Benefits

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

Thomson Reuters Offers Solution to Help Firms Market Healthcare Reform Services

As trusted financial advisors to millions of Americans and businesses, accounting firms are uniquely positioned to provide their clients with information and services regarding the Affordable Care Act. Thomson Reuters is offering a new solution to help firms market their expertise to clients and has released a tax act overview and monthly client marketing newsletter focused on the Affordable Care Act.

The Best States for Military Retirees

Retirement is typically viewed as the end of the line – a time for rest, relaxation and the pursuit of interests long ago put on the back burner. But the narrative is far different for military retirees.

Which States Have the Best 401(k) Growth?

Which states have the best 401(k) plans? That question isn't usually tied to geography, but financial advisory firm Judy Diamond Associates has found some key differences and benefits based on location.

What are the Tax Implications of ObamaCare?

Most people have heard the endless political arguments about the Affordable Care Act, aka ObamaCare, but many still don't really know the full extent of what the law is. The Affordable Care Act was enacted by Congress and signed into law by President Obama in 2010, becoming the biggest healthcare reform measure since the implementation of Medicaid and Medicare in 1965.

The ObamaCare of Computing? Microsoft’s Silly Trick

By now you have discovered the sad and silly trick that Microsoft played on you during the last days of tax season. Windows XP has been killed, and you have to upgrade to Windows 8.1 or leave your accounting computers both unprotected and in violation of federal law.

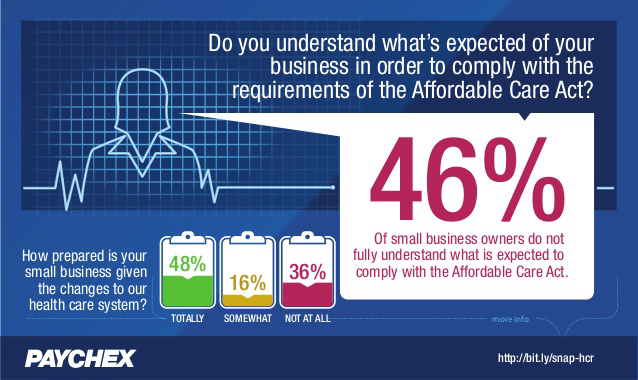

Survey: Only Half of Businesses are Prepared for Healthcare Law

A new survey shows that, four years after being signed into law, about half of businesses understand and are prepared for the implications of the Affordable Care Act, also known as ObamaCare.

Strategic Mid-Year Business Tax Tips

Traditionally, tax planning is targeted to individual taxpayers, but small business owners can also benefit from such tax-saving techniques. Instead of waiting until the very end of the year to pitch ideas to clients, present them with the following ten strategies at midyear.

Contribution Limits Raised for Health Savings Accounts

The Internal Revenue Service has increased the annual limitation on deductions for Health Savings Accounts for 2015, the agency announced on Wednesday.