Income Tax

Latest News

FASB Seeks Comment on Financial KPIs

N.Y. Congressman Requests Trump’s Support For Tax Cap Elimination

AICPA News – Nov. 2024

Chicago Aldermen Give Mayor Brandon Johnson’s $300M Property Tax Plan the Boot

Annual Institute on Federal Taxation Returns to NYC and San Diego

Designed for professionals who handle federal tax matters, the IFT provides high-level updates and practical advice that can be implemented immediately into ...

New! Intuit Tax Advisor Delivers Innovative Tax Planning and Tax Strategies

With the integration between Lacerte and ProConnect Tax, client data is automatically mined to bring significant time savings to your practice and more accurate tax projections for your clients.

Deferred Payroll Taxes Are Coming Due Soon

Businesses have until December 31, 2022, to meet their obligations for federal payroll taxes deferred from as far back as 2020. If a business fails to comply, it may be hit with a hefty tax penalty.

IRS Warns of Huge Increase in Scam Texts

So far in 2022, the IRS has identified and reported thousands of fraudulent domains tied to multiple MMS/SMS/text scams (known as smishing) targeting taxpayers.

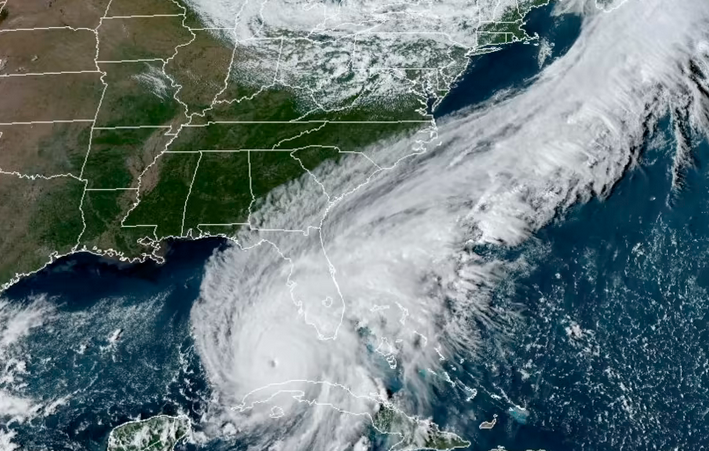

Hurricane Ian Victims Granted Tax Extensions

Hurricane Ian victims throughout Florida now have until February 15, 2023, to file various federal individual and business tax returns and make tax payments.

700 Volunteers Turn Out for Illinois CPA Society’s 13th Annual CPA Day of Service

Assisting at animal shelters, preparing meals at food banks, feeding the homeless, making children’s school backpacks, and running marathons were just some of the activities ...

IRS Increases Per Diem Rates

For lower-cost locations of business travel, the daily per diem rate will be $204. The high rate will be $297.

Accounting and Finance Salaries Increasing, Says Report

The study found that demand for these roles is most acute in California, Texas, New York, Florida, Illinois, North Carolina, Ohio, and Georgia.