Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

February 17, 2017

Got Cash? Here are a few quick strategies to jump start cash flow when the going gets tough.

February 17, 2017

QuickBooks Online is the cloud-based version of the ever-popular QuickBooks. Well suited for small business owners, as well as nonprofit organizations, QuickBooks Online offers complete accounting functionality in its three versions, though they are ...

February 17, 2017

Kashoo is cloud accounting software that is well designed and aimed at the small business owner. Cloud based, Kashoo also offers both iOS and Android apps, and can be used on any device. Pricing is simple, with a single monthly cost for all users.

February 17, 2017

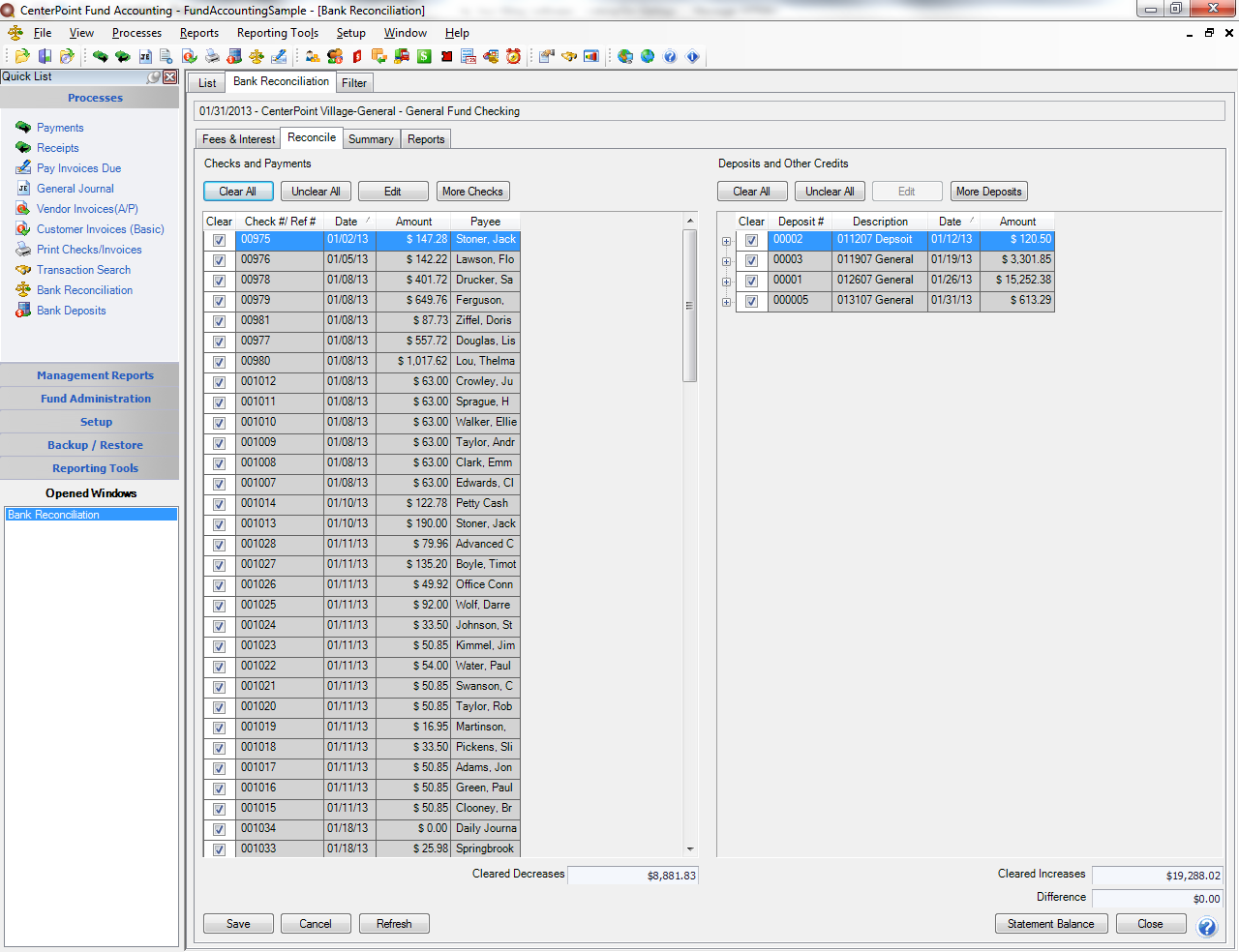

One of the biggest challenges of reconciling a bank account, particularly one with lots of transactions, is combating the “blur.” As you compare the many numbers and columns on your statement to the reconciliation window, it won’t take much for your ...

February 17, 2017

Intacct is a cloud-based accounting software product that offers a variety of core financial modules which include AR, AP, GL, Order Management, and a solid Cash Management module. Intacct also offers a variety of add-on modules that can boost cash ...

February 17, 2017

FreshBooks cash management features are fairly generic, with a basic cash forecasting report available that allows users to track their current billing and expenses, as well as get a handle on current and expected revenues. All transactions entered in ...

February 17, 2017

Acumatica Cloud ERP is a robust accounting system that contains excellent cash management solutions for businesses of all sizes, though the scope of the product makes it a good solution for larger organizations. Acumatica offers industry specific ...

February 17, 2017

Accounting Power, part of Accountants World Suite of products designed specifically for accountants is a comprehensive accounting product designed for accounting firms that offer accounting services directly to clients. Accounting Power offers a ...

February 17, 2017

Per the U.S. Chamber of Commerce, about 75% of employees are stealing from their employer. Research has shown that the most common item stolen was cash, with the average amount stolen amounting to $20,000. Here is a checklist of internal controls your ...

February 17, 2017

Thomson Reuters Accounting CS is designed for accounting firms that handle accounting and bookkeeping for their clients. Designed to work with other Thomson Reuters products for accountants, Accounting CS offers solid cash management capability ...

February 17, 2017

The accounting professional often views cash management as another piece of the accounting puzzle that can often be handled more effectively by these same professionals. This has never been truer, as more accountants begin to offer cash management ...

February 17, 2017

The word cash is starting to get a funny ring to it, isn’t it? Like “davenport”, “slicker” or “billfold”. Coin and paper currency are fading into the background of modern finance and appear only most frequently in movies about heists or shady ...