Firm Management

Latest News

Understanding Employees’ Preferences: The Key to CPA Firms Attracting Top Talent in 2025

2025 Tax Refund Date Estimator – And Last Minute Tax Tips for 2024

IRS Will Phase in $600 1099-K Reporting Threshold in 2026

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

Professionals on the Move – August 18, 2014

A weekly roundup of professionals in the tax and accounting profession that have changed jobs and/or been promoted.

NetDocuments Names New CEO, Receives $25M Investment

Cloud-based document and email management provider NetDocuments has announced that Matt Duncan has taken the helm as the company's new chief executive officer.

Cleveland CPA Works to Bring Young Talent to Hometown

Cleveland CPA Gary Shamis is working to attract younger accountants to his firm and city.

31% of Workers Have No Retirement Savings

Nearly one third of American workers have no retirement savings or a pension, and 19 percent of workers nearing retirement age have no nest egg either, according to a new report by the Federal Reserve Board.

To Payroll or Not to Payroll? That is the Question… For CPA Startups Now and Then

Los Angeles-based Team Jenn Corp founder Jennifer McCabe is a careful proponent of offering payroll services. “I won’t minimize it, payroll errors can be a nightmare. But payroll is an important part of the confidential employee relationship bucket.” Offering payroll services can also help to instill invaluable confidence and a deep relationship. “It’s worth it. No doubt.” Having provided payroll services from the get-go she and her team have learned quite a bit along the way on what to do and what you want to avoid in spades.

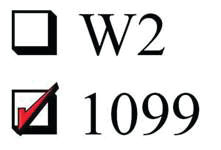

Employee vs. Independent Contractor: Do You Know the Rules?

When you’re running a business and someone works for you or provides a service, you pay them. That’s easy. What isn’t always so easy is determining how you should treat those payments. Before you enter into a business relationship, it’s important to establish the type of relationship – is this person providing services as an independent contractor or an employee?

How to Start or Expand a SALT (State and Local Tax) Practice

The first thing you should do NOW, and the one thing you should not do, at least not yet.

CohnReznick Raises $105,000 for Make-a-Wish Program

The accounting and advisory firm CohnReznick LLP recently raised more than $105,000 at its 13th annual employee Bowl-A-Thon, which benefits Make-A-Wish New Jersey. This brings the total raised for Make-A-Wish by the Firm over the last 13 years through employee fundraising, donations, and raffles to more than $1.45 million.