Benefits

2020 Review of Gusto Payroll

Oct. 14, 2020

From the 2020 reviews of professional payroll systems.

Gusto is a cloud-based payroll application designed for small businesses, though the application is also suitable for accounting firms offering payroll services to clients. Gusto can be accessed from all devices including desktop and workstation computers, laptops, smart phones, and tablets.

Along with full payroll services, Gusto also includes a number of add-on options such as hiring and onboarding, benefits, time tracking tools, and HR resources including guides, law alerts, and access to HR professionals. Their latest addition, Gusto Cashout, is designed to provide employees with access to funds between pay periods, with the advance automatically repaid from their next check with no fees or interest.

Gusto supports an unlimited number of payrolls, and easily handles flexible payment schedules as well as multiple pay schedules and multiple pay rates for each employee. Gusto also supports employee reimbursements, garnishments, and unlimited extra and off-cycle payroll runs.

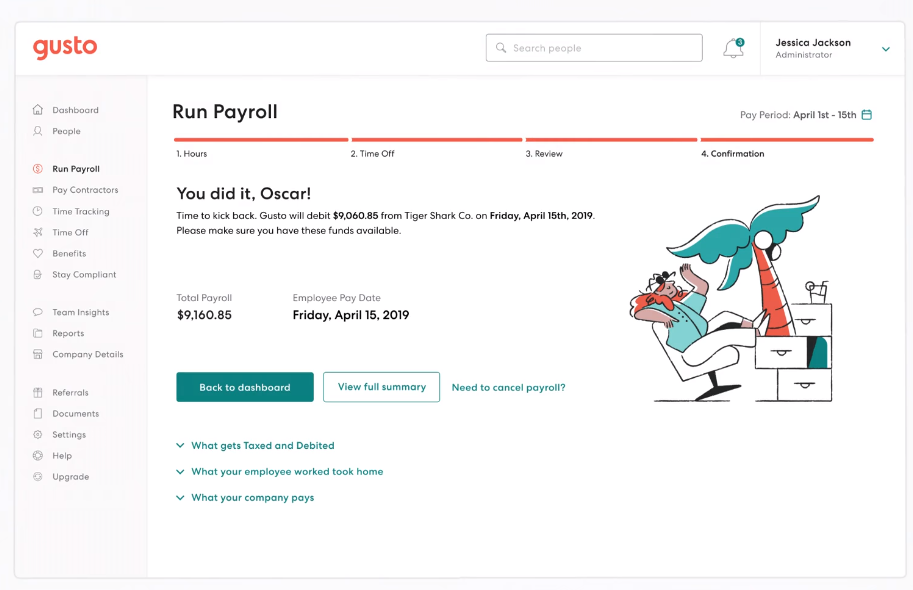

Gusto’s easily navigated dashboard offers access to all payroll functions from the vertical menu found to the left of the screen. The dashboard displays handy reminders such as a to-do list as well as anything items of note that are upcoming in the next week. A search option makes it easy to locate a particular employee and for those running payroll for multiple clients, access to all clients is available directly from the dashboard.

Click for larger image: The Run Payroll screen provides details of the pay run including total payroll amount.

Gusto automates both the payroll and tax filing processes, with employee setup handled directly by the employee, and the application supports contractor pay as well. Payrolls can be automated, with users only needing to make any changes or additions when necessary. Next day direct deposit is available for those that don’t want to fund payroll days in advance, and all payroll taxes are handled by Gusto, with local, state, and federal payroll taxes automatically filed and paid. In addition, the product also issues year-end W-2s and 1099s, and stores I-9s online for compliance purposes.

Gusto offers a good selection of reporting options including summary reports, payroll history reports, contractor payment reports, and custom reports. Reports available include an Employee Summary report, a Year-to-Date report, a Payroll Journal, a Benefits report, and Contractor Payments, with all tax-related reports available well. All reports can be downloaded as a CSV file for exporting, or saved and stored as a PDF.

Gusto offers integration with a variety of time tracking applications including TSheets, When I Work, Homebase, Deputy, and TimeTracker. In addition, Gusto also integrates with popular accounting software applications such as FreshBooks, QuickBooks Desktop, QuickBooks Online, ZipBooks, Xero, Aplos, and Autobooks.

One of Gusto’s most convenient features is the employee onboarding process, which is completed by the employee. The onboarding feature also allows employees, once signed up, to access payroll information, change personal information, and view paystubs. If processing payroll for multiple clients, each client can access their payroll data through an assigned portal, where they can enter employee time data and access payroll related reports and tax information.

The Concierge Plan in Gusto offers extensive HR resources including employee handbook templates, HR alerts, and diversity and training guides. Users also have access to HR professionals should any questions or concerns arise. Gusto also offers complete benefits management, including health insurance and 401(k) plans.

The Gusto Help Center is accessible directly from the payroll dashboard and includes a searchable knowledgebase as well as access to a variety of payroll related categories. Just click on an option to access step-by-step help. A FAQ page is available as are detailed instructions on payroll setup. Gusto offers toll-free support during regular business hours, with both email and chat support options available as well. Accounting firms using Gusto will also be assigned their own dedicated account representative at no additional cost.

Gusto is designed for small businesses and offers a flexible pricing structure, with four plans available: the Basic Plan, which is a beta program that is recommended for 1-2 employees; the Core Plan, which is $39 per month, with a $6 per person fee; the Complete Plan, which includes next-day direct deposit and an employee directory, which is $39 per month, with a $12 per person fee; and the Concierge plan, which offers access to HR professionals and the HR resource center, and runs $149 per month, with a $12 per person fee. They also offer a contractor option for businesses that only pay contractors. Those interested in Gusto can access an online interactive demo to try out prior to subscribing.

2020 Payroll Rating – 4.75 Stars

Strengths:

- Multiple plans available

- Good integration with third-party applications

- Includes employee self-service

Potential Limitations:

- Add-on modules raise monthly cost

- Top plan pricing may be too expensive for some small businesses