Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

April 25, 2013

80% Year-Over-Year Growth in New Customer Bookings Reflects Strong Performance Across All Business Areas for Cloud Financial Management Leader

April 25, 2013

Practice management software developer BigTime Software, Inc. has announced that it has joined the Business Resource Network of the BDO Seidman Alliance, a nationwide association of independently owned local and regional accounting, consulting and service firms.

April 25, 2013

Ernst & Young LLP recognized as best overall consultancy by Operational Risk & Regulation four years running.

April 24, 2013

Global partner awards recognize top SAP partners for delivering outstanding value to customers in partnership with SAP

April 24, 2013

College students build skills by tackling complex financial accounting issues

April 24, 2013

Most business owners buy annual tax and assurance services from their accountant easily enough, but when it comes to investing in business advice, owners can be hesitant. Entrepreneurs reckon they know their business better than anyone and many take the attitude “if it ain’t broke, why fix it?”

April 24, 2013

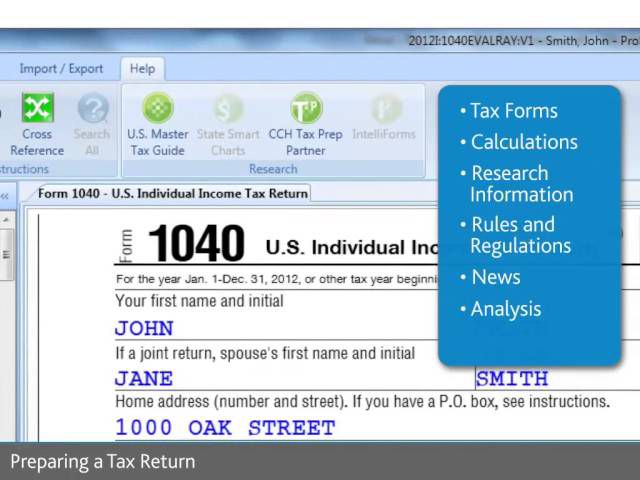

The new CCH Axcess gives professional tax and accounting firms a cloud-based solution for tax, document management, portals, workflow and practice management.

April 24, 2013

Doug Sleeter, president of The Sleeter Group, explains how the 2013 Thought Leader Symposium helped attendees synch up and better develop strategies for firms going into the future.

April 24, 2013

Wave Continues to Disrupt Small Business Software Industry With New Payroll App for iOS.

April 23, 2013

FICO Debt Manager 9 puts more power in the hands of front-line business users to meet business goals and preserve customer relationships

April 23, 2013

CPA Practice Advisor’s App Depot gives accounting, tax and business consulting professionals a single location to find the mobile tools that can help their firms and their clients be more connected to the data they need — no matter where they are. Better business insights equal more accurate planning, leading to more productive and profitable...…

April 23, 2013

Wasp Barcode Technologies has released InventoryControl version 7, a complete inventory tracking solution for small and medium-sized businesses. Wasp InventoryControl version 7 is available in three editions: Standard, RF Professional, and RF Enterprise.