Income Tax

Latest News

U.S. Consumer Inflation Outlook Fell Slightly, Fed Survey Shows

KSM Adds Valuation Firm ValueKnowledge in Illinois

How AI is Reshaping the Future of Finance

EY Acquires HR Tech Consulting Firm Jubilant

2013 Review of FormMagic, Inc. – Tax-Mate 1099

Tax-Mate 1099 by FormMagic allows users to print and electronically file year-end information forms. Compatible with both Mac and PC, Tax-Mate 1099 comes in four versions: Print, Print+, Transmittal and Advisor. This review is of the comprehensive Advisor version. Basic System Functions – 4.5 Stars Tax-Mate Advisor is a comprehensive management, filing and printing solution for accounting […]

Thomson Reuters Offers Updated Report on Tax Changes in U.S. Healthcare Reform

Thomson Reuters Checkpoint has released an updated special report, Tax Changes in Health Care Reform Legislation, which is designed to help tax practitioners understand the tax provisions of health care reform that take effect now through 2018.

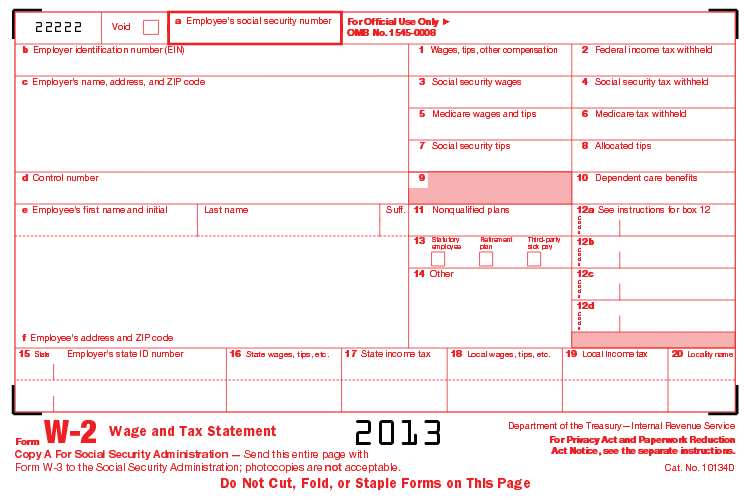

W-2 and 1099 Systems Help Accountants and Businesses Stay Compliant

2013 Overview of W-2/1099 Preparation Software

Liquor Stores in Washington State Struggling with New Taxes

A year and change after private liquor sales began in Washington, nearly two dozen mostly small retailers are in danger of losing their licenses for failing to pay the required taxes and fees.

Nurses Aides Guilty of Stealing Health Records, Filing Fake Tax Returns

Two former Sentara Healthcare employees pleaded guilty this month to accessing patients' electronic health records inappropriately in a scheme to file fraudulent tax returns.

Tax Planning and Preparation Guidance for 2014

The impact of the recent federal government shutdown is being felt by the Internal Revenue Service (IRS) which announced that the beginning of the 2014 tax filing season will be delayed by up to two weeks.

Grant Thornton Offers Year-End Tax Planning Tips

The dawn of 2013 brought the biggest tax changes in more than a decade and this dramatic reshaping of the tax code will change tax planning according to Grant Thornton LLP.

2014 Income Tax Filing Season will Start Late Again

Last year, it was the fiscal cliff that delayed the start of tax season- this coming year, blame it on the partial government shutdown.