Benefits

Latest News

FASB Seeks Comment on Financial KPIs

N.Y. Congressman Requests Trump’s Support For Tax Cap Elimination

AICPA News – Nov. 2024

Chicago Aldermen Give Mayor Brandon Johnson’s $300M Property Tax Plan the Boot

Most U.S. Employers Making Safety Plans for Getting Back to Business

Over 90% of employers are including these functions in their return to work task force: senior leadership, human resources, communications, operations and safety.

Invoiced Partners with Amex for Automated Payments and Collections

Invoiced, the award-winning Accounts Receivable Automation platform and American Express, announced that the two companies have teamed up to offer an exclusive 40% discount for an Invoiced plan via American Express’s new Business Services Suite.

House Passes $3 Trillion Stimulus Plan, Includes Additional $1,200 Checks

The measure, passed 208-199, would give cash-strapped states and local governments more than $1 trillion while providing most Americans with a new round of $1,200 checks.

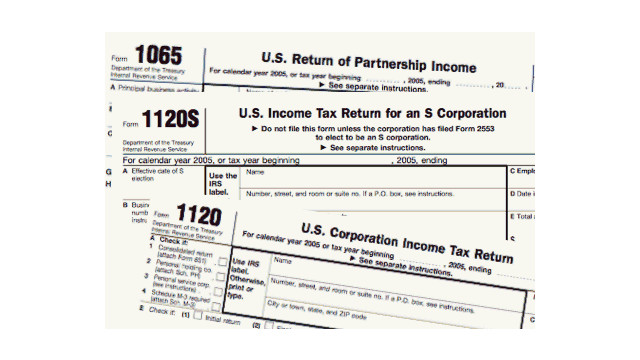

What’s the Best Entity Type for a Family Business?

Most of your clients probably started their family business solo and with little thought to what happens to the business when the owner gets married and has a family. Smaller owner-operator businesses are usually structured as sole proprietorships with...

Majority of Paycheck Protection Program Applicants Face Loan Status Uncertainty

The study revealed business owners’ optimism has dropped significantly since the start of 2020. On a scale of 1-100 with 1 representing the highest level of pessimism and 100 representing the peak of optimism, ...

COVID-19 Highlights Need for Automation in Accounts Payable Departments

Accounts payable departments that had yet to automate processes before the crisis are facing significant disruption. For example, in accounts payable, simple tasks like receiving, processing and approving paper invoices require onsite teams.

3 Million More Americans Join Unemployed Ranks

The number of Americans seeking unemployment benefits remained in the millions for an eighth straight week as the economy continued to reel from the coronavirus pandemic.

IRS Makes Changes to Sec. 125 Cafeteria Health Plans

These changes extend the claims period for health flexible spending arrangements (FSAs) and dependent care assistance programs and allow taxpayers to make mid-year changes.