Firm Management

Latest News

IRS Will Phase in $600 Form 1099-K Reporting Threshold in 2026

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

FASB Issues Standard on Induced Conversions of Convertible Debt Instruments

IRS Announces National Tax Security Awareness Week Starts on Dec. 2

2014 CCH User Conference To Be Held in Orlando

CCH Connections: User Conference 2014 will be held from October 26 – 29, 2014. Grande Lakes is located about 15 minutes from Orlando International Airport (MCO) and a short distance from Florida's world-famous theme parks and attractions. The resort was also the location of the 2010 CCH User Conference.

How CPAs Should Respond to a Malpractice Suit

CPAs have close relationships with their clients (especially in smaller accounting practices) and rightfully so. Who else is better to understand their client’s financial and business affairs than their trusted CPA? And the relationship generally remains close…

Tool Helps Test Effects of Healthcare Law on Businesses

Thomson Reuters Releases ACA Decision Support Tool for Tax and Employee Benefits Professionals

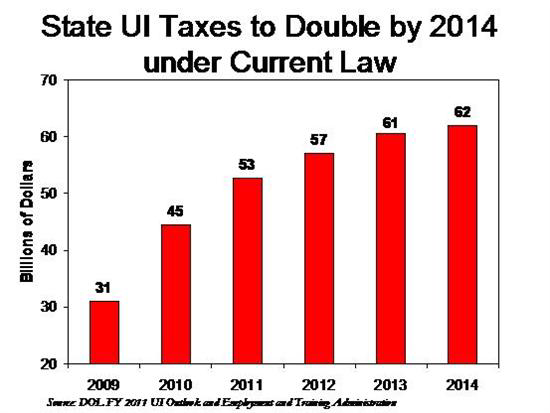

How to Reduce Your Clients’ SUTA Tax Rate in 2014

This month, we'll look at state unemployment tax, or SUTA. Unlike FUTA, SUTA offers employers in many states a way to reduce their tax rates in 2014. It's called a "voluntary contribution."

Illinois CPAs Offer Free Tax Preparation to Actibve Duty Military

Illinois CPA Society members volunteer to help active duty military members and their families with free federal and state income tax preparation.

Accounting Firm Names First Chief Innovation Officer

ne of the largest public accounting and consulting firms in the U.S., Crowe Horwath LLP, has named Derek Bang as its first chief innovation officer.

How an Accounting Firm Can Offer Full Financial Planning

Financial trends and strategies beyond the tax advice basics.

2013 Review of Intuit Tax Research for Lacerte and ProSeries – Expanded Review

From the Dec. 2013 issue. Intuit Tax Research for Lacerte and ProSeries directly integrates with both tax preparation software packages. The tax research product is web-based, but is easily launched from the two tax programs, and tax research documents can be attached to a client’s file in the tax programs with one click. The program […]