Auditing

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

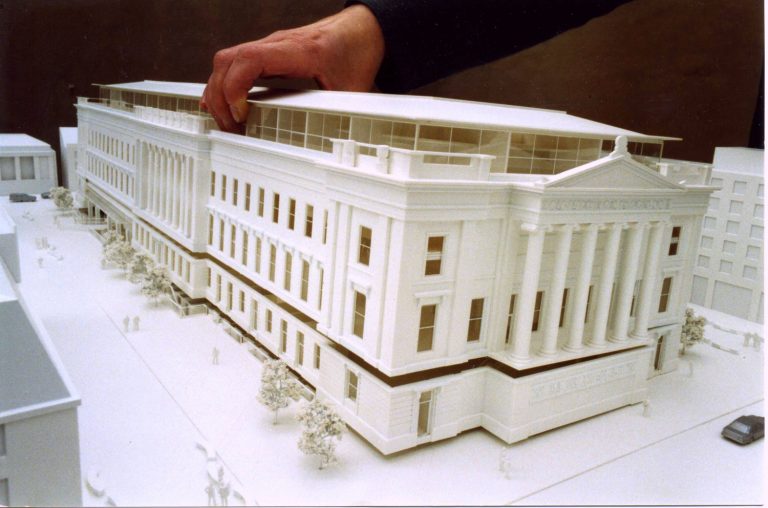

Five Ways 3-D Printing Will Impact the Accounting Profession

the massive expansion of applications and decreasing costs of 3D processing are driving a new generation of additive processes that will revolutionize industries. It will also drive a revolution in accounting.

Effective Internal Auditing in Today’s Dynamic Business Environment

The world as we know it is rapidly changing. For example, 3D printing devices are revolutionizing design and manufacturing; automated drones are transforming the way goods are delivered; big data analytics are enabling people to slice and dice through ...

AICPA Makes Major Revisions to Key Audit Guides

The 2015 edition of the AICPA Audit Guide, Government Auditing Standards and Single Audits, is an indispensable resource for auditors performing single audits of federal expenditures, as well as audits performed in accordance with Government Auditing ...

IRS Changing Identity Theft Policy to Combat Tax ID Threats

If you have ever had a client facing identity theft, you know that the first thing they want to find out is what specific information was compromised. But, until recently, the IRS has had a policy in place that prevented identity theft victims from ...

Thomson Reuters Issues Special Report for Financial Audits of School Districts

Thomson Reuters has released a special report on school district auditing to address the unique characteristics of planning and performing audits for public school districts and provides tips to help professionals perform effective and efficient school...

IRS Has Material Weakness in Internal Controls Over Unpaid Tax Assessments

The Internal Revenue Service (IRS) is currently planning activities to address a recurring financial material weakness in its internal control over unpaid tax assessments. However, planning for the Customer Account Data Engine 2 (CADE 2) Transition State 2 (TS2) has not included specific actions and activities necessary to guide new system development efforts and to […]

Audit Committee Members Say New Technologies Provide Vital Benefits

More than 75 percent of audit committee members and financial statement preparers surveyed believe there are significant benefits to auditors utilizing advanced technologies.

Thomson Reuters Issues Updates to Checkpoint Audit Portfolio

Thomson Reuters has released the 2015 editions of its widely-used series of audit guides and related practice aids for multiple industries, including commercial entities, nonprofit organizations, local governments, and employee benefit plans.