Advisory

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

Security Issues That Stop You in Your Tracks

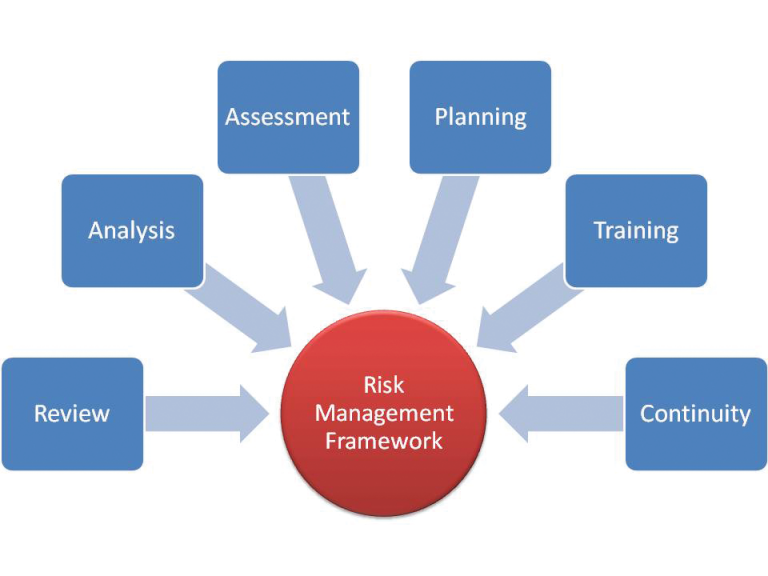

Someone in your firm needs to be literate on security and managing your risk. The number of security risks are increasing.

Banks increasing focus on risk management

Rising focus on board governance, enterprise-wide systems, risk and technology; operational risk deemed area that needs further attention

PwC appoints new leader for U.S. Advisory Services

Everson succeeds former U.S. Advisory Leader Dana Mcilwain, who is now PwC US Services Leader

NC tax overhaul means credit for early-stage investors will expire

Investor groups say the upcoming expiration of a state tax credit designed to spur investments in early-stage businesses will make it harder for young technology companies to raise the capital they need to survive and thrive.

New York CPA and Advisory Firm Streamlines Tax Processes and Workflow

Berdon, LLP recently announced changes to its workflow management systems in efforts to streamline its tax processes and scheduling.

New York Accounting Firm Wins Top Advertising Award

WeiserMazars LLP, accounting, tax and advisory services firm, received first place in the Ad Campaigns with a Spend of Over $25,000 category for its “Exactly Right” campaign.

New identity verification system seeks to better secure e-commerce

E-commerce security startup Payfont, led by credit card and banking industry expert Dr. David Lanc, has released a beta version of its comprehensive patented system for securing personal and financial identity, available now to banks, e-commerce processors, credit card companies, and their consumers and merchants.

Avalara partners with accounting firm alliance

Avalara and AGN International-North America have announced the formation of a new strategic alliance that will enable AGN-NA member firms to access critical sales and use tax (SUT) and value added tax (VAT) information and related resources to better meet member firm clients’ needs.