Benefits

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

What’s the Best Time to Start Drawing Social Security?

The federal government allows retirees to start drawing Social Security as early as age 62, a feature that more than 40 percent of Americans take advantage of as they gladly draw from the system they spent a lifetime paying into.

How to Collect Tax Benefits for Business Bad Debts

From a business perspective, there’s practically nothing worse than providing goods or services to a customer or client and not getting paid. Or maybe you’ve made loans to vendors or suppliers that haven’t been repaid. It can take a long time to get ...

A Small Business Prescription for Health Insurance Premium Tax Credits

Employers are facing increased obligations in 2015 relating to the health insurance coverage provided to employees, but at least some small business owners might benefit from a special tax break.

The Most Important Factors In Keeping Retirement Savings Safe

Don’t be so quick to simply accept what a financial advisor offers for your retirement – that’s the takeaway from multiple red flags since the 2008-09 economic crisis.

IRS Says 401(k) Limit to Stay $18k for 2016, Announces 2016 Pension Plan Limitations

Cost of living adjustments affecting dollar limits for pension plans and other retirement-related items will not change for tax year 2016, the Internal Revenue Service has announced. In general, the pension plan limitations will not change for 2016 ...

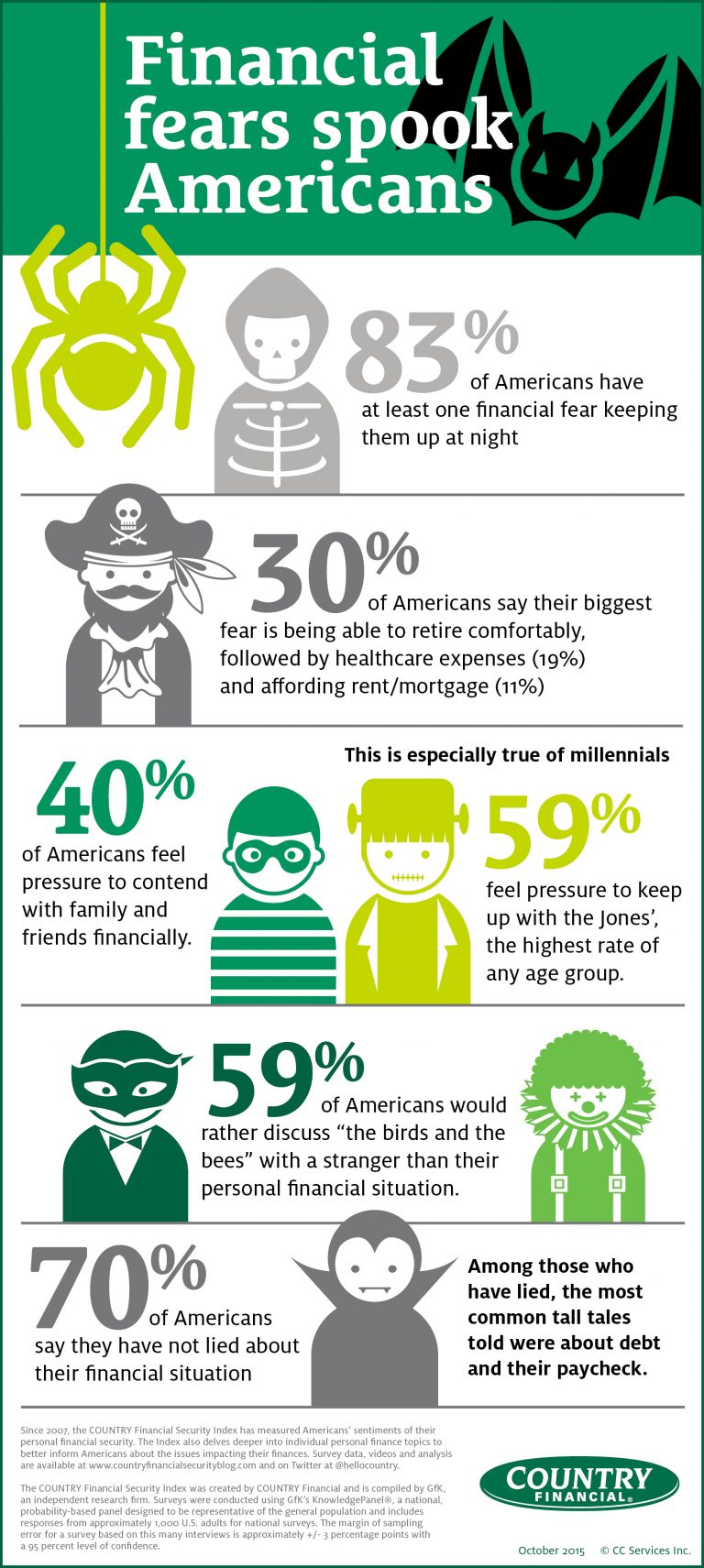

Retirement and Healthcare Costs Top List of Financial Fears

Money talk can be so scary that 59 percent of Americans would rather discuss "the birds and the bees" with a stranger than their personal financial situation (39 percent). This is especially true of women, as 63 percent share this preference compared ...

Thinking of Expanding Your Payroll Business? Consider Offering Benefits Administration Services

As you start evaluating your clients and current service offerings, consider ways you can provide additional services to clients, starting with existing clients.

How to Shield a Retirement Portfolio from Hitting Rock Bottom

Jittery investors saw the volatile market play havoc with investment portfolios. But while the ups and downs may have created anguish for some, financial planner Bryan S. Slovon says he fielded few if any calls from nervous clients.