Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

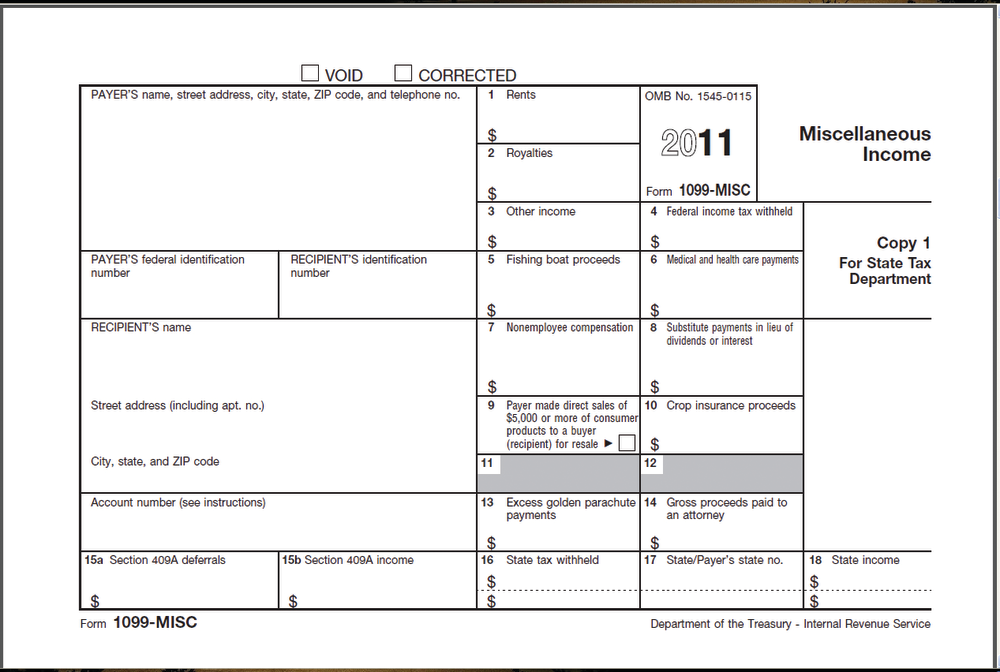

December 1, 2012

Every year, tax and accounting professionals and their clients are faced with the often daunting task of year-end wage and information reporting.

November 8, 2012

Doug Shulman, Commissioner of the IRS, will leave office Nov. 11, 2012, after five years in the office.

October 29, 2012

The Internal Revenue Service’s next IRS Live webinar, “Get Prepared: A to Z Details on the Registered Tax Return Preparer Test” is Wednesday, Oct. 31, at 2 p.m. Eastern Time.

October 17, 2012

From Darren’s CPA Practice Advisor blog: My Perspective. Just this week, a new cloud-based IRS “research center” application was released to the tax and accounting profession—Beyond415 Guidance. The stand-alone app from New River Innovation offers practical and up-to-date guidance for resolving issues after tax filing. Product features include searchable guidance that covers individual, business, and...…

September 27, 2012

The IRS has selected CCH to provide sales tax rates and taxability tables for the eighth consecutive year.

September 10, 2012

The IRS has announced emerging or significant areas that it will prioritize for the coming year. When it comes to compliance, the IRS has increasingly focused on small business underreporting, which is responsible for 84% of the $450 billion tax gap.

August 31, 2012

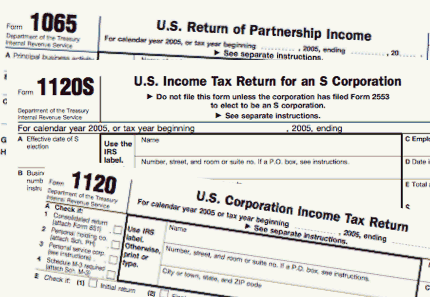

As tax season approaches, practitioners can expect the IRS to quickly expand its audit focus to flow-through entities, according to an IRS official.

July 10, 2012

IRS Inside Blog: Ruling leaves questions on the IRS' role in implementing the individual mandate "tax"

March 6, 2012

The IRS regularly conducts national, regional, and local compliance initiative projects (CIPs) to study perceived areas of noncompliance.

March 3, 2012

Simplifying IRS representation services by partnering with the right technology. From the April 2012 Digital Issue. Lisa Richards has been in the tax and accounting game for many years, so she is more than aware of the time investment and frustration that can come with working with the IRS.“Handling IRS issues for clients has...…

July 18, 2011

The Internal Revenue Service today advised truckers and other owners of heavy highway vehicles that their next federal highway use tax return, usually due Aug. 31, will instead be due on Nov. 30, 2011