Income Tax

Latest News

U.S. Consumer Inflation Outlook Fell Slightly, Fed Survey Shows

KSM Adds Valuation Firm ValueKnowledge in Illinois

How AI is Reshaping the Future of Finance

EY Acquires HR Tech Consulting Firm Jubilant

The Biggest Tax Mistakes for Small Businesses

There are strategies that these business owners can take to help alleviate many of these tax time woes, and a big one is by staying in more frequent contact with their accountant. That's according to a new nationwide survey of accounting professionals.

Ex-Con Tax Preparers Put Clients at Risk

Fresh out of prison, two felons went to work for uncredentialed tax offices, using fraudulent deductions to create bigger tax refunds for clients.

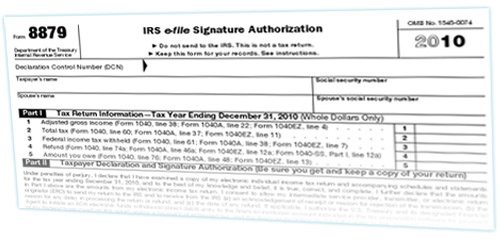

IRS Approves E-Signatures on Form 8879

Effective March 11, 2014, the IRS approved e-signatures on Form 8879 through an online revision to Publication 1345.

10 Income Tax Breaks for the Rich and Famous

Many federal income tax breaks are reserved for low-income families – the earned income tax credit (EITC) instantly comes to mind – but that doesn’t mean that wealthier individuals can’t get their fair share of the pie.

N.Y. Town Clerk Accused of Embezzling $117K

New York state police, based on information developed by a state comptroller's audit, have arrested a former clerk/treasurer of the now-dissolved village of Altmar, Oswego County, and charged her with embezzling $117,615 in village funds.

Autonomy CEO Says HP is Misleading Investors

In a sharply worded letter released Wednesday, Mike Lynch, former chief executive of Autonomy, has accused Hewlett-Packard of misleading shareholders about the accounting problems it claimed to have uncovered at the British company it acquired in 2011.

Don’t Miss These Six State Income Tax Items

State income taxes are often overlooked by the general public, but professional tax return preparers should not make the same mistake. Nevertheless, it is easy to miss tax benefits or liabilities associated with state income taxes, especially as they relate to federal Form 1040.

The Biggest Tax Mistakes for Small Businesses

There are strategies that these business owners can take to help alleviate many of these tax time woes, and a big one is by staying in more frequent contact with their accountant. That's according to a new nationwide survey of accounting professionals.