Benefits

Latest News

IRS ‘Get Ready’ Campaign Helps Taxpayers Prepare for Filing Season

Trump Nominates Hedge Fund Exec Bessent to Lead Treasury Department

The Top Toys and Gifts for the 2025 Christmas and Holiday Season

Professionals on the Move – Nov. 2024

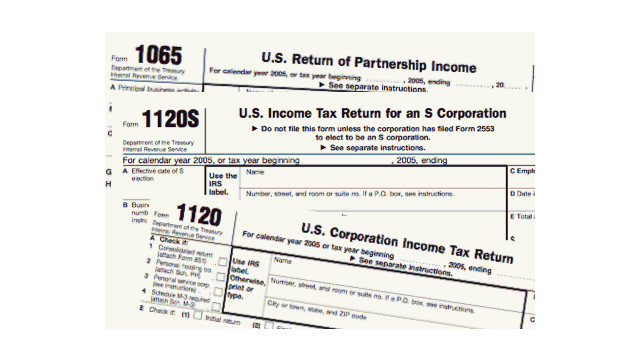

New Jersey Society of CPAs Reminds Small Business Owners About Tax-Saving Benefits of the New Pass-Through Law

The switch to a pass-through entity, as opposed to a C corporation, where long-term double taxation can be expensive, has other benefits, such as reducing the chances of an audit if the business owners file their taxes as a partnership versus a single own

3 Tips for Redesigning Benefits Packages

In the public accounting field, talent shortages over the past few years have led companies to offer higher pay and additional perks, all of which serve to attract top talent, but don’t always help retain them.

What Are Excepted Benefits, and Should You Offer Them to Employees?

Navigating through the waters of health insurance coverage is tricky. You might be wondering, "Do employers have to offer health insurance?" Although the Affordable Care Act (ACA) requires employers with 50 or more full-time equivalent employees to ...

The Tax Benefits of EFTPS for Small Businesses

Many employers outsource to third-party payroll service providers some or all their payroll and related tax duties, such as tax withholding, reporting and making tax deposits. Third-party payroll service providers can help assure filing deadlines and ...

The 8 Most Common Tax Benefits for Military Families

Members of the military and their families often qualify for tax benefits that could lower the tax they owe or allow them more time to file and pay their federal taxes. One of the key sources of information for military families ...

3 Benefits Technology Brings to Financial Reporting & Planning

New financial management technologies enable businesses to grow and provide an avenue to elevate their market status. These technologies help businesses recognize emerging opportunities and pinpoint obstacles in their way, while also providing a ...

3 Benefits Technology Brings to Financial Reporting and Planning

Financial management is steering away from the old days of paper-based, manual processes and into an increasingly digital world – and for good reason. We live in a digital economy where nearly every facet of life – including financial management ...

AICPA Comments on IRS Rules for Qualified Transportation Fringe Benefits

The AICPA explained in its letter that the TCJA amended Internal Revenue Code section 274(a)(4) so that no deduction is allowed for the expenses of any qualified transportation fringe benefit (QTF) provided by a taxpayer to an employee. Under ...