Payroll

2020 Review of Intuit Online Payroll for Accountants

Oct. 14, 2020

From the 2020 reviews of professional payroll systems.

Intuit Online Payroll for Accounting Professionals is designed specifically for accounting firms that are interested in offering payroll and related services to clients not currently using QuickBooks applications. For QuickBooks clients, firms can choose to use QuickBooks Online Payroll.

Intuit Online Payroll for Accounting Professionals can be used as a stand-alone payroll application, but will offer accounting firms greater functionality if used with other Intuit or QuickBooks applications.

Intuit Online Payroll is completely cloud-based, with users able to access the application from any type of device, including desktop computers, workstations, laptops, tablets, and smart phones, with a mobile app available for iOS and Android devices.

One of the application’s best features is the ability to customize client access for each individual client, allowing some clients complete access to the entire payroll application, including entering payroll information and running payroll, to handling all payroll processing at the firm, with clients only able to access payroll registers and paystubs. Each client set up in Intuit Online Payroll has access to the client portal, which can be custom branded with the firm’s logo and other marketing details.

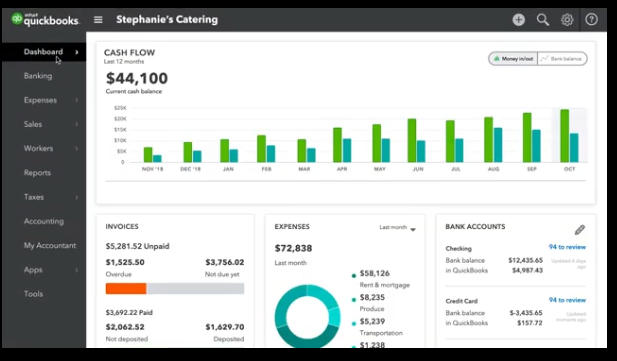

Click for larger image.

Intuit Online Payroll has a convenient user dashboard, where all clients can be easily accessed. The dashboard displays a notification for all client payroll dates, notifying users when a pay date is close. Users can choose a client from the client list. Once the client is chosen, a list of all employees and contractors associated with the client is displayed with their pay type included.

Intuit Online Payroll supports numerous pay types, including regular pay, commissions, allowances, reimbursements, overtime, PTO, and sick time. Firms can opt to enter payroll data for each employee or provide clients with access to the payroll application, with system access easily customizable for each employee. Intuit Online Payroll supports regular paychecks as well as direct deposit, which is included at no additional charge.

Intuit Online Payroll includes tax tables for all 50 states, with the application sending a convenient reminder when taxes are due. All taxes can be e-filed, with quarterly filing of Form 940, 941, and 943 available. Year-end W-2 and 1099 processing is available in the application, with electronic filing available.

Intuit Online Payroll offers a good selection of payroll related reports with standard payroll reports available individually for each client, including a Wage Summary report as well as various tax liability reports. All reports can be customized as needed, with users able to export any report to Microsoft Excel for further customization if desired. In addition, users can create custom report groups for each client, running reports after each payroll, or providing access to clients to run reports when needed.

Intuit Online Payroll allows users to import time data using an Excel spreadsheet, or have clients enter their own time data directly into the application. Intuit Online Payroll also offers seamless integration with TSheets, which can track time and create time entry reports. The application also integrates with all QuickBooks applications including QuickBooks Desktop, QuickBooks Online, and QuickBooks for Mac.

The availability of the online portals makes it easy for clients to access their account.

Intuit Online Payroll does not offer HR resources in the application, but does integrate with a variety of third-party applications including firm marketing materials and templates that can be used by accounting firms to grow their business.

Intuit Online Payroll for Accounting Professionals includes both telephone and chat support, with all phone support handled in the U.S. Users also have access to a robust online help system that includes getting started guides, product updates, and various training options, as well as access to the robust online user community.

Intuit Online Payroll for Accounting Professionals is offered exclusively to accounting professionals interested in offering payroll services to non-QuickBooks clients. The product can be used as a stand-alone application, but is better suited to firms already using other Intuit/QuickBooks applications. Pricing for Intuit Online Payroll for Accounting Professionals starts at $45 for a single client per month, with a per employee charge of $4 per month assessed, with the price dropping to $22.50 per client for 2-5 clients, with the per employee charge dropping to $1.50. The price drops for additional employees.

2020 Overall Payroll Rating – 4.75 Stars

Strengths:

- Designed for accounting firms

- Pricing levels drop as number of clients increase

- Excellent integration with QuickBooks applications

Potential Limitations:

- No integration with third party applications

- No HR capability is included in the application

- No report expert availability

- No after-the-fact payroll availability