Advisory

Latest News

IRS ‘Get Ready’ Campaign Helps Taxpayers Prepare for Filing Season

Trump Nominates Hedge Fund Exec Bessent to Lead Treasury Department

The Top Toys and Gifts for the 2025 Christmas and Holiday Season

Professionals on the Move – Nov. 2024

The Human Touch: Using Technology to Maintain Real Client Relationships

Accountants have long had a reputation as being somewhat reclusive, perhaps even seen as professional hermits, because of the nature of many of the traditional services they provided.

CPA Practice Advisor Turns 20

From DOS and Windows 3.1, from the end of service bureaus and the emergence of the internet, and now into the full-blown SaaS and Mobile Revolution, CPA Practice Advisor celebrates 20 years serving tax and accounting professionals. Here’s a look back at where we were and how we’ve grown alongside the technology changes in the profession over the past two decades.

Beyond Just Business: A Strategy That Works

?9222 In economic climates such as this, when jobs are somewhat scarce, markets are in flux and retirement can seem so far away, it’s natural for some to cling to what levels of stability they have, whether it’s Linus and his “security blanket,” or a comfortably permanent job as an in-house accountant for a large […]

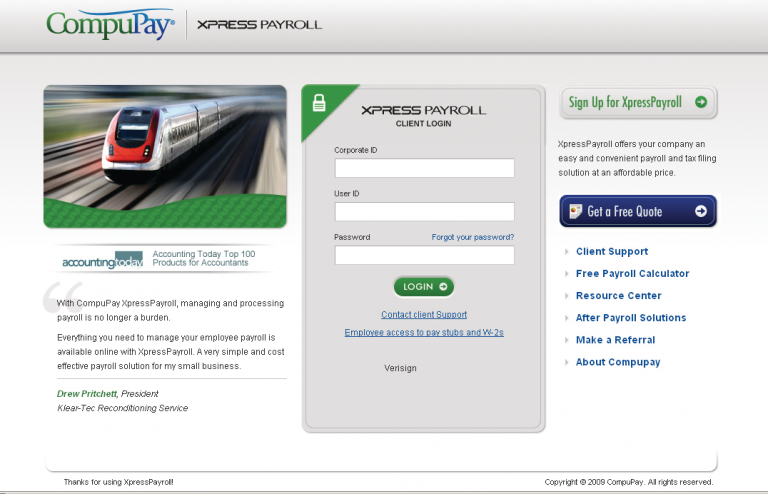

Review of XpressPayroll For Accountants – 2010

CompuPay – Xpress Payroll for Accountants877-729-6299 www.CompuPay.com From the Sept. 2010 Review of Professional Payroll Systems CompuPay has a variety of payroll systems designed primarily for direct use by small businesses that offer varying degrees of automated processing, reporting and compliance. The company also offers an Accountant Solutions division, which offers guidance to professionals […]

ACL Releases ACL Analytics 11 and ACL Analytics Exchange 5

New Visualization Capabilities Allow Audit, Risk, and Compliance Professionals to Deliver Data Interpretations That Matter to the Business

CohnReznick Awarded for Workplace Practices

The Baltimore, Bethesda, and Chicago offices of CohnReznick LLP, one of the leading accounting, tax, and advisory firms in the U.S., have been honored with the 2014 When Work Works Award for their use of effective workplace strategies to increase business and employee success.

Jim Dolinar to Head AICPA Financial Reporting Executive Committee

Dolinar, 55, is managing partner of the Assurance Professional Practice, national office of Crowe Horwath LLP, Chicago, Ill. As chairman, he will head one of the Institute’s most important volunteer bodies. It serves as the AICPA’s official voice on financial reporting matters and develops industry-specific accounting guidance. The committee’s membership includes representation from business and industry, public practice and academia.

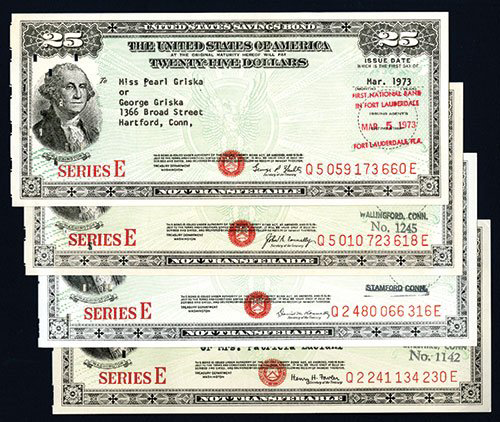

Clever Financial Strategy For Reporting Interest Earned On U.S. Savings Bonds

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings bonds are cashed in, a 1099-INT is normally issued for any interest earned amount over $10. Savings Bonds are free from state and local taxes.