Income Tax

Latest News

April Launches New Tax Filing Solution to Tackle Complex Financial Situations

Vero AI Launches Iris GRC

RSM Teams with Additive to Enhance Tax Service Capabilities Using Generative AI

Sikich Launches IAEdge for Internal Audit Compliance

Tax Analysts Pushes for Tax Law Transparency in Federal Court

Asks Court to Grant Access to Oral Arguments in Case Challenging Constitutionality of Colorado's Taxpayer Bill of Rights

Hey CPAs: Don’t Be Just Your Clients’ “Tax Guy”

Some of these accountants are suited for and satisfied with that role, but there are many others who recognize that the market demands a more proactive, advisory approach with clients.

Oct. 15 Tax Extension Deadline Stands, Despite Government Shutdown

The current lapse in federal appropriations does not affect the federal tax law, and all taxpayers should continue to meet their tax obligations as normal. Individuals and businesses should keep filing their tax returns and making deposits with the IRS, as required by law.

Will New Healthcare Laws Hurt the CPA-Client Relationship?

As this column goes to print, provisions of the Patient Protection and Affordable Care Act (also known as the “ACA,” or ObamaCare) will change accountants and tax preparers from “trusted advisors” to a more derogatory status:

Ohio Woman Sentenced to 15 Months for 79 Bogus Tax Returns

Despite a plea from her attorney, a 34-year-old mother of four was sentenced yesterday to 15 months in prison for filing 79 false income-tax returns and claiming more than $400,000 in bogus refunds.

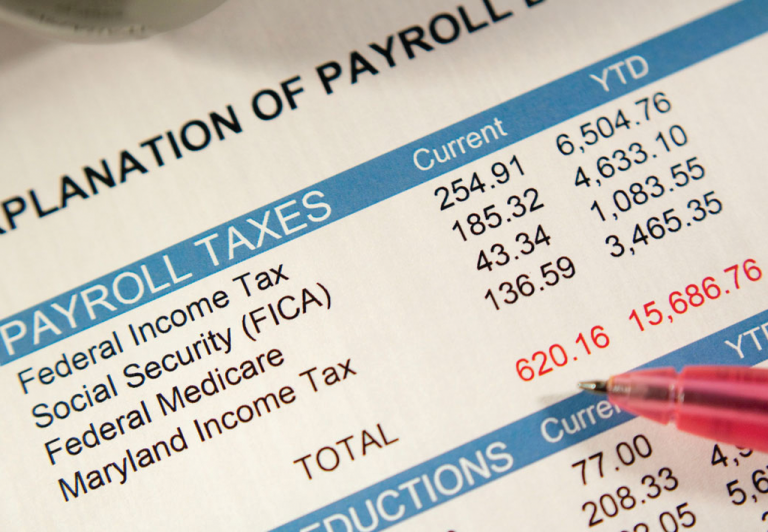

Payroll Systems Becoming More Mobile, with More Employee Self-Service Options

As we began 2013, taxpayers were shrouded in a cloud of uncertainty concerning taxes. That seemed to quickly be resolved for this year and into 2014, but we are now faced with a number of new tax and payroll issues.

Government Shutdown Begins- What it Means for Small Business

On Monday night, the U.S. Congress rejected the U.S. Senate's version of the House bill for a debt limit increase, which effectively shuts down some of the non-critical operations of the federal government.

How to Avoid the Top 4 Household Employment Tax Mistakes

When families become employers, they take on many of the same responsibilities that business employers do – although many of the forms, deadlines and labor laws for household employers are unique.