Accounting February 6, 2026

AICPA News – Feb. 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

Accounting February 6, 2026

AICPA News is a round-up of recent announcements from the American Institute of CPAs, the Association of International CPAs, and the Chartered Institute of Management Accountants (CIMA).

February 5, 2026

February 4, 2026

February 4, 2026

February 4, 2026

August 28, 2013

Cloud definitions, strategies, and marketing messages continue to shift. What is most important is the business problem you are trying to solve and the solutions available.

August 28, 2013

Simply put, “cloud” systems are deployed outside your organization, typically accessed through the Internet.

August 28, 2013

Know what to do when your clients receive one of the IRS’ four new business income underreporting letters

August 28, 2013

From the Bleeding Edge Blog. Here’s a memo to my friends in the financial services industry: I could care less what my credit score is. I don’t lay awake sweating over whether I will be approved for a loan. I don’t worry about how expensive a car I can buy on credit. I don’t even...…

August 27, 2013

Company Announces New QuickBooks Online and QuickBooks Cloud ProAdvisor Program

August 27, 2013

SmartVault has announced the appointment of Rick Pharr, a veteran of the software industry, as Chief Operating Officer. The company is a provider of SaaS online document storage and secure file sharing solutions.

August 27, 2013

The 2013 Midwest Accounting and Finance Showcase kicked off this morning in Rosemont, Illinois, with one directive for accounting professionals: help develop the skills and talents of the young professionals that will follow in your footsteps.

August 27, 2013

Rapid Growth Driven by Increase in Workers Looking for Anytime, Anywhere Access to Payroll, Time and Benefits Information

August 27, 2013

Nationwide effort coordinated by TechVoice, TECNA and CompTIA

August 27, 2013

Crowe Horwath LLP releases findings from its 2013 Financial Institutions Compensation Survey

August 27, 2013

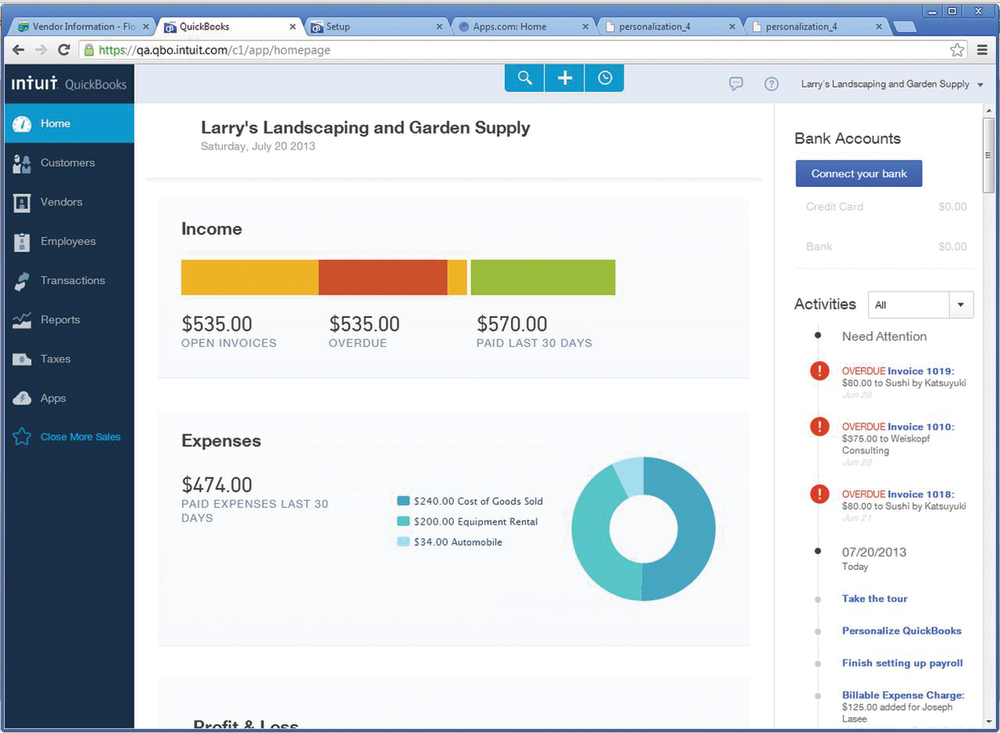

From the Sept. 2013 issue. A little harmony can go a long way. And that’s exactly what Intuit set out to demonstrate when it debuted a new, redesigned version of QuickBooks Online at the Midwest Accounting & Finance Showcase in Chicago in August. With a cleaner and simpler user interface, seamless navigation new features and...…

August 26, 2013

While many small retailers continue to use a cash register, many others have moved into more sophisticated payment systems; which can increase sale processing speed by quickly scanning bar codes, and processing electronic payments quickly.