Advisory

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

CPA authors ‘how-to’ guide to help small business owners retire rich

Thanks to Tim McDaniel, a CPA with additional business valuation and financial credentials, business owners now have a new financial resource at their fingertips.

Bank risk experts expect U.S. consumer credit gap to shrink or disappear

61 percent of bankers surveyed expected the average credit card balance to increase during the next six months. Just 26 percent of respondents expected delinquencies on credit cards to increase.

Survey: Half of U.S. enterprises increasing outsourcing

Findings reveal future outsourcing strategies to be more value focused

Taxes still a split issue for most same-sex married couples

Same-sex couples and their tax advisors are anxiously waiting for the Obama administration to answer a key regulatory question left unresolved by the Supreme Court when it struck down the federal Defense of Marriage Act.

Ohio CPA Society names new Executive Board, Chairman

Zunich becomes new Chair of the Board; LaPlace honored with prestigious Gold Medal

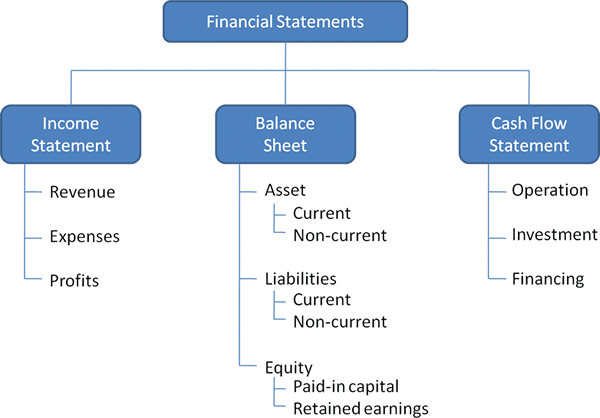

The Accountant’s Second Most Important Financial Statement

Business owners don’t have a boss to give them feedback, so many use their annual Profit & Loss (P&L) statement as their performance evaluation.

2013 Review of TrustFile Sales and Use Tax

TrustFile, an Avalara Company877-780-4848 www.avalara.com From the July 2013 Review of Sales and Use Tax systems. Best Firm Fit: Businesses who would like to prepare and electronically file sales and use taxes in any or all of the 12 supported states. Firms and businesses who need sales tax, use tax, and VAT (GST/HST) forms for […]

2013 Review of Avalara — AvaTax

Avalara — AvaTax877-780-4848www.avalara.com From the July 2013 Review of Sales and Use Tax systems. Best Firm Fit: Businesses who must file sales tax, use tax, or VAT returns in multiple jurisdictions across the US, Canada, and over 70 other countries. Firms with clients who are subject to Streamline sales tax requirements (22 states) and want […]