Benefits

Latest News

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

State Societies in Action: Wisconsin Institute of CPAs

LinkedIn + AI = A Recipe for Prospecting Success for Accounting Firms

IRS Faces Customer Service Challenges Under Obamacare

A new report by the Treasury Inspector General (TIGTA) on the Patient Protection and Affordable Care Act (the PPACA) – the 2010 federal legislation also known as “Obamacare” – focuses on the “customer service” strategy promised by the IRS.

More Employers Focusing on Workers’ Financial Well-Being in 2014

As U.S. companies grow increasingly concerned about the financial well-being of their workforce, a new survey by Aon Hewitt, the global talent, retirement and health solutions business of Aon plc, finds that employers are looking for new ways to improve the long-term financial health of their employees in 2014.

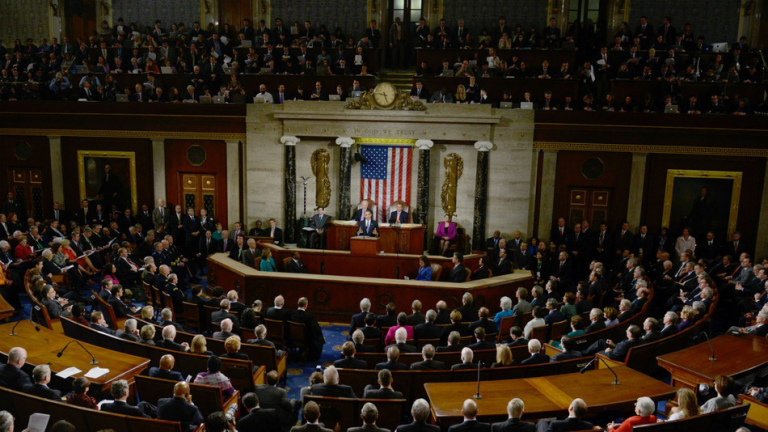

How President’s Policy Initiatives Could Affect Small Business

In his annual State of the Union Address last week, President Obama mentioned several policy initiatives he plans on advancing that could have an impact on the small businesses across the country.

Ohio Ranks Among Worst for Personal Finances

Financial security remains elusive for almost half of Ohio households, which often are one medical issue, pink slip or other crisis away from plunging into severe poverty, according to a new report from the Corporation for Enterprise Development.

New Hampshire Considers Taxing Nonprofit Hospitals

An analysis of charity care at the state's 24 nonprofit hospitals, conducted in cooperation with the New Hampshire Hospital Association, shows that hospitals here are more charitable than the national average and less profitable, although there are wide variations from one New Hampshire hospital to another.

Tax Expert Speaks on Impact of Health Care Reform

The new health insurance laws still have many individuals and small business owners scratching their heads. In an effort to help those in North Carolina, Tim Robinson, CPA, tax director at the CPA Firm of Hughes Pittman & Gupton, LLP, in the Raleigh-Durham area, recently spoke to financial executives on compliance with the Affordable Care Act. He discussed several tax penalties that will affect Triangle businesses with 50 or more full-time equivalent employees.

IRS Proposes Fines For Non-Compliance With Health Insurance Mandate

Most U.S. taxpayers must secure health insurance coverage this year whether they want to or not. But the IRS and Treasury Department have clarified several exceptions to the rules in new proposed regulations relating to the health insurance mandate for individuals.

Equality In Employer Health Insurance Plans Delayed

Unless you’ve been living under a rock the last few years, you’re well-aware that the massive health care legislation known informally as “Obamacare” by both its detractors and proponents remains the law of the land.