Payroll

2019 Review of W2 and 1099 Systems

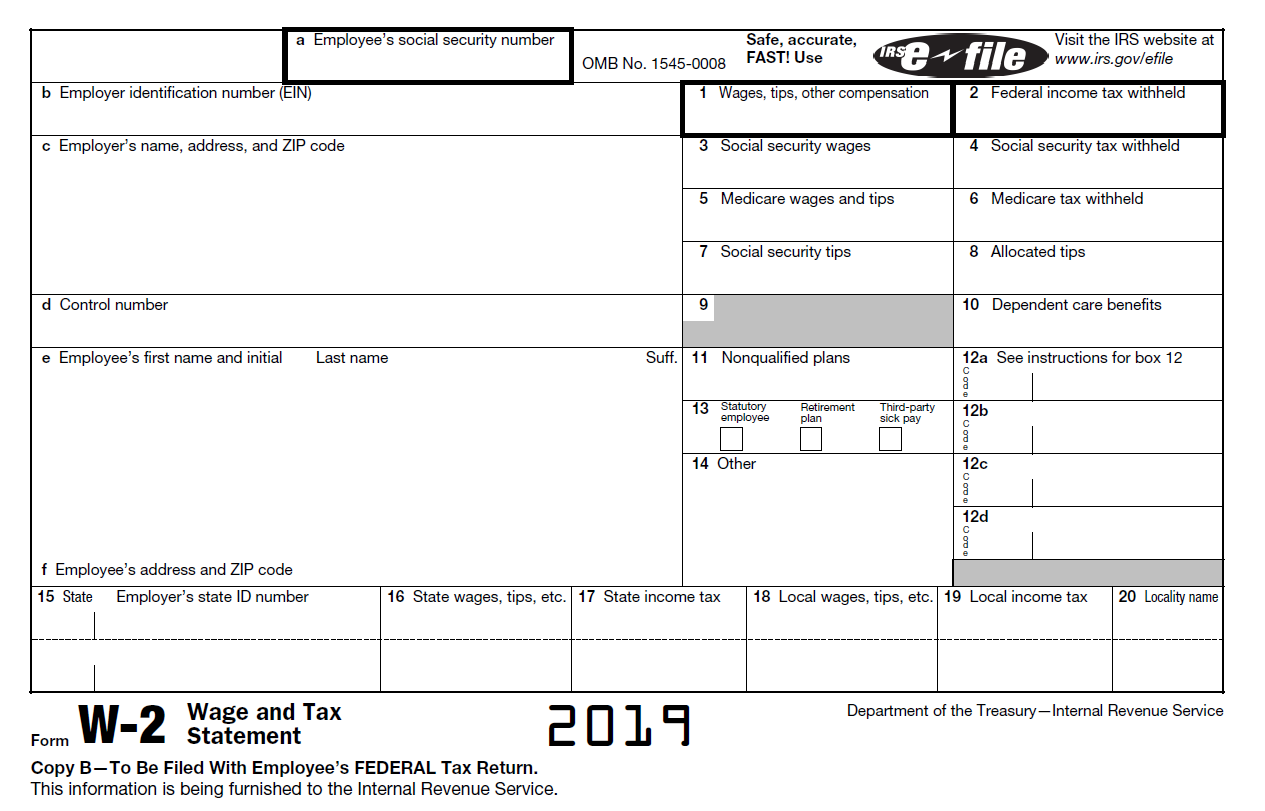

Whether you’re a small, local businesses, or a global enterprise, if you have employees, you need to process W-2s. This is typically completed through your payroll service, but if you handle payroll in-house, you are responsible for processing these ...

Dec. 16, 2019

According to an NPR/Marist Poll, 20 percent of American workers today are contract workers. Of course, this increased use of contract employees also means an increase in the number of 1099s that will need to be processed and distributed at year end.

Good 1099 compliance starts when a contractor is hired, not at year-end. There is no excuse for not having the appropriate information on file for any contractors you may hire. You wouldn’t hire an employee without their social security number and home address on file, so there’s no reason not to have this information on file for contractors. Remember, non-compliance can be costly, with penalties and interest assessed for late filing of these forms. Why take that risk? In fact, many small business owners, with no interest in completing this task, have turned to their accountants to handle this task for them.

And let’s not forget about W-2s. Whether you’re a small, local businesses, or a global enterprise, if you have employees, you need to process W-2s. This is typically completed through your payroll service, but if you handle payroll in-house, you are responsible for processing these forms, and ensuring that your employees receive them when they’re supposed to receive them.

Which leads us to W-2/1099 software. If you’re currently in need of W-2/1099 software but are unsure which program(s) would work best for your situation, many of the applications reviewed in this issue offer a free demo that you can try out prior to purchasing.

A total of 11 W-2/1099 software applications were reviewed in this issue. A few of these applications are part of a larger suite of applications and are designed to work only within that application suite, while others are stand-alone applications that can be used with a variety of third-party applications. Most W-2/1099 software applications update their software in the fall in preparation for the upcoming filing deadline early the following year, so the 2019 version of these applications are either available now or will be very shortly.

Many of the products reviewed offer electronic filing options and other features such as Tax ID Number (TIN) verification which results in a higher percentage of accuracy, as well as less need for corrections and penalties.

Both on-premise and online products are included in the review. These products include:

- AccountantsWorld – After-the-Fact Payroll

- American Riviera Software – Magtax

- AMS – W-2 and 1099 Forms Filer

- CCH – W2/1099 from Wolters Kluwer

- EG.Systems Inc. – W-2/1099 Filer

- Greatland – Yearli

- Real Business Solutions – W2 Mate

- Spokane Computer – MAG-FILER

- Tenenz – Eagle View Filing

- Tenenz – Laser Link

- Track 1099

We’ve also included our standard chart that shows the features and functions available for each of the reviewed applications.

Contract employees will only increase in the years to come, making it a necessity that you have the tools and resources in place to process and file 1099 forms. Don’t be penalized for noncompliance. Find the application that’s right for you.

Click for larger image.