Income Tax

Latest News

U.S. Consumer Inflation Outlook Fell Slightly, Fed Survey Shows

KSM Adds Valuation Firm ValueKnowledge in Illinois

How AI is Reshaping the Future of Finance

EY Acquires HR Tech Consulting Firm Jubilant

What’s Not On Your Clients’ W-2s Can Be a Goldmine For Your Firm

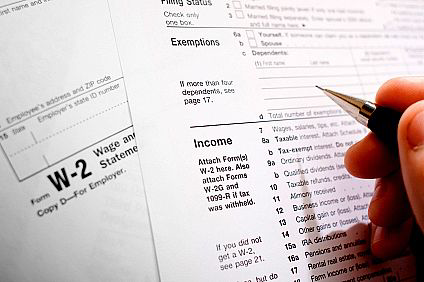

There’s so much nifty tax preparation software out there these days. Don’t you just love the software that allows us to import W-2 data, stock sales data, QuickBooks data, etc.? With all those tools, we barely even have to look at our clients’ documents. But we should!

Tips On How To Choose A Tax Professional

Find out how to pick a reputable tax preparer.

When Will You Get Your Tax Refund? Sooner, If You Use Direct Deposit

One of the top-searched questions between mid-February and April 15 each year is, "When can I expect my income tax refund?" Well, the answer depends on a couple of things, but the good news is that there are a number of tools to help find out.

Payroll Taxes for 2014: The Effects of the Demise of DOMA

The Supreme Court's rejection of the Defense of Marriage Act (DOMA) was big news in 2013. And in 2014, it has big payroll tax implications for employers who offer cafeteria benefits to same-sex spouses.

Debunking Common Income Tax Myths

It's tax time, and that means busy days for many tax professionals, and many errors and mistakes by individuals who choose to prepare their own taxes.

5 Tips to Keep More of Your Paycheck

Millions of American workers have received their W-2s (or will receive them soon, since January 31 was the deadline to send them), and they are the primary income reporting tool for most 1040 filers. They can be received in person, electronically or by mail. In addition to taxes, the W-2 also is used to determine future social security benefits, so it's important to make sure the information on the form is accurate.

Treasury Dept. Urges Congress to Raise Debt Limit

Treasury Secretary Jacob J. Lew on Monday pressured Congress to raise the debt limit well before an end-of-the month deadline, warning that lawmakers risked derailing a potential "breakthrough year for our economy" if they don't act quickly.

Unlicensed Milwaukee Tax Preparer Charged for $1 Million Fraud

A Milwaukee tax preparation service filed thousands of returns based on phony claims of self-employment that generated as much as $1 million in undeserved refunds, according to the results of an undercover IRS investigation launched in 2011.