Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

Accounting May 17, 2024

Solving client issues by leveraging your team member’s expertise is one of the best ways to have a rewarding career and life.

Small Business May 16, 2024

Lili also partnered with Amazon Bedrock to ensure Accountant AI has robust privacy and security measures to keep businesses’ data safe from potential leaks or misuse.

Accounting Standards May 16, 2024

The changes are intended to align them with the AICPA standards pertaining to quality management, and related financial statement audit and non-audit standards.

Accounting May 16, 2024

Among all respondents surveyed, “time” emerged as the top-ranked challenge—or deterrent—to becoming a CPA.

Firm Management May 16, 2024

The deal is the Chicago-based top 10 firm's first since it announced receiving a large private equity investment in February.

Firm Management May 16, 2024

Tim Ryan, who was to officially step down as PwC US senior partner on June 30, will reportedly leave the firm a month earlier to join Citi.

Auditing May 15, 2024

The Big Four firm audited eight of the 46 IPOs, tops among the 20 different firms with at least one IPO audit client in the first quarter.

Small Business May 15, 2024

While headwinds still persist in the industry, the survey results show wineries are feeling cautiously optimistic about sales growth over the next five years after a challenging destocking phase.

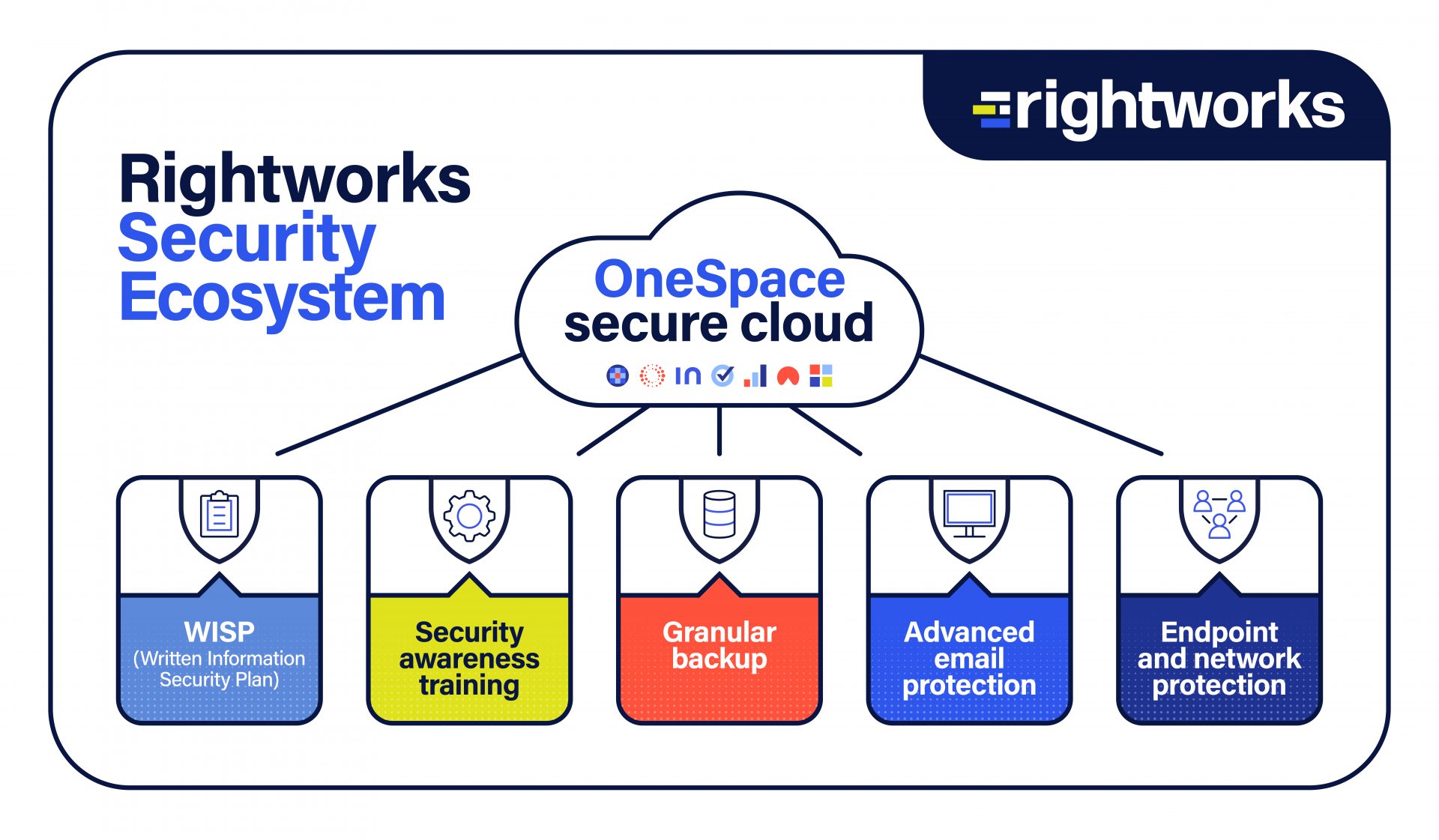

Technology May 15, 2024

The solutions help accounting firms and small businesses create a WISP to achieve regulatory compliance and resolve security gaps.

Payroll May 15, 2024

U.S. household debt has reached a record and more borrowers are struggling to keep up.

Small Business May 15, 2024

As a business grows and sales volume ticks up, all that activity can trigger new tax obligations.

Accounting May 14, 2024

From evolving CPA licensure models to better starting pay, the profession can do several things to attract new talent, a new NPAG report says.