Benefits

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

Self-Employed Workers Respond to Obama State of the Union Address: Ask for Income Tax Equity, Changes to Healthcare

Supporting the middle class means helping the small business community, too, said a national association in response to President Obama's State of the Union speech on Tuesday evening.

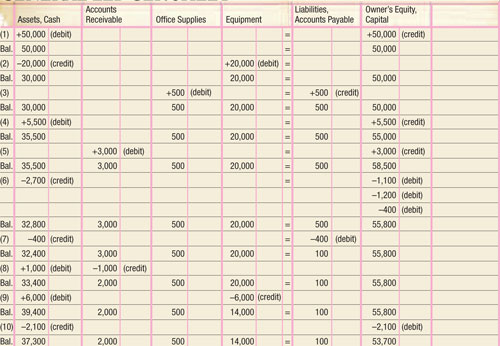

The Benefits of Open Book Finance

It’s a practice known as open-book finance and is used by more than 4,000 companies around the world, including Southwest Airlines, Harley-Davidson, and Whole Foods. Baker has studied open-book finance at several organizations and published a related case

AICPA Personal Financial Planning Conference Starts Next Week

Economic and political uncertainty, the effects of the Affordable Care Act, and estimating the true cost of retirement are just some of the factors creating a complex and challenging financial landscape for Americans. This year’s AICPA Advanced Personal Financial Planning Conference, held at the Bellagio Hotel in Las Vegas January 19-21, will give planners the necessary […]

Ensuring Success 2014 – Session 3: Benefits of Taking Bookkeeping Out of the Back-Office and Into the Cloud

In this session you will learn how a cloud-based business payment service can reduce time spent and improve organization and control over the accounts payable and accounts receivable processes.

Taxpayers Barely Avoid a Tax Hike On Commuter Benefits

The new tax extenders law enacted in 2014 – the Tax Increase Prevention Act (TIPA) – preserved a key tax break for commuters. Under TIPA, a higher tax-free monthly allowance for mass transit passes and vanpooling was approved for 2014, retroactive to ...

The Tax Benefits of Buying a New Car Before the End of the Year

Under the new tax law signed by the president on December 19, taxpayers can claim an optional tax deduction on their personal 2014 returns for state sales tax paid this year. And the sales tax you pay on a vehicle – usually, a significant amount – may ...

CBIZ Offers New Affordable Care Act Compliance System

The employee benefits provider and insurance advisory consultancy CBIZ has released CBIZ ACA CheckPoint, a platform offering the advanced availability of ACA reporting and compliance tools and expertise. The system was developed in conjunction with SyncSt

Another Epic Fail For the IRS and ObamaCare?

It would be nice to believe that with years to prepare, the Internal Revenue Service is prepared to manage the complexities of verifying insurance qualifiers for Obamacare, collecting the $95 from those who owe a penalty, and easing the way for the ...