IRS

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

Tax Implications of 2015 Presidential Budget Proposal

Report reveals direction of tax reform debate and how companies can prepare for potential changes.

How Does Your Firm Handle Inept Clients?

After working with clients for (mumble) decades, I still don’t know how to resolve this. Unless you think your clients would be receptive to sitting through a course (live or webinar) on “How to be a Tax Client”?

Move Over Fido – The Tax Filing Extension is a Taxpayer’s Best Friend

One could say that the automatic tax filing extension is the taxpayer’s best friend – besides being a bosom buddy to tax return preparers – as the tax filing season rushes to a close. And this BFF may be able to do more for you than you think. However, just like most good friends, it’s not without fault.

For Seniors: April 1 is Deadline to Take Required Retirement Plan Distributions

The Internal Revenue Service today reminded taxpayers who turned 70½ during 2013 that in most cases they must start receiving required minimum distributions (RMDs) from Individual Retirement Accounts (IRAs) and workplace retirement plans by Tuesday, April 1, 2014.

IRS Says Bitcoin is Considered Property, Not Currency

The question has lingered for about two years, but the IRS has finally decided how to treat Bitcoins and other virtual currencies when it comes to taxes.

IRS Gives Colorado Flood Victims Extension for Claiming Damages

Taxpayers in Colorado who suffered property damage during last year's flooding are being given additional time to decide on when they will claim those losses against their taxes.

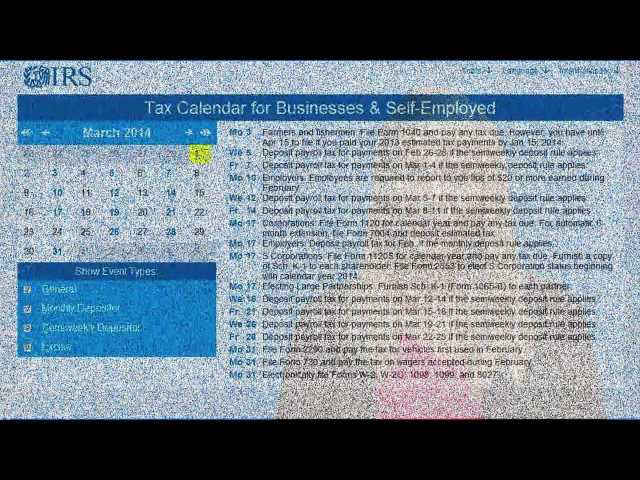

2014 IRS Tax Calendar for Businesses & Self-Employed

View business due dates with the IRS's online tax calendar.

10 Income Tax Breaks for the Rich and Famous

Many federal income tax breaks are reserved for low-income families – the earned income tax credit (EITC) instantly comes to mind – but that doesn’t mean that wealthier individuals can’t get their fair share of the pie.