Benefits

2020 Review of AccountantsWorld Payroll Relief

Oct. 14, 2020

![Payroll-Relief-logo1[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2020/10/Payroll_Relief_logo1_1_.5f738c981870a.png)

Payroll Relief

Accountants World

888-999-1366

From the 2020 reviews of professional payroll systems.

Payroll Relief, from AccountantsWorld is designed for accounting firms that wish to offer payroll services to their clients. Though the application offers complete integration with other AccountantsWorld programs, it can also be used as a stand-alone payroll application if desired.

Best suited for small to mid-sized accounting firms, Payroll Relief is an online application that can be used with any device including desktop and workstation computers, as well as tablets and mobile devices, with the same features found regardless of the device used.

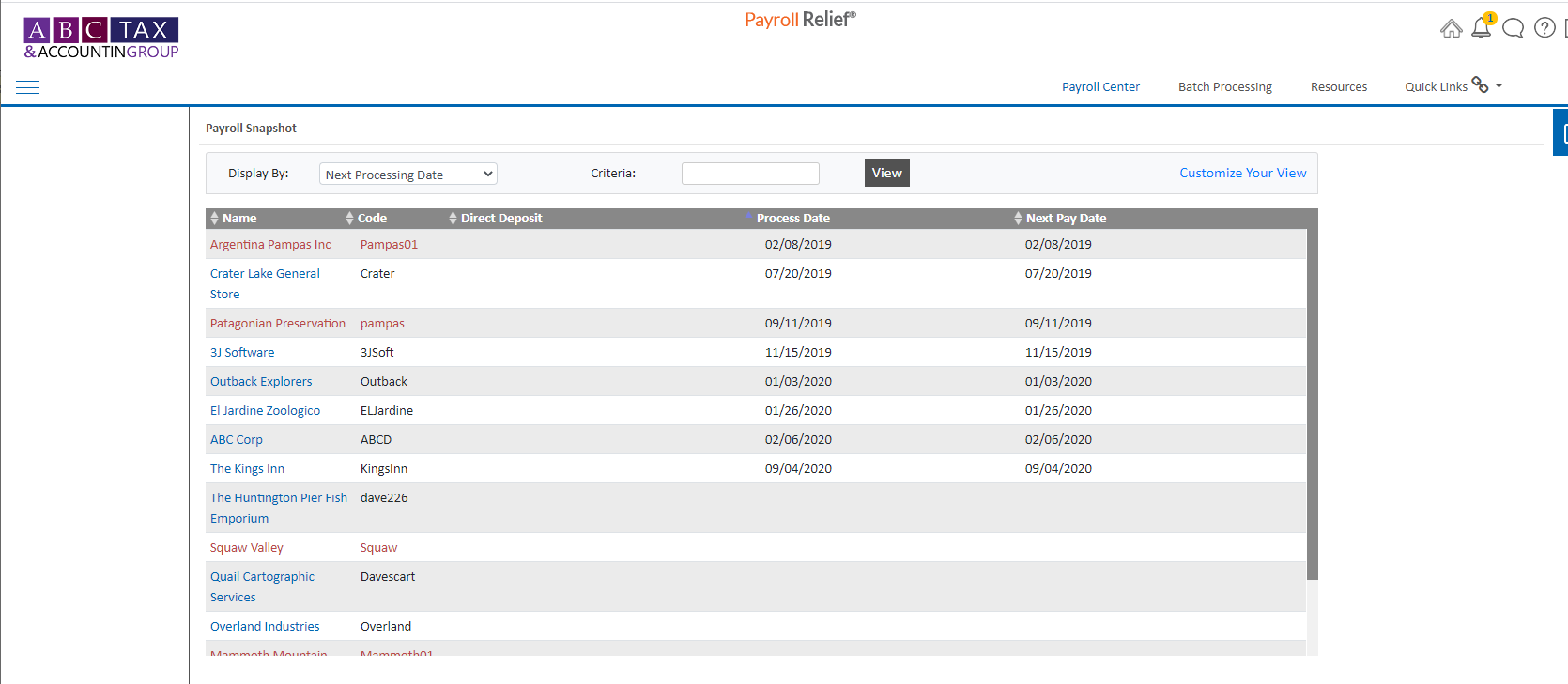

Click for larger image: Payroll Relief Snapshot screen.

Designed for streamlined payroll processing, Payroll Relief uses an exception-based process to for entering payroll, which means only changes to the regular payroll such as the addition of vacation or sick hours will need to be added prior to each pay run, eliminating the need to enter hours for each employee. Users can also provide their clients with a link to an electronic timesheet, where they can enter their own payroll information, reducing data entry time even more. When the spreadsheet is completed, firms can simply import the form directly into Payroll Relief. For select clients, users can provide direct access to the payroll data entry screen in order to enter all payroll information.

Firms can customize access levels for each client, with some clients granted complete access, while others only have access to payroll information such as reports and paystubs which are available after payroll has been completed. For firms that handle only payroll reporting, AccountantsWorld offers After-the-Fact Payroll, a module that can be purchased separately and used with Payroll Relief. For those processing payroll for multiple clients, batch processing is available in Payroll Relief and can be used for running payroll as well as processing year-end W-2s and 1099s for employees and contractors.

Payroll Relief supports multi-state payroll, as well as multiple payroll schedules and multiple pay runs per client. Firms can choose to run paychecks and distribute them to clients or email a PDF of all paychecks for the client to print and distribute to employees. Direct deposit is supported in the application, as is third-party sick pay, dependent care benefits, health insurance, and manual check processing, as well unlimited customizable deductions.

Firms can manage payroll data for all clients from the client dashboard, with the ability to monitor payroll data for each client. A separate dashboard is available for each client, displaying information such as upcoming pay dates, taxes dues, and forms that need to be processed, with an ACH transactions screen available that displays electronic funds transfer information for each client. In addition, firms can view all current payroll clients directly from the Payroll Snapshot screen which also provides the current status of each client.

Payroll Relief includes an unlimited number of client portals, with portal access able to be determined on a client-by-client basis, with complete access to all payroll related tools include data entry options available, as well as limited access to only reports and paystubs. Payroll Relief does not offer HR tools or resources.

Payroll Relief includes tax tables for all 50 states, Washington D.C., and Puerto Rico, and offers state and local tax compliance as well, with all electronic filing for both federal and state taxes included in the application, with year-end forms such as W-2s and 1099s processed in the application as well.

Payroll Relief offers good payroll, compliance, and employee/employer reports, with firms able to create a custom set of reports for each client. Users can easily email all required reports to clients directly from the report screen, with all reports able to be exported for both Microsoft Word and Excel for customization if desired.

Payroll Relief offers seamless integration with other AccountantsWorld applications including Accounting Power, After-the-Fact Payroll, and Practice Relief with integration with popular third-party applications such as QuickBooks, CS Accounting, and Sage 50cloud available as well. Integration with HR, workers comp, 401(k) services, and timekeeping applications is offered as well.

Payroll Relief assigns all new users an implementation specialist, who guides users through the system, assisting with migrating payroll from another application, and demonstrating how to use the application. This service is included at no additional charge. In addition, online and telephone support is available to all users, with chat support available as well. Payroll Relief also includes numerous training videos as well as context-sensitive help and FAQs, with users able to access both live and recorded webinars on a variety of topics.

Payroll Relief from AccountantsWorld is well suited for small to mid-sized accounting firms that offer or wish to offer payroll services to clients. Those interested in Payroll Relief should contact AccountantsWorld directly for additional information as well as a custom quote.

2020 Overall Rating – 5 Stars

Strengths:

- Unlimited client portals available

- Friendly user interface

- Strong automation

Potential Limitations

- Is only available to accounting firms (may or may not be a weakness)

- No HR tools