly long and frustrating. The average cycle time for identity theft victim assistance cases closed in April 2023 was 436 days, or nearly 15 months. That is about three months longer than the 362-day cycle time for cases closed in April 2022.

Telephone service

The IRS answered more calls, answered a substantially higher percentage of calls, and significantly reduced wait times this filing season, the report said.

The IRS reached the Treasury Department’s goal of an 85% “level of service” (LOS) on the accounts management telephone lines. However, IRS employees only answered 35% of all calls received. As the report details, the LOS measure doesn’t account for the significant majority of taxpayer calls and isn’t the best measure of overall service levels. The report also points out that calls to certain telephone lines, including the collection lines and the installment agreement/balance due line, were answered at lower rates.

“Despite these areas of relative weakness, the big picture shows taxpayers had a much easier time reaching the IRS this filing season, reducing the need for repeat calls and lengthy wait times—a welcome relief for millions of taxpayers,” Collins wrote.

Technology upgrades greatly needed

The report addresses the IRS’s strategic operating plan to utilize funding the agency received under the Inflation Reduction Act. Of the roughly $80 billion allocated to the IRS over a 10-year period, only $3.2 billion was allocated for taxpayer services and only $4.8 billion was allocated for business systems modernization.

However, President Biden made a key IRS concession in the recent debt limit deal with Republicans. Biden agreed to reallocate $10 billion of the IRS’s funding in 2024 and another $10 billion in 2025 to other spending priorities. Plus $1.4 billion more was cut. This means the IRS will now get nearly $59 billion over 10 years for enforcement, modernization, and other priorities.

The report urges the IRS to prioritize IT upgrades that will improve the taxpayer experience. It says that although the COVID-19 pandemic was an unexpected development, the refund delays and service challenges taxpayers experienced over the past three years would’ve been substantially less severe if the IRS had better technology.

“[T]o achieve and sustain transformational improvement over the longer term, the IRS must focus like a laser beam on IT,” Collins wrote. “The IRS must give taxpayers robust online accounts that are comparable to accounts provided by banks and other financial institutions. It must make it possible for all taxpayers to e-file their tax returns. It must limit the number of rejected electronic tax returns. It must provide faster relief for victims of identity theft. It must make it possible for taxpayers to receive and submit responses to information requests electronically in all interactions with the agency. For taxpayers who prefer to submit returns or correspondence by mail, it must digitize all paper upon receipt. It must replace its 60 discrete case management systems that currently have limited ability to communicate with each other with an integrated, agency-wide system. And it must complete the modernization of its Individual Master File and Business Master File, which were originally deployed in the 1960s and are the repository for official taxpayer records. It must transform the way it performs its tax administration mission and become a responsive and trusted agency. Improved IT is imperative to achieving that goal.”

Collins expressed optimism that the IRS will be able to make even more improvements in the near future.

“[W]ith adequate funding, leadership prioritization, and appropriate oversight from Congress, I believe the IRS will make considerable progress in the next three to five years in helping taxpayers comply with their tax obligations as painlessly as possible,” she wrote.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, IRS, Taxes