Taxes February 9, 2026

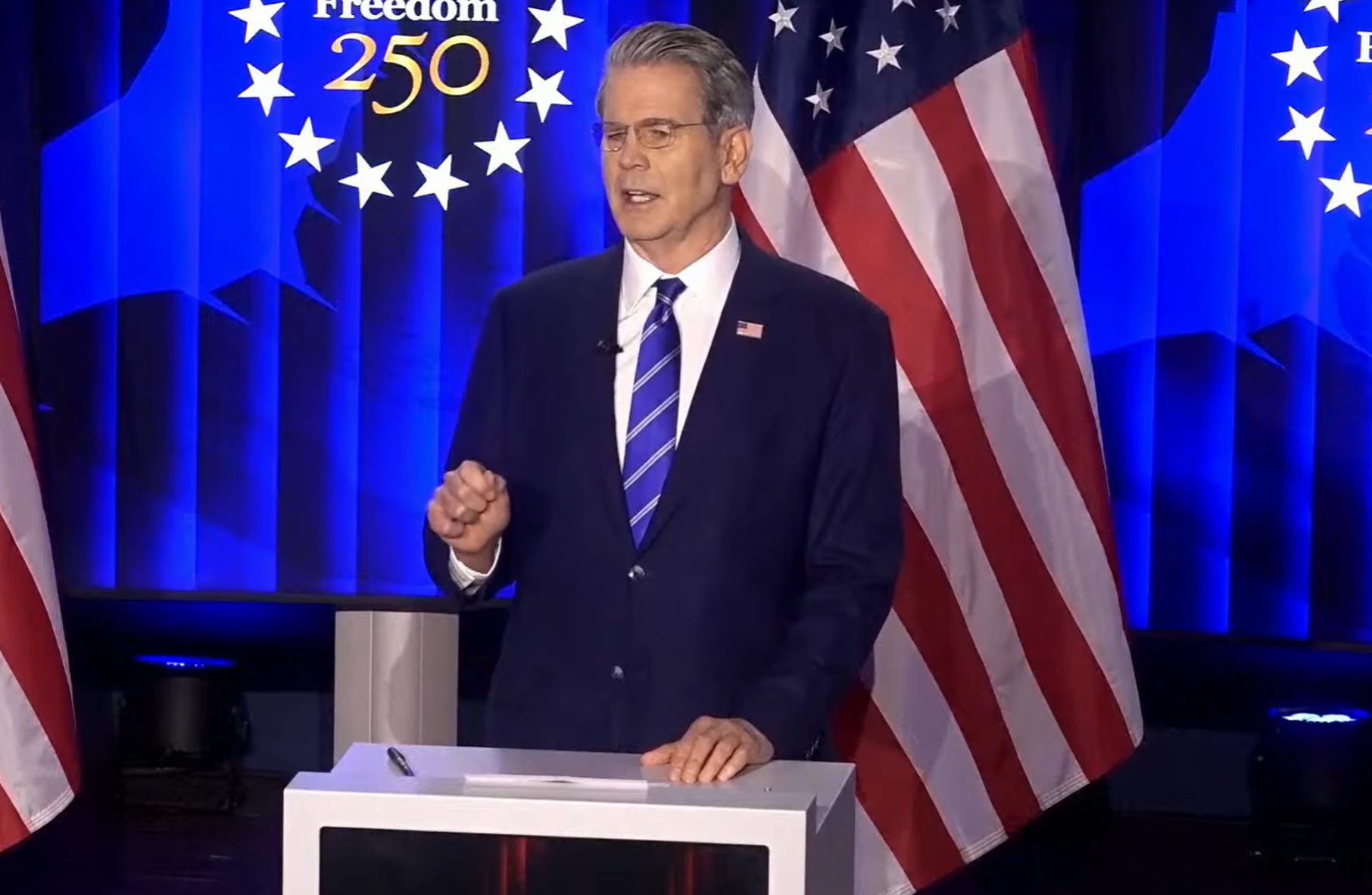

Opinion: This Tax-Refund Bonanza Won’t Do What Bessent Says It Will

Treasury Secretary Scott Bessent has been talking up Americans getting bigger-than-usual tax refunds this year for months, saying that it will help spark “a non-inflationary boom.” That's unlikely.