Accounting

2020 Review of FastFund Nonprofit Accounting

Apr. 16, 2020

![Araize_300x98_1_.5b32728a99a05[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2020/04/Araize_300x98_1_.5b32728a99a05_1_.5e837d55d2745.png)

800-745-4037

From the April 2020 reviews of nonprofit accounting systems.

FastFund Nonprofit Accounting from Araize is best suited for small nonprofit organizations and government entities. Offered as an online application, FastFund offers flexible purchasing options, with two editions available, Standard and Premium, and users are able to add modules to the Standard version or scale up to the Premium version when necessary.

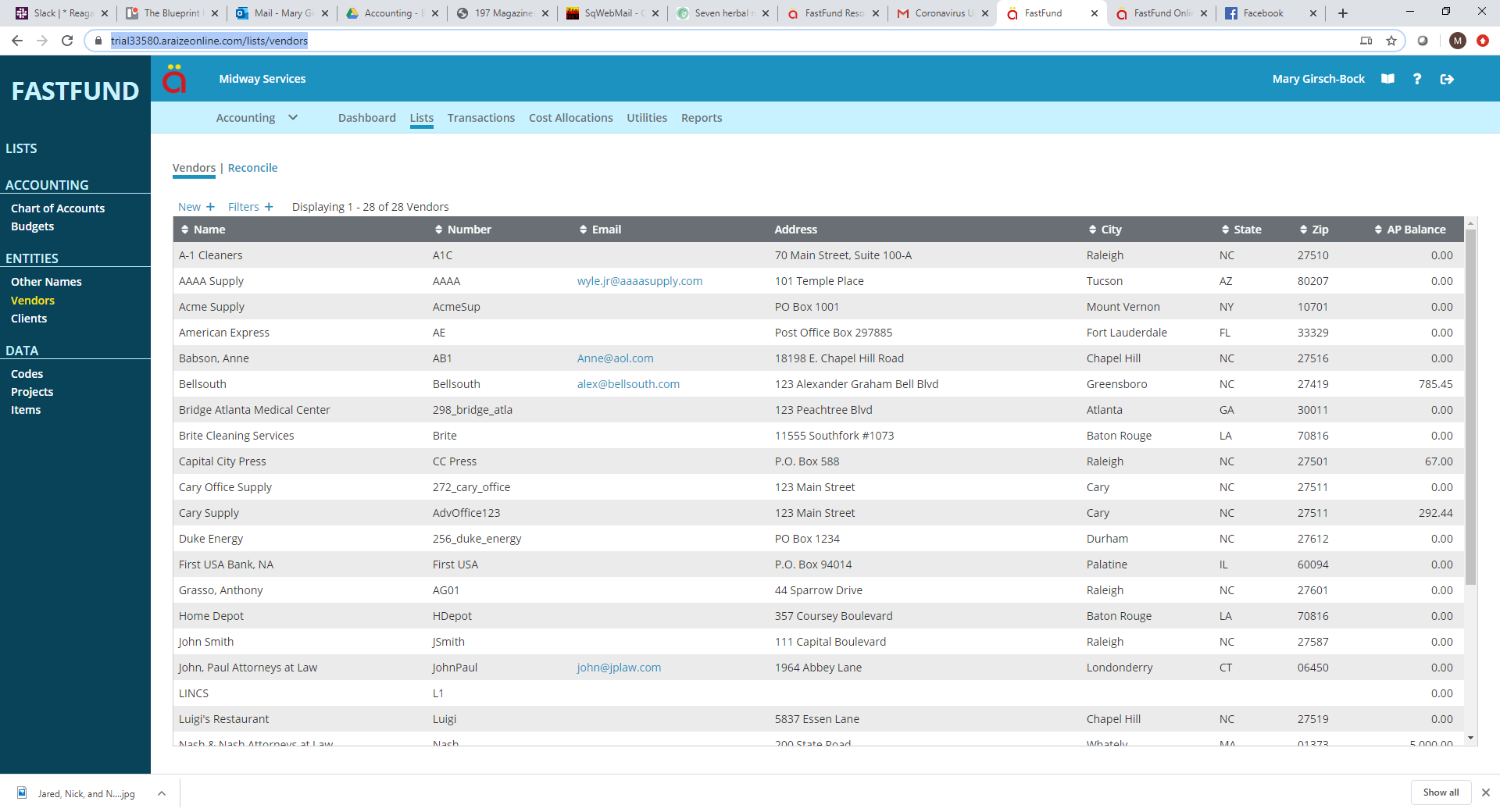

FastFund is currently rolling out an updated user interface for its online application, with the updated user interface available in Administration, Fundraising, Payroll, and various Accounting features including budgets, vendors, clients, and projects. The roll-out is expected to be completed by mid-2020. FastFund has also added additional dashboard information as well as enhanced budgeting capability.

The updated user interface offers easy navigation, with users able to choose from a variety of options at the top of the screen including Dashboard, Lists, Transactions, Cost Allocations, Utilities, and Reports. A drop-down option to the left of the categories offers access to Accounting, Fund Raising, and Payroll modules, and the updated menu bar to the left of the screen offers access to other system features.

FastFund’s chart of accounts offers users up to six segments, and each segment supports up to six digits, for a total of 36 digits supported. This structure makes it easy to track various programs, funds, and grants. FastFund processes multiple transaction types including cash disbursements, purchase orders, cash receipts, recurring journal entries, and it includes easy transaction editing. FastFund also offers a cost allocation feature that includes both point of entry and indirect cost allocations.

FastFund offers solid budgeting capability, allowing users to create a budget for any revenue or expense account. Budgets can be created from scratch or by using prior budget totals, and multiple budget revisions can be made to any budget, which can then be locked to prevent unauthorized changes. Budgets can be created across fiscal years, and existing budgets can be imported into FastFund if desired.

FastFund offers solid budgeting capability, allowing users to create a budget for any revenue or expense account. Budgets can be created from scratch or by using prior budget totals, and multiple budget revisions can be made to any budget, which can then be locked to prevent unauthorized changes. Budgets can be created across fiscal years, and existing budgets can be imported into FastFund if desired.

FastFund’s Fundraising module includes features such as Constituent Management, Members Management, Pledges & Payments, and Automated Receipts, and it can manage more than 50,000 names in a donor database.

Grants can be managed in FastFund by assigning a unique cost center number to each grant, with the ability to create a separate budget for each grant. In addition, multiple funds can be managed in the application, with users able to create financial statements for each fund created. All inter-fund transactions in FastFund automatically create a balancing entry to ensure that funds are in balance.

FastFund offers multi-level security. All system access is password-protected, and new users added to a specific user group with similar access levels. All FastFund activity is tracked in the application, and system admins can assign read-only system access to specific users if desired.

FastFund offers good reporting options, with reports available in a variety of categories including Accounting reports, Financial Statements, Project reports, A/P and A/R reports, and a variety of lists. Nonprofit specific reports such as Statement of Financial Position, Statement of Activities, and a Fund Balance report are also available. All FastFund reports can be exported to Microsoft Excel, to a CSV file, or saved as an HTML file or PDF.

The Standard edition of FastFund includes Cash Receipts, Cash Disbursements, Print Checks, Bank Reconciliation, Budgeting, Project Accounting, Recurring and Reversing Entries, Financial Statement, Customized Reports, Custom Filters, and Audit Trail functionality, with AR, AP, and Direct Cost Allocation modules available in the Premium version of the product. Purchase Order, Fundraising, and Payroll modules are available as well, with all modules seamlessly integrating.

Free product support is included in FastFund’s pricing, and users are able to contact support personnel via telephone, email, or chat during regular business hours. Additional resources such as YouTube training videos and on-demand webinars are offered, as is easy access to a comprehensive support guide that offers detailed instructions on company setup and transaction entry.

FastFund Online Nonprofit Accounting from Araize is better suited to smaller nonprofits. Offered as an online application, the Standard version of FastFund currently runs $42.00 per month for a single user, with AR, AP, and Cost Allocations modules available for an additional $19.00 per module (per month?), while the Premium edition is $85.00 per month and includes the AR, AP, and Cost Allocations modules. The Fundraising module starts at $42.00 per month and Payroll starts at $66.00 per month for up to five employees, with payroll for 50 employees running $176 per month. The monthly subscription includes unlimited customer support by telephone, email, and web as well as weekly training webinars and any software enhancements and upgrades.

2019 Rating – 4.75 Stars

Strengths:

· Two plans available

· Product support included in the price

· Good budgeting capability

Potential Limitations:

· Does not include a separate grant management module

· Not suitable for very large nonprofit organizations