ESG

Latest News

BlackLine Launches Studio360 Platform

Bipartisan Bill Would Boost Monthly Social Security Benefits for 2.5M Americans

HubSync Ranked No. 221 Fastest-Growing Company in North America on 2024 Deloitte Technology Fast 500

Treasury, IRS Final Regs on Direct Pay Expand Clean Energy Tax Credit Access

Financial Advisors Upbeat on Economy

Advisor concerns about managing volatility, generating income, growing wealth and reducing taxes fell over the past quarter, according to the latest Eaton Vance Advisor Top-of-Mind Index (ATOMIX) survey, a quarterly survey of more than 1,000 financial ...

Professionals on the Move – August 1, 2017

A roundup of professionals in the tax and accounting profession that have changed jobs and/or been promoted.

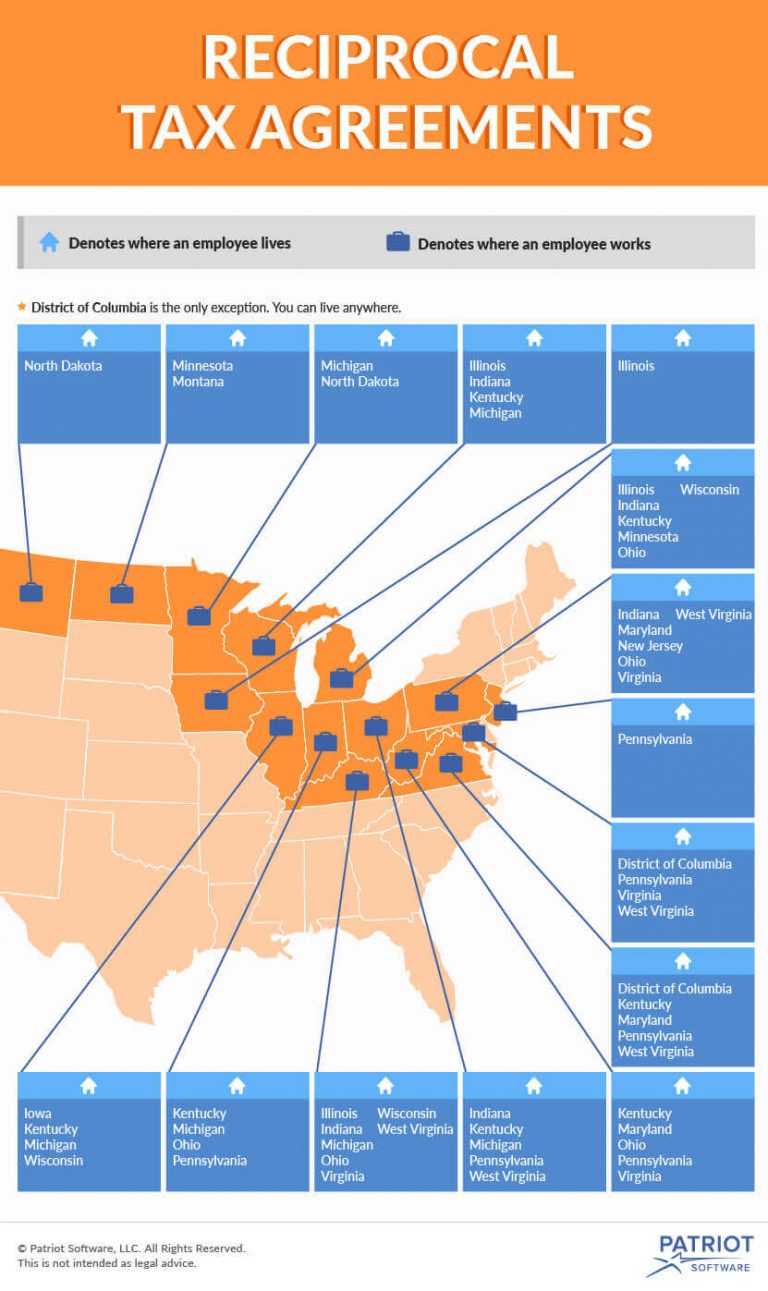

What is Tax Reciprocity?

Tax reciprocity normally applies to any wages an employee earns through employment: hourly wages, salaries, tips, commissions, and bonuses. Reciprocal tax withholding agreements between states usually do not apply to income earned outside of employment.

Financial Advisors Upbeat on Equities

Although concerned, advisors appear poised to capitalize on the opportunities volatility presents, with 54% saying volatility should be both managed to avoid losses and harnessed to take advantage of opportunities. However, their clients had a ...

New System Offers State Compliance Research for S Corps and Partnerships

Thomson Reuters has released Checkpoint State Clear Comply, which simplifies the analysis of complex state compliance questions for multi-tier partnerships and S Corporations with a presence in multiple states.

Execs Worry Over FATCA and CRS Compliance

More than 50 percent of senior executives from multinational financial firms are concerned non-compliance with the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) mandates could affect the reputations of their institutions.

2016 Review of Wolters Kluwer – CCH Axcess Tax

CCH Axcess offers a comprehensive, cloud-based suite of professional accounting and tax systems that utilize a singular database and can enhance firm productivity across multiple engagement types, and help firms standardize their workflow processes.

Midsized Businesses Struggling With Tax Compliance

The research revealed that nearly half of business owners do not know how many fines they incurred in the past 12 months or how much they cost their organizations.