Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

November 16, 2015

Prior to 2015, as corroborated by the AICPA staff, the Code of Conduct was not clear on this issue, even though firms by the thousands had adopted the non-equity position.

November 16, 2015

The report offers tax planning tips that highlight the opportunities and challenges faced by taxpayers in today’s uncertain legislative environment. It describes a number of moves to make by year-end to achieve maximum overall tax savings for 2015 and ...

November 16, 2015

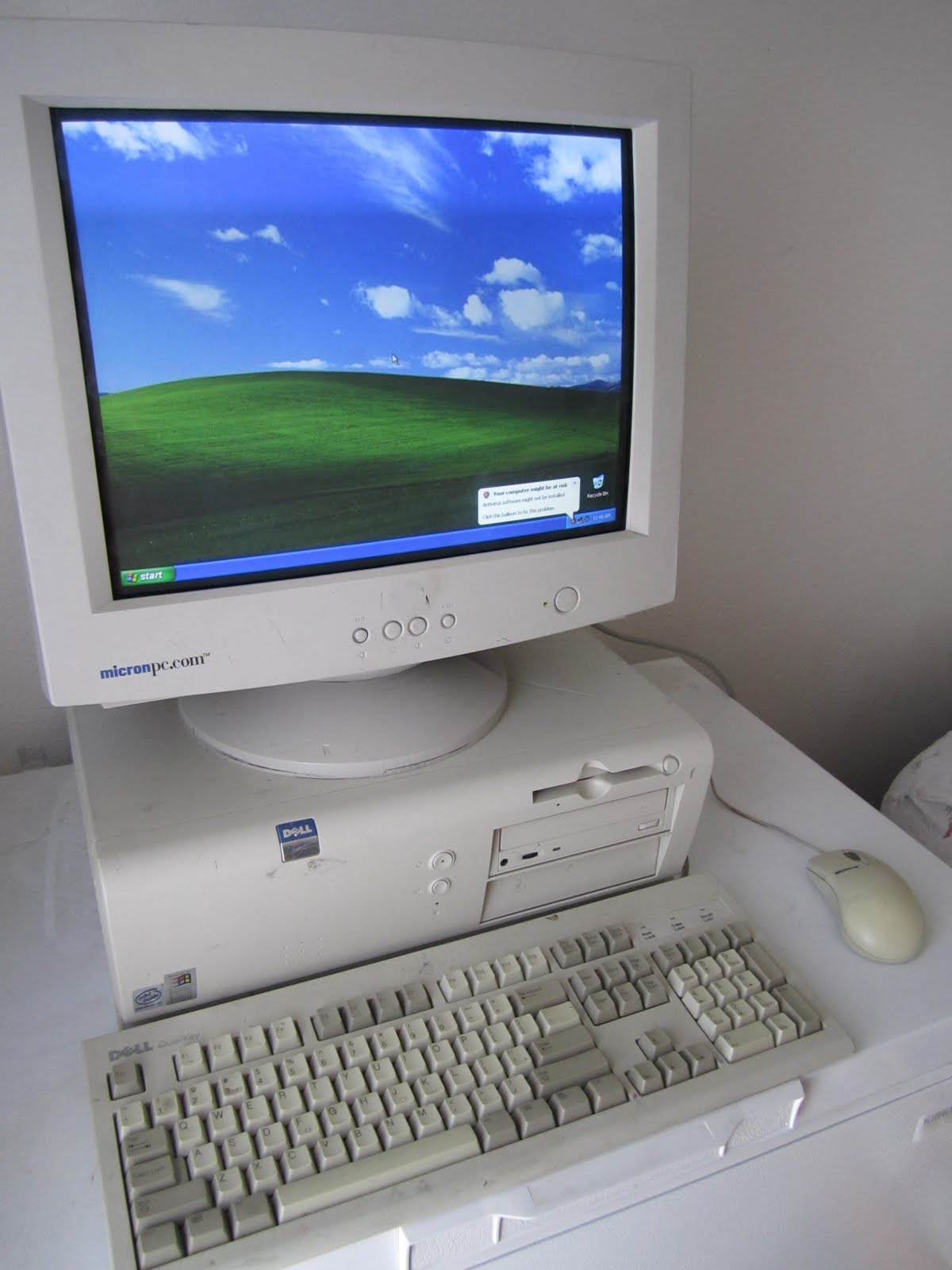

Businesses periodically need to upgrade or replace creaky computer systems, or risk falling behind their competitors. If they try to muddle through with a cranky jalopy when everyone else moved up to the latest sports car, they may find themselves ...

November 16, 2015

What should you be doing in your payroll practice this month? Here's your Payroll Checklist for November.

November 13, 2015

This new intermediate/advanced program allows individuals to dive head first into more complex accounting and financial reporting, tax compliance, governance and assurance matters in a variety of NFP settings.

November 12, 2015

This new product provides practitioners with all of the practice aids they need to perform their international audits effectively and confidently. Since these tools work with PPC’s SMART Practice Aids Audit Suite, the new solution is easily integrated int

November 10, 2015

The end of the year is a busy season for payroll practitioners, but it’s a good time to start planning your year ahead.

November 9, 2015

Optimism for the nation’s economic outlook among U.S. business leaders rose 20 percentage points in third quarter 2015 to a net balance of 74 percent, marking only the second time since 2004 it had eclipsed net 70 percent, according to data from ...

November 8, 2015

Software as a Service (SaaS) is making great progress. However, if you can’t solve your business needs with all SaaS tools, and you want to live in the cloud, how do you do that? We’ve discussed in prior columns the advantages of private cloud and ...

November 6, 2015

Survey respondents said the biggest challenges facing their companies’ trade-related activities are manual processes and disparate systems and managing complex and changing regulatory requirements.

November 6, 2015

Private sector small business employment increased by 90,000 jobs from September to October according to the October ADP Small Business Report.

November 5, 2015

Firms need professionals who can help with areas ranging from systems and controls to processes and policies. Many organizations will likely find they need to rely on a mix of current full-time personnel and outside experts.