Income Tax

Latest News

Understanding Employees’ Preferences: The Key to CPA Firms Attracting Top Talent in 2025

2025 Tax Refund Date Estimator – And Last Minute Tax Tips for 2024

IRS Will Phase in $600 1099-K Reporting Threshold in 2026

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

![Islands-Group2[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2020/04/Islands_Group2_1_.5e973ed1511e8-768x509.png)

The Rules on Sales Taxes for Food Takeout and Delivery

There’s a lot to learn, and not a lot of time to learn it. The business landscape is changing overnight: Another unknown may be how to handle sales tax on takeout or delivery services.

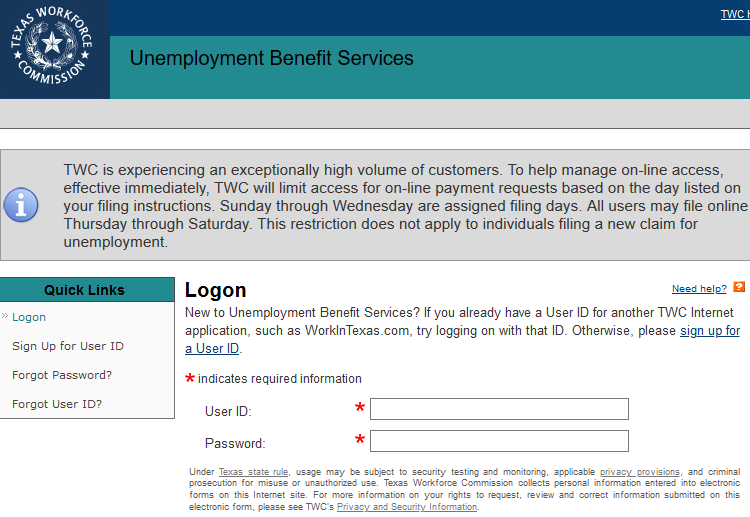

Most State Unemployment Websites Crashing, Or Fail Mobile and Accessibility Tests

Overall, unemployment website crashes have been reported in Alabama, Arizona, Arkansas, Colorado, Connecticut, Florida, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nevada, New Jersey, New York, ...

Where’s My Coronavirus Stimulus Payment? IRS Launches Website to Track Payments

The IRS has unveiled the new Get My Payment with features to let taxpayers check on their Economic Impact Payment date and update direct deposit information.

What Taxpayers Can Do to Speed Up Coronavirus Stimulus Payments

The last few weeks have been extraordinarily challenging for most Americans, as many of us have been cloistered in our homes, told to shelter in place, and been urged to refrain from gathering with family or friends.

IRS Launches Website to Get and Track Coronavirus Stimulus Payments

Get My Payment also allows people a chance to provide their bank information. People who did not use direct deposit on their last tax return will be able to input information to receive the payment by direct deposit into their bank account, expediting ...

Tax Scammers are Still in Business, Warns IRS

The IRS, state tax agencies and the nation’s tax industry continue to see an upswing in data thefts from tax professionals as cybercriminals try to take advantage of COVID-19 and Economic Impact Payments to create new scams.

QuickBooks Capital Approved as Paycheck Protection Program (PPP) Lender

Company preparing to accept applications for billions of dollars in requested PPP relief next week. 1 in 12 American employees is paid through QuickBooks Payroll

IRS Launches Website for Non Tax Filers to Register for Coronavirus Stimulus Payments

To help millions of people, the Treasury Department and the Internal Revenue Service today launched a new web tool allowing quick registration for Economic Impact Payments for those who don’t normally file a tax return.