Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes April 28, 2025

Tax Court judges are notoriously a no-nonsense bunch. They consistently deny claims by taxpayers that are considered to be “frivolous” in nature.

IRS April 25, 2025

An unknown number of employees who work in those two offices within the IRS received notice Friday afternoon that they are being laid off as part of the agency's reduction to its workforce.

Taxes April 23, 2025

Lawrence Summers said that the Trump administration’s moves to downsize the IRS, along with other changes, are likely to incentivize reduced tax-payment compliance.

Taxes April 22, 2025

By checking tax withholding, individuals can prevent having to owe additional money and any potential penalties at tax time.

Taxes April 21, 2025

After the feds froze more than $2 billion in grants to the Cambridge campus and threatened its tax-exempt status, Harvard University has filed a lawsuit against the Trump administration in Massachusetts federal court.

IRS April 19, 2025

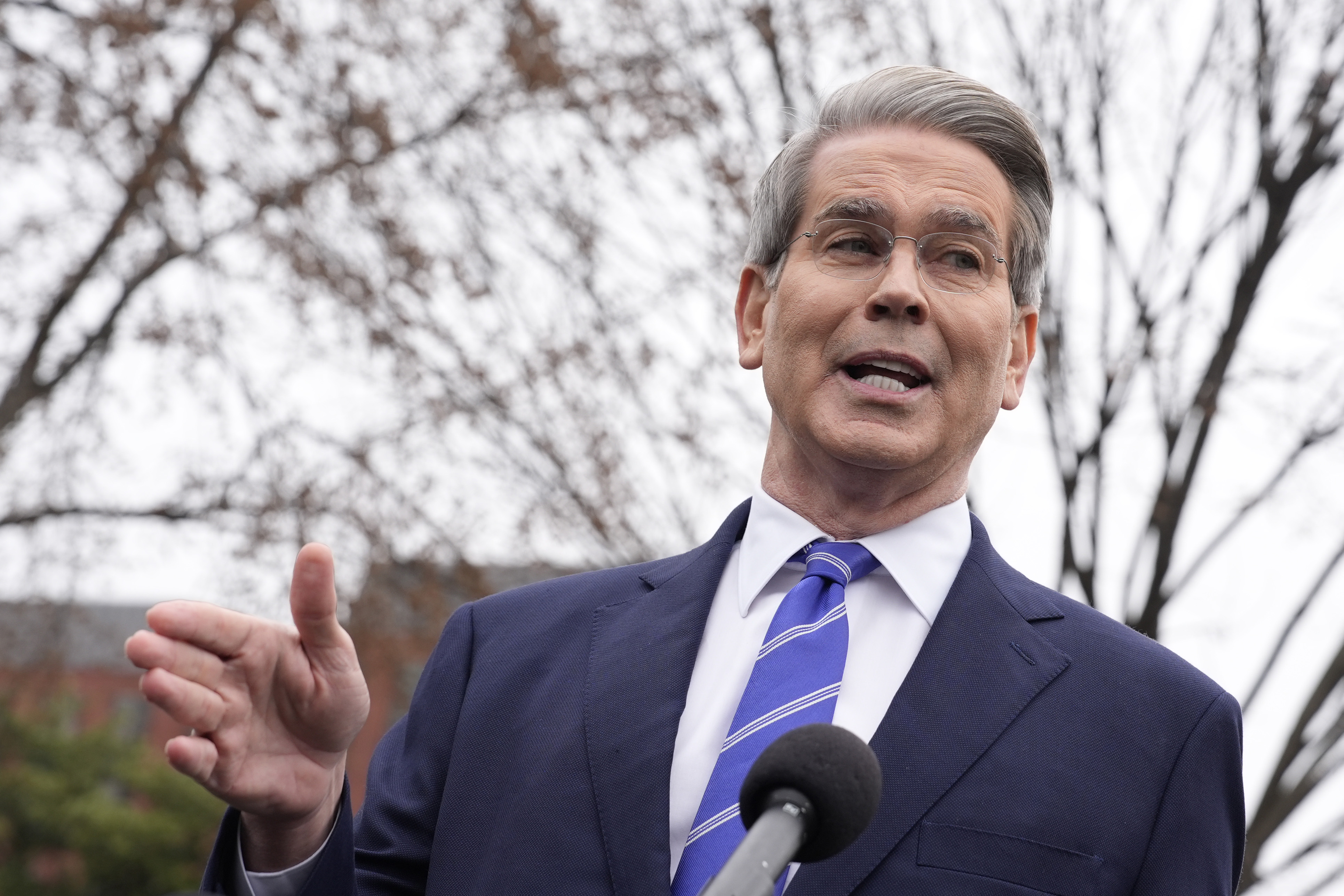

Treasury Secretary Scott Bessent appointed his deputy, Michael Faulkender, as the next acting chief of the IRS after reports the current leader of the agency, Gary Shapley, had been installed at the urging of Elon Musk without Bessent’s knowledge.

IRS April 18, 2025

Many IRS employees, who didn't take the first deferred resignation offer earlier this year, jumped at the chance to take the buyout this time around, while others have decided to ride it out, hoping they will be spared from the reduction in force plans at the tax agency.

IRS April 18, 2025

The IRS is telling some employees who have requested to take the latest deferred resignation offer from the Department of the Treasury that they're ineligible because their positions within the tax agency are "deemed critical."

IRS April 17, 2025

Billy Long, a former GOP lawmaker and President Donald Trump’s nominee for IRS commissioner, disclosed in new federal filings on Tuesday that he paid himself back using campaign donations for a $130,000 loan he made to his failed 2022 Senate campaign.

Taxes April 17, 2025

Harvard University pushed back against the U.S. government after President Donald Trump said the school should lose its tax-exempt status, warning that such a move would endanger its ability to carry out its mission and threaten higher education in America.

Taxes April 16, 2025

The Trump administration is reportedly planning to pull the plug on IRS Direct File, the free online service that allows many taxpayers to file their tax returns directly with the agency.

IRS April 16, 2025

An internal memo said the IRS workforce, which sat at approximately 100,000 when President Donald Trump took office on Jan. 20, could be reduced to as little as 60,000 to 70,000 employees in the coming months.